Ethereum changed allegiance but will the proceeds of the transition reflect in 2023

- The Ethereum Merge was successful, with follow-up upgrades expected in 2023

- Staking withdrawals are expected to begin in the first quarter after OFAC compliance improvement

The Ethereum [ETH] mainnet transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) was the primary reason the second biggest blockchain was in the spotlight in 2022. The Merge, as it was named, marked the largest mechanism change in crypto history.

However, it wasn’t an all-year smooth ride for the blockchain as investors’ expectations dampened. Moreover, the blockchain’s validators needed help adapting to OFAC compliance policies. But before we dive deep into all that, let’s do a quick run back of how Ethereum fared in 2022.

Read Ethereum’s [ETH] Price Prediction 2023-2024

The Merge: A switch finally accomplished

Prior to the Merge, the crypto ecosystem was confronted with several challenges which in turn, negatively affected the crypto market. Exploits, scams, and notably the Terra [LUNA] collapse sent the overall market capitalization into dilapidation.

So, on account of the Ethereum Merge occurring in September, the community filled their hearts with hope of stability in the sector.

On 15 September 2022, the Ethereum team publicly announced that the Merge was successful around 6:43 a.m UTC. This was after Ethereum recorded triumphs with the Ropsten, Rikenby testnets, and Bellatrix upgrades.

And we finalized!

Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.

— vitalik.eth (@VitalikButerin) September 15, 2022

We're good. It's done. We Merged. Holy shit. Amazing work everyone ??! https://t.co/bhbNS8LkZR pic.twitter.com/zx1d3L7Iox

— timbeiko.eth (@TimBeiko) September 15, 2022

Although the Merge helped reduce Ethereum’s energy consumption by 99.5%, it failed to lend a helping hand to the high gas fees on the network. During the event, the Ethereum Foundation hosted a virtual Merge viewing party with revered co-founder Vitalik Buterin in attendance.

During the event attended by thousands of people, Vitalik shared details of some “going forward” plans. In the course of the party, the co-founder noted that the PoS transition was only a part of a long roadmap that will spur into 2023. He pointed out that plans were also in place for the surge, verge, purge, and splurge upgrade.

Meanwhile, the Ethereum development team already put one foot forward with its 2023 objectives. Earlier in December, it communicated about the Shanghai upgrade, propelling it toward processing staking withdrawals.

