Ethereum holders seem to be disappearing as…

- Ethereum holders with more than 10,000 ETH declined to a two-year low.

- ETH staking continues to increase as ETH attempts to break the $2,000 price barrier

Ethereum’s [ETH] holder metrics have been on a downward trend lately, indicating a decline in some key aspects. Recent data revealed that the number of certain ETH cohorts has reached an all-time low.

As holders appear to be diminishing, examining the state of ETH staking and its price dynamics becomes intriguing.

Ethereum holders decline

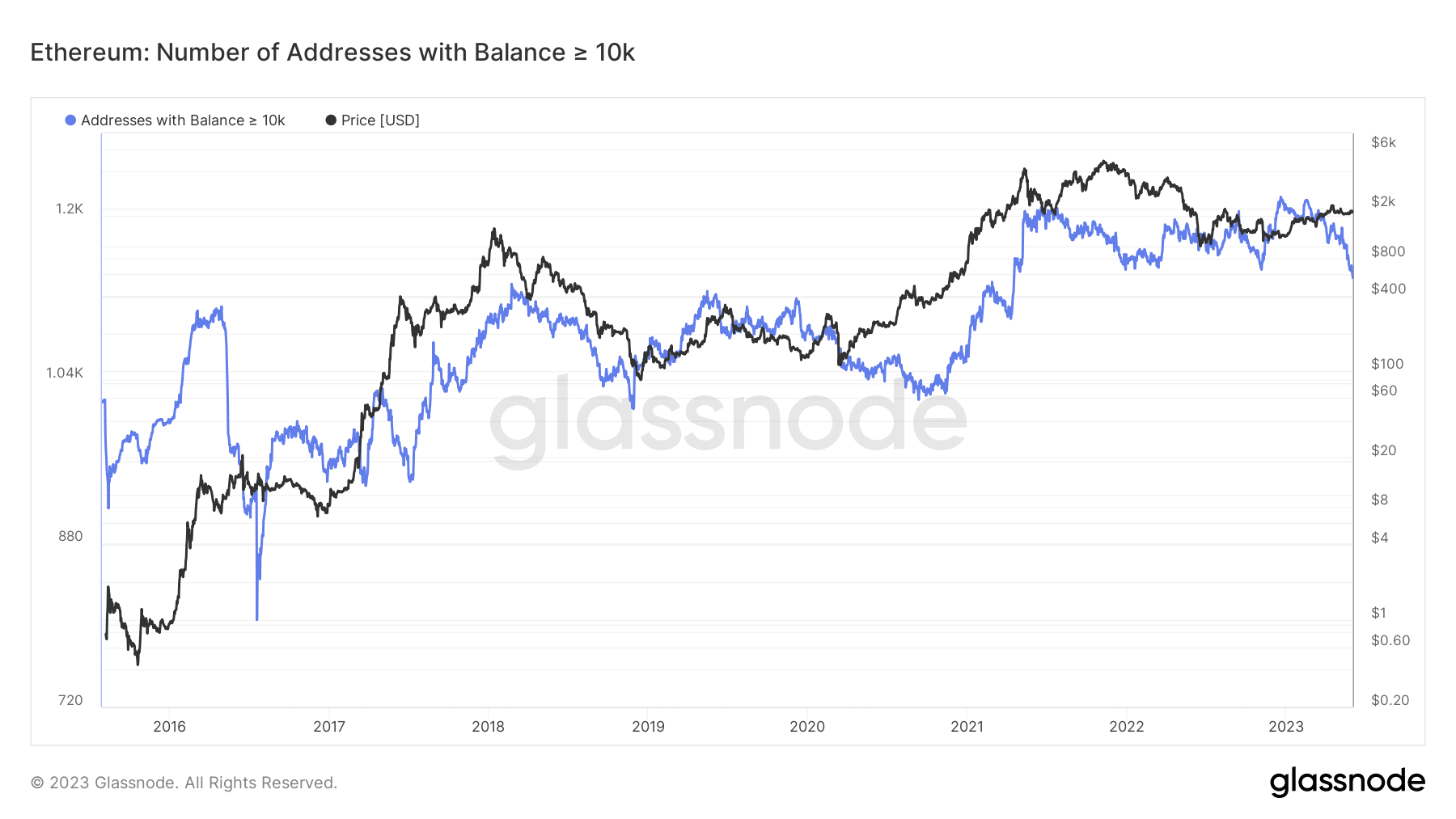

Recent data from Glassnode Alert revealed a concerning trend in Ethereum cohorts holding over 10,000 ETH. The chart on Glassnode showed a gradual decline since April, with a steeper drop observed in May.

