Ethereum investors planning to profit on Merge day should read this

Many Ethereum [ETH] investors may expect the Merge day to bring good tidings. However, this anticipation may need to be followed with a rethink of the situation.

This is because the community may need to withhold transacting on D-day. While this assertion should not cause panic, investors should understand that risks are involved.

According to a report by the CoinMetrics team led by Kyle Waters, the ETH Merge may be followed with some negative implications. The crypto research firm noted that network translation is not always seamless. ETH’s move from Proof-of-Work (PoW) to Proof-of-Stake (PoS) may affect transactions.

Are there risks?

CoinMetrics reported that the threat was not limited to transactions alone, citing a possible start from the ETH macroeconomic change.

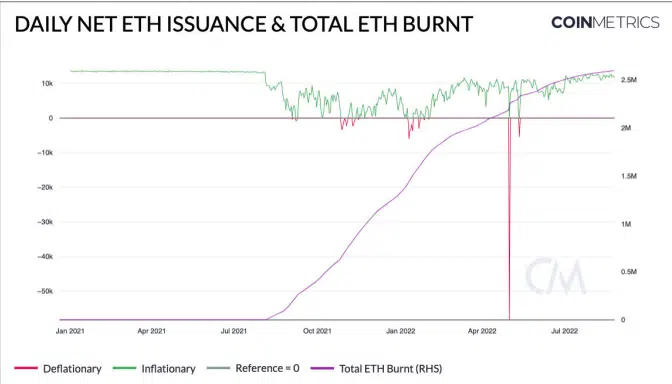

