Ethereum HODLers surpass Bitcoin, what now?

- ETH HODLers were unconcerned about the altcoin’s price fluctuations.

- The short and long-term technical outlook suggested a bullish move for ETH.

Long-term Ethereum [ETH] holders have desisted from liquidating their holdings while helping the coin reach a new milestone, IntoTheBlock noted.

According to IntoTheBlock, the amount of ETH owned by HODLers has now hit 70% since the 1st of December.

The data also means that the altcoin had passed Bitcoin’s [BTC] position per the same metric. For BTC, the amount of coins held by long-term holders was almost at 70%, but ETH still surpassed it, AMBCrypto found.

It is important to mention that the blockchain analytics firm came to this conclusion after examining the BTC/ETH ratio.

The amount of $ETH owned by long-term hodlers reached a record of over 70% in December pic.twitter.com/znKGxTAkvU

— IntoTheBlock (@intotheblock) December 24, 2023

HODLers are vital to the health of any blockchain. This is because they rarely sell their coins irrespective of volatility or price performance.

So, the increase in the ETH owned by HODLers implies that there is enough conviction that the cryptocurrency’s long-term potential was worth waiting for.

However, it is not surprising that the record came in December. This is because there have been predictions that ETH’s time to outshine Bitcoin is near.

Though the price action was not yet at Bitcoin’s level, the impressive run of altcoins including L2 projects suggests that an ETH rally could be close.

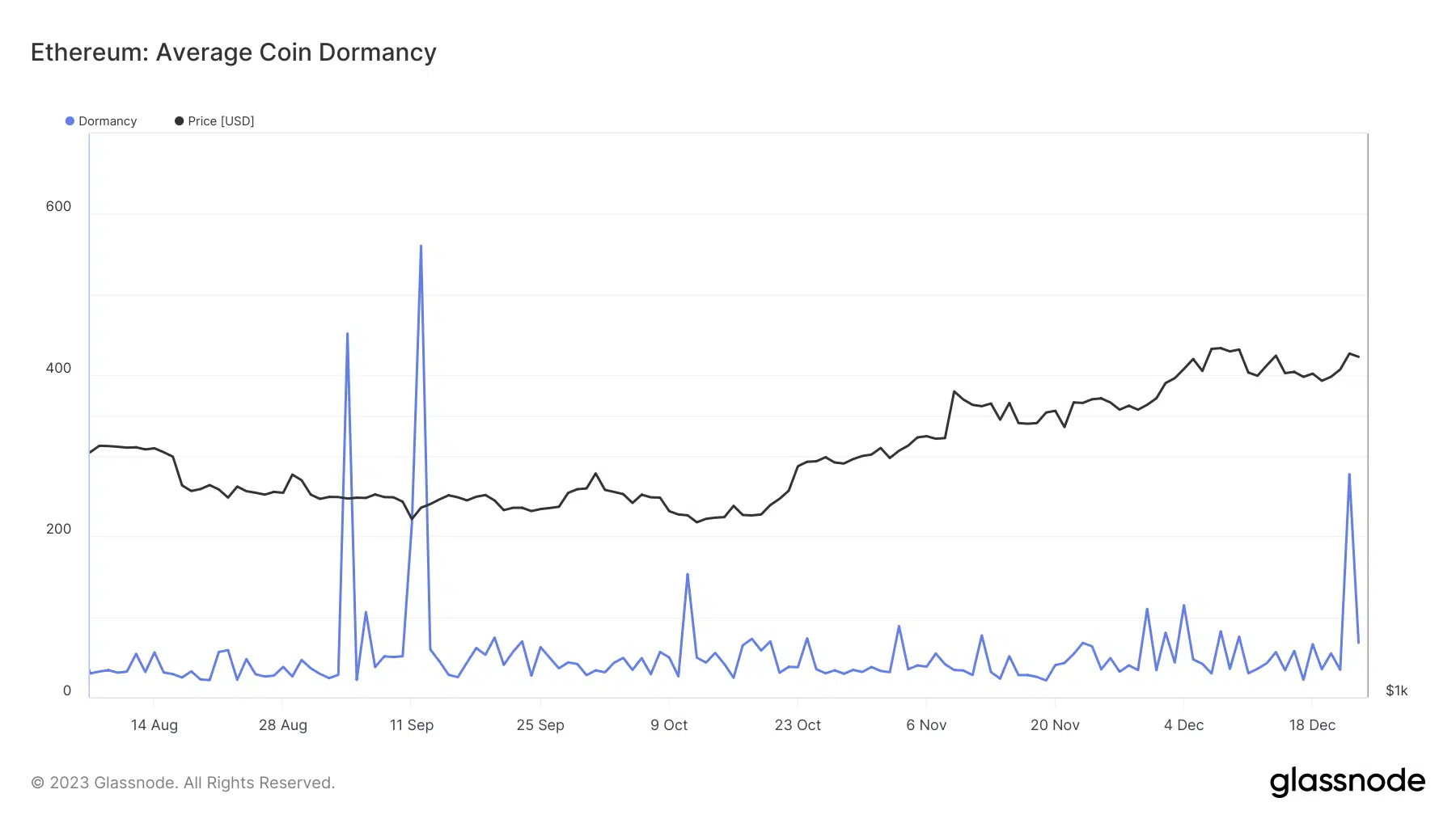

As of this writing, ETH’s price was $2,290— a 3.69% increase in the last seven days. Regarding the long-term price potential, AMBCrypto decided to check Ethereum’s Dormancy.

Dormancy is the ratio of coin days destroyed and total transfer volume. The metric gives an insight into the sentiment of long-term holders.

Up until the 23rd of December, Ethereum’s Dormancy showed high values. This suggests an increase in transactions by older coins. However, at press time, the metric was down to 67.61. This implies that older coins have largely remained unspent.

If Dormancy remains lower, then ETH may have a good shot at a rally in the near term.

Per the 4-hour ETH/USD chart, the Exponential Moving Average (EMA) showed that the coin might be bullish in the mid to long term. This was because the 50-day EMA (blue) had crossover the 200 EMA (yellow).

This position is usually in favor of a bullish trend.

So, investors planning to hold ETH for an extended period might have a chance at buying at a discount. Another indicator to consider is the Aroon indicator. Results from the Aroon provide an idea of what ETH might do in the short term.

Realistic or not, here’s ETH’s market cap in BTC terms

At the time of writing, the Aroon Up (orange) was 21.43% while the Aroon Down (blue) was at the zero midpoint.

Thus, short-term holders may not need to wait for the long-term ETH rally before making potential gains. However, traders may need to be cautious as it could take a little while before confirmation of the bullish thesis.