As of this writing, there were only 1,139 holders with more than 10,000 coins, marking a two-year low for this metric. To provide context, back in February, the number stood at approximately 1,213.

Furthermore, Ethereum’s supply on exchanges also experienced a decline in recent months, adding to the enigma surrounding ETH holdings. This decline is noteworthy, particularly considering the Shappella upgrade and ETH staking activation.

Massive outflow dominates Ethereum flow

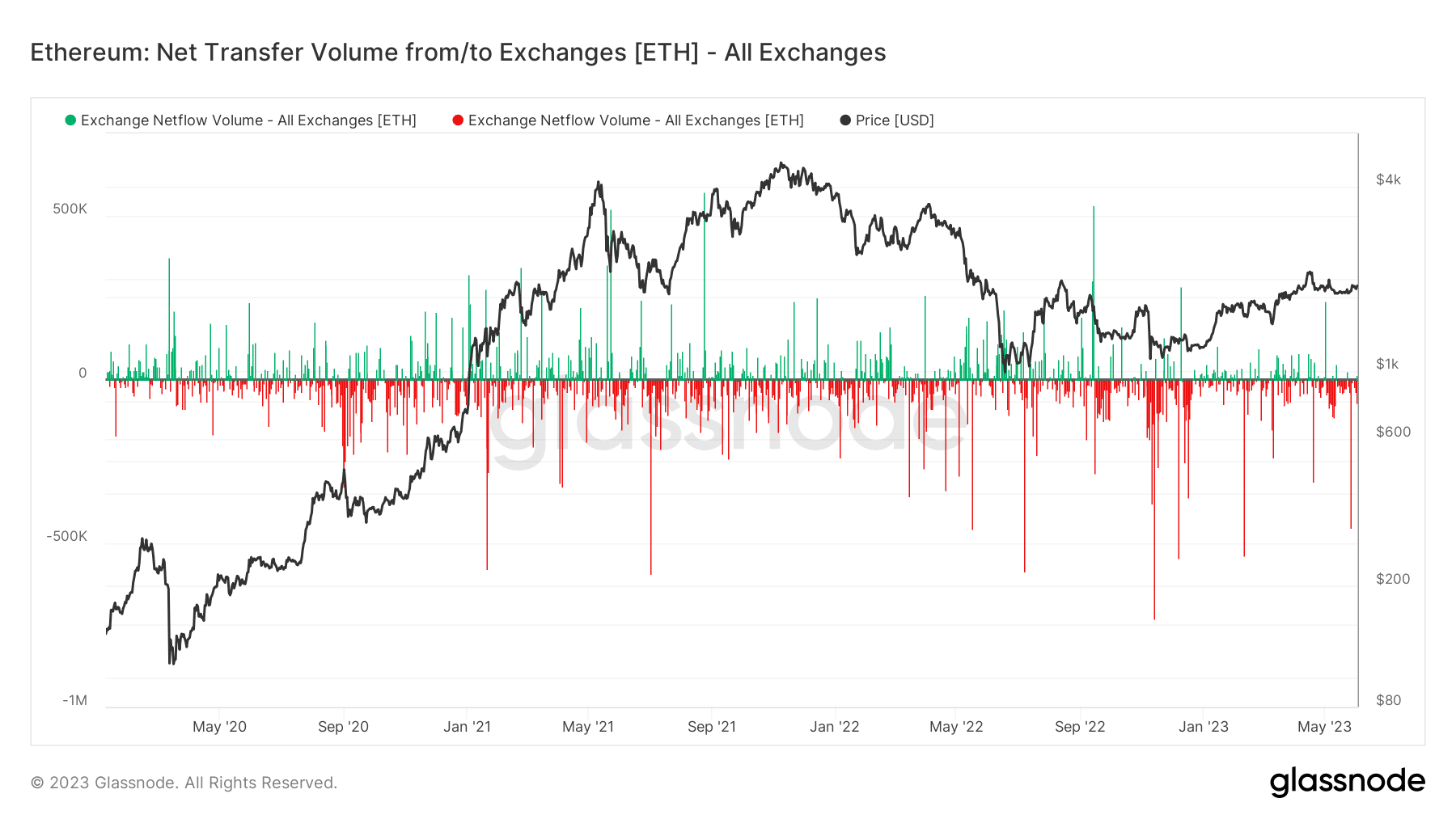

The Netflow metric on Glassnode provided insight into Ethereum’s recent activity, revealing a significant level of movement. However, a predominant pattern observed on the chart was negative flow, indicating more outflow than inflow.