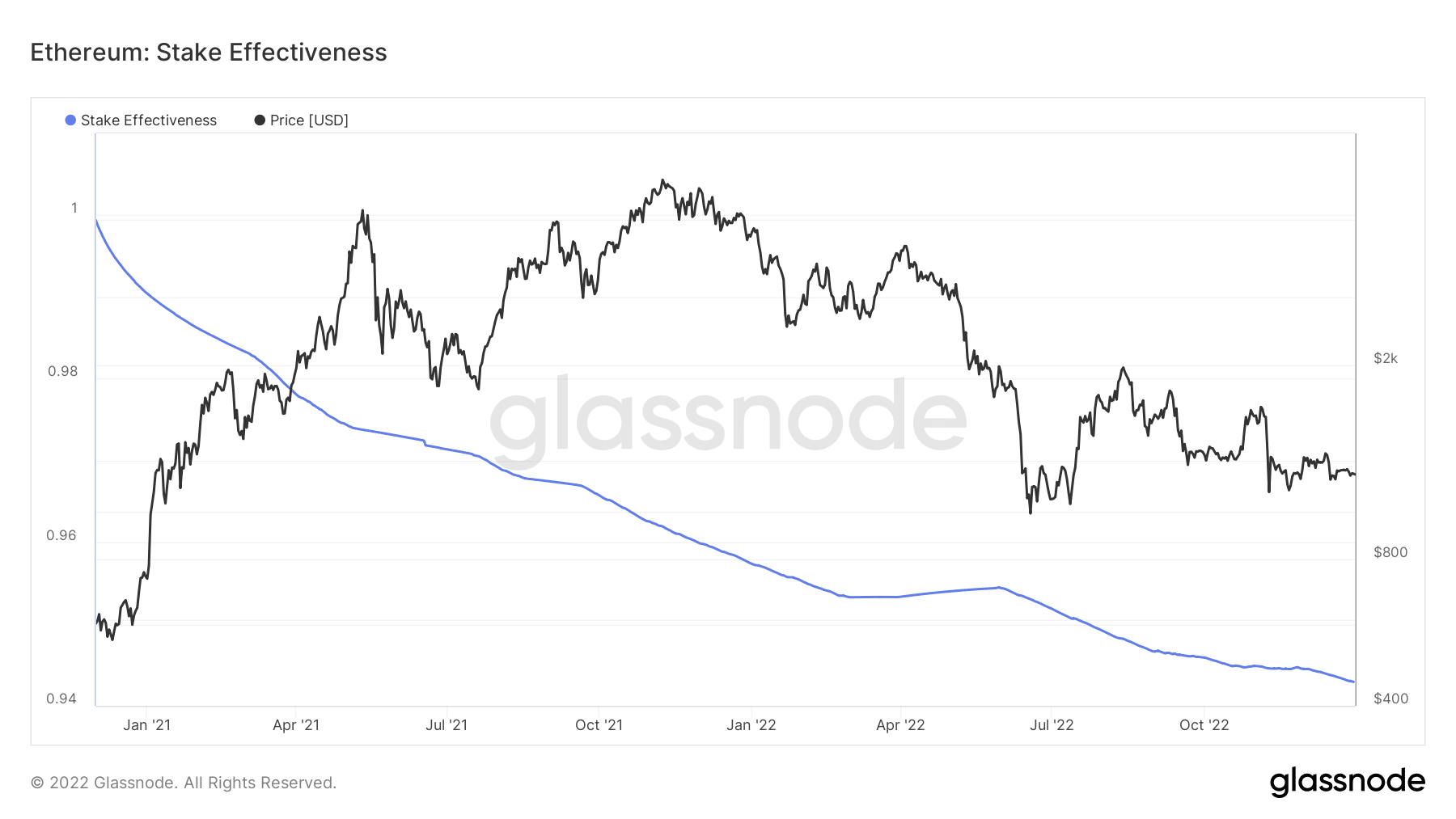

Despite the push, Ethereum struggled to improve adoption for staking activities. Of course, it might still be early days, but Glassnode data revealed that performance in this aspect has been largely unimpressive.

According to Glassnode, the Ethereum stake effectiveness has been in free fall. At press time, it was 0.942. The decrease indicated that only a few validators were participating in putting up their staked Ether [stETH] to work.

ETH: Fatigue in the midst of optimism

In terms of its market performance, ETH investors were optimistic that the historical event would bring some respite to the ailing cryptocurrency. The reason for the enthusiasm was not far-fetched.

In the lead-up to the Merge, Ethereum’s hard fork, Ethereum Classic [ETC], consistently performed excellently as its hashrate continually spiked. According to CoinMarketCap, the ETC price increased from $14.41 to $43.53 between July and September.

It was similar to Ethereum’s staking protocol, Lido Finance [LDO]. In contrast, ETH investors were left hanging even after CNBC called the days before the Merge “the last chance” to accumulate ETH. Days after the event, ETH’s value decreased by about 15%, as it brought conversations about buying the rumor and selling the news.

