Ethereum, China, and how they played a part in Tether’s flattened supply

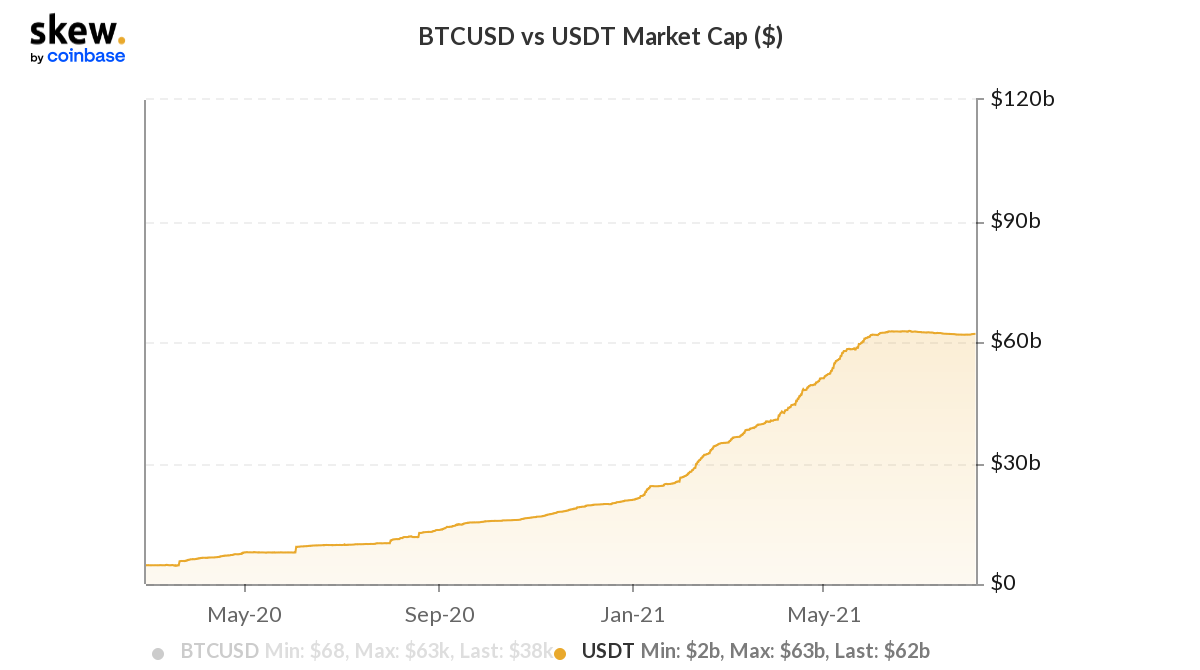

Every sector within the digital asset industry saw significant growth in 2021. This included developments in DeFi, Bitcoin’s new ATH levels, and the growth of pre-existing projects such as Cardano and Binance Coin. On a similar note, the total supply of stablecoins also spiked by 4x, with USDT at its forefront.

While Tether dominated more than 50% of the total supply, USDC’s supply rose from 4 billion to 26 billion in 2021. Surprisingly, 75% of the said hike came after 11 May. Alas, post the crash in May, the dynamics evidently changed.

This article will take a closer look at the new discrepancies identified over the past few weeks.

Tether supply has flattened since 30 May

Since the aforementioned date, Tether’s market cap has oscillated around $62 billion. Apparently, such a prolonged period of stagnancy has transpired for the first time since March 2020. According to CoinMetrics, however, it might be down to the decreasing free float supply.

Free Float is defined as the supply which excludes supply that is considered illiquid. Now, Tether’s decrease in free float might suggest that users are selling their USDT and sending them back to Tether’s reserves. Hence, the total supply also hasn’t increased, possibly due to a lack of demand. The aforementioned report added,

“This free float decrease has been especially noticeable on Ethereum – the free float supply of Tether issued on Ethereum (USDT_ETH) has decreased by about 1B over the last 30 days, while the total supply has remained flat.”

One of the reasons that explain Tether’s reduced interest may be its dependency on the Asian market. According to data, Tether registered most of its activity during Asian business hours. Recent miner and investor migrations out of China might be hurting Asia-based Tether activity.

Part of USDT’s reduced utility may also be due to Ethereum being used extensively as DeFi collateral. That is reducing the ETH_USDT free float supply. The popularity of USDT distribution was mostly seen on centralized exchanges where investors would prefer its settlement infrastructure. The move to the DeFi ecosystem, however, is a different ball game altogether.

USDC one-up

Now, USDC can cater to rising demand because most of its activity tends to follow US market hours. Western markets hardly rely on USDT pairs as their emphasis on USD pairs has always been higher. Plus, Coinbase backs USDC. And, it is currently the only public company in the digital asset industry.

Hence, it is of little surprise that USDC picked up momentum post the May Crash. This, coupled with China’s mining “ban” and investors’ conundrum, was a perfect storm.

USDT is still ahead in the game

A previous article had discussed USDT’s dominant hold over liquidity brought forward in the market. Similarly, the stablecoin also holds the command in terms of cash-settled Futures. Crypto-USDT paired Futures currently facilitate more trading volumes than crypto-collateralized Futures.

USDC hasn’t made a mark on this sector yet, while USDT is moving ahead with its expansion. While Futures being collateralized with USDT do not necessarily trigger an increase in total supply, it highlights the fact that USDT still has a lot of utility across the wider crypto-industry.