As of this writing, the Netflow showed a negative value surpassing 70,000 ETH. Notably, on March 26, there was a substantial outflow of over 451,000 ETH, marking the highest negative flow since February.

This observation suggested that the holdings released by various cohorts, particularly the 10,000 ETH holders, might not be immediately entering the market for sale on exchanges. Instead, it was plausible that these holdings were being directed toward ETH staking activities.

ETH staking landscape

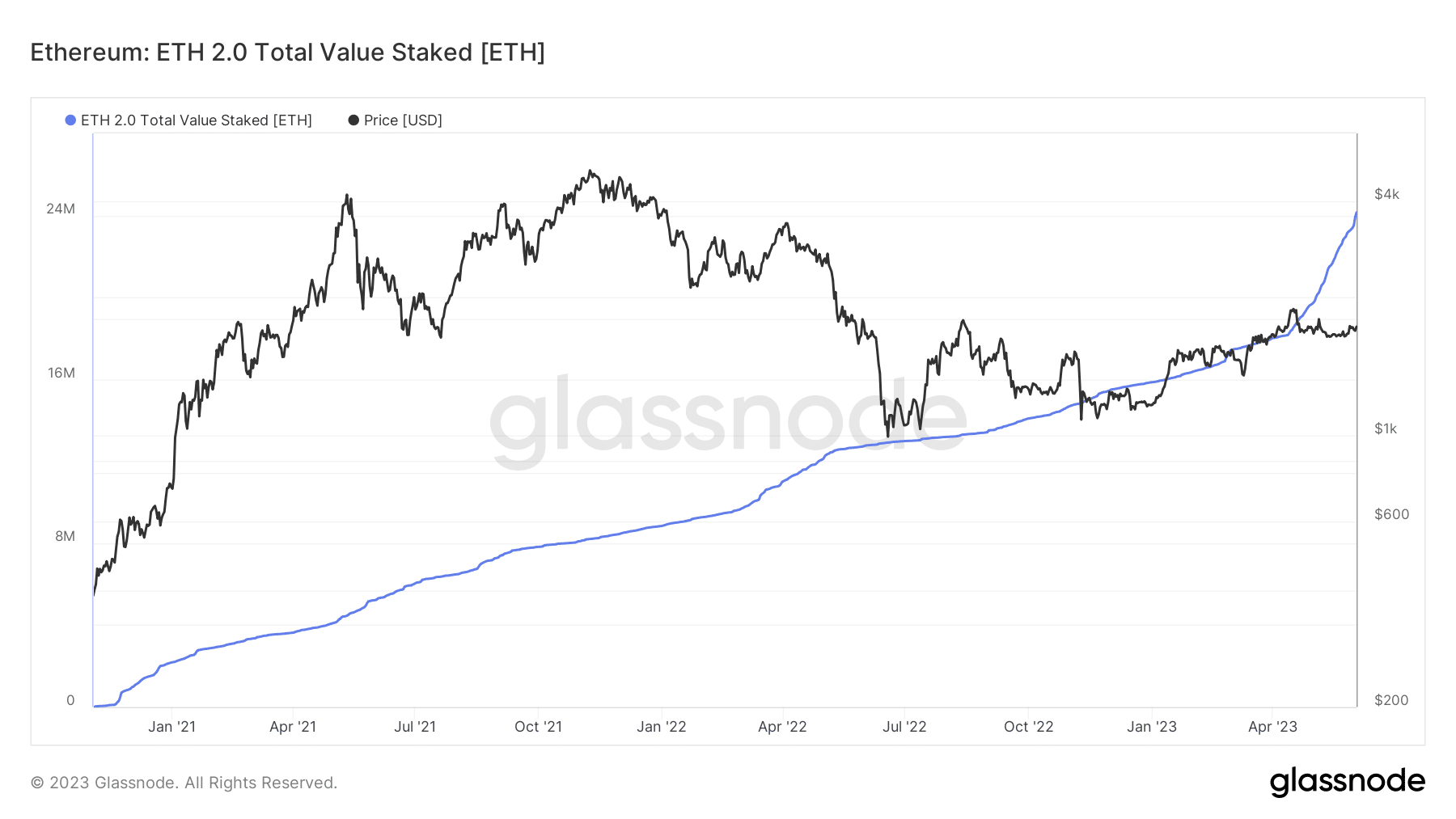

The Ethereum total value staked demonstrated a clear and consistent upward trajectory, evident from observing the chart. It revealed a daily increase in the value of staked ETH, with new all-time highs achieved almost daily.

As of this writing, the total value staked surpassed 24 million ETH. To put this into perspective, just a day prior, it was slightly above 23 million ETH, signifying an impressive addition of nearly a million ETH in 24 hours.