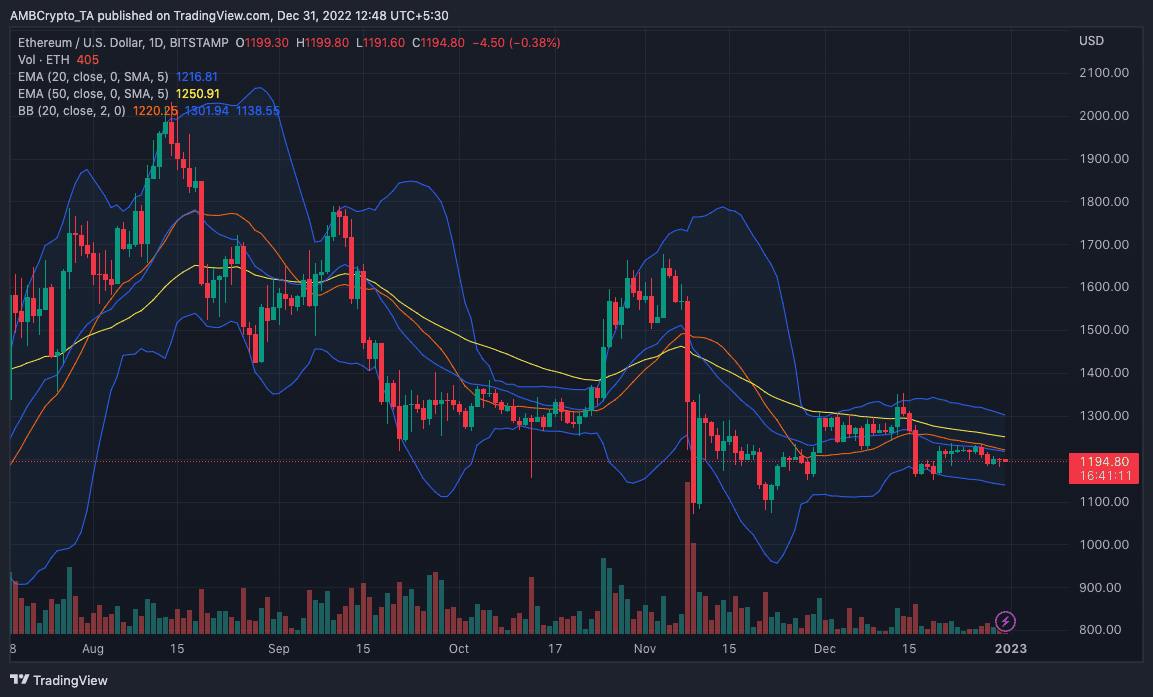

At the time of writing, ETH was changing hands at $1,195. However, ETH might fall below the current price heading into 2023. Indication from the Exponential Moving Average (EMA) suggested this potential.

Based on the daily chart, the 20 EMA (blue) positioned below the 50 EMA (yellow). This observation meant that a price decrease was likely, and a drop below $1,000 could be imminent. Per its volatility, the Bollinger Bands (BB) did not reflect extreme levels. So, since the price touched neither the upper nor lower bands, ETH was not oversold or overbought.

Layer-Two (L2) to the rescue

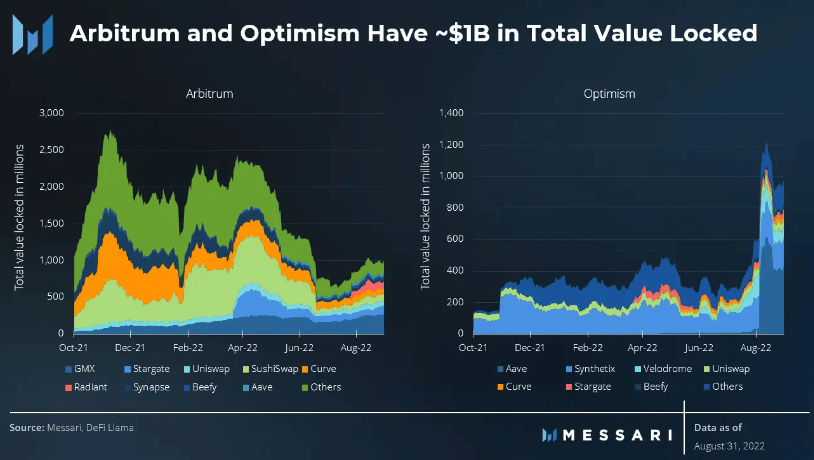

While Ethereum struggled with positive post-Merge outcomes, L2 protocols like Arbitrum and Optimism [OP] filled in for the downturn. In the third quarter (Q3), Messari reported that transactions on both protocols grew tremendously.

Transactions on Arbitum grew from 39,000 in January 2022 to 115,000 in August; Optimism enjoyed a 3.5x hike from 41,000 to 142,000 within the same period. This growth also impacted the Total Value Locked (TVL) of the L2 gems to $1 billion.

In turn, Arbitrum and Optimism scaling meant that Ethereum’s rollup scalability was fully operational. If improved, it could translate to increased adoption within the Ethereum blockchain in the coming year. As with possible traction, the roll-up offering transactions at a cheaper cost could also drive attention.

Censorship persists still

Amid the back and forth, the Office of Foreign Asset Control (OFAC) in the United States punished an Ethereum decentralized protocol, Tornado Cash. The sanctions came as allegations of seemingly illegal activities using the crypto mix platform.

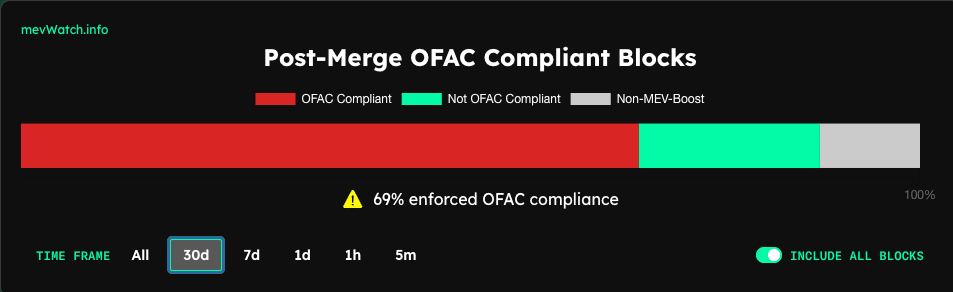

This was a wake-up call for Ethereum validator as it had struggled to become OFAC compliant amid the risk of censorship. Meanwhile, validators from the Ethereum end responded to the task with efforts to improve Miner Extractable Value (MEV).

At the time of writing, Ethereum’s post-Merge OFAC complaint block had hit 69% in the last 30 days. According to MEV Watch, only 11.14% were in the non-MEV boost region. Although they recorded progress, Ethereum validators might need to do more to escape the hammer from the authorities.

As for its competitors, Solana [SOL] has been badly hit since the FTX contagion, especially as Sam-Bankman Fried (SBF) was a notorious shiller of the cryptocurrency.

In recent times, active development on the Solana chain was almost nonexistent. SOL also lost about 97% of its value in 2022. Cardano [ADA], on the other hand, had been at the forefront of development activity. But for its token, it was not an excellent year, just like the broader market.

Going into the new year, what awaits Ethereum?

As 2023 begins, Ethereum developers announced that the community should expect more upgrades to the blockchain. According to its protocol developer. Tim Bieko, activating staking withdrawals is a priority for the team.

To recap:

– Shanghai/Capella's scope has been finalized: withdrawals are priority #1️⃣ , along with the ability for validators to update their withdrawal credentials. EOF, and a few other minor changes are expected on the EL side. The update has all the details ?— timbeiko.eth (@TimBeiko) December 13, 2022

He noted further that the EIP-4844 would be vital in helping validators with the withdrawal process. Billed to start from the first quarter in 2023, Ethereum could experience a hike in demand due to staking participation.

“Blobspace is coming .oO! With Shanghai/Capella centered around withdrawals, EIP-4844 will be the main focus of the subsequent upgrade”.

Besides, the industry expects Ethereum to have a busy schedule in the coming year. However, there was no certainty that ETH would react positively to the expected developments.

In a recent video posted on his YouTube Page, crypto analyst Nicholas Merten encouraged his subscribers to avoid getting too excited about ETH in 2022. Citing an incoming collapse, Merten said,

“Our target range for Ethereum is somewhere around $300 to $500. I don’t think it’s going to live there for long, but it has to do with the fact that right now, there is a big skeleton closet that is over $1.5 billion of cumulative liquidations that can potentially happen in the DeFi [decentralized finance] ecosystem.”