Furthermore, the total number of deposits also exhibited an upward trend, closely reflecting the uptrend in the total value staked. There were over 778,000 deposits at press time, further emphasizing the continuous growth in this metric.

Read Ethereum (ETH) Price Prediction 2023-24

Ethereum price trend

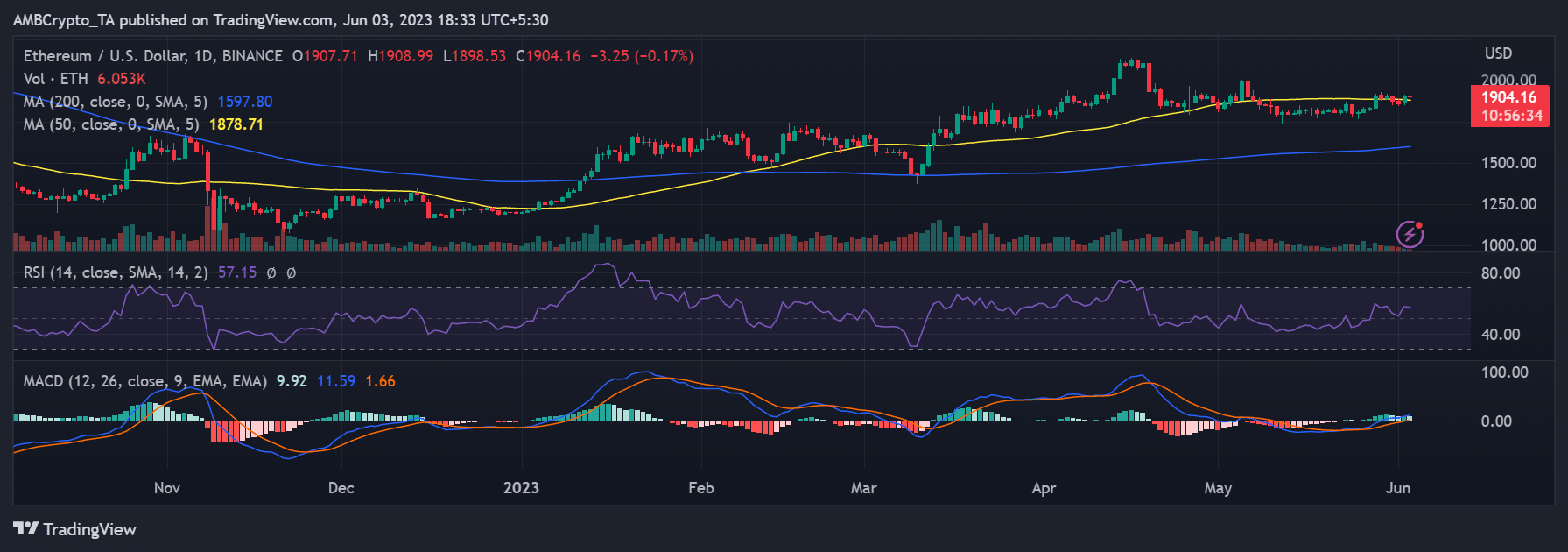

Examining the Ethereum price trend on a daily timeframe chart revealed a recent breakthrough above its short Moving Average (MA), represented by the yellow line. This breakout coincided with a 2.4% price increase observed on June 2. ,

Ethereum was trading at around $1,900 at press time, experiencing a slight loss. The current price level brought it closer to the $2,000 region, which was a psychological barrier for Ethereum’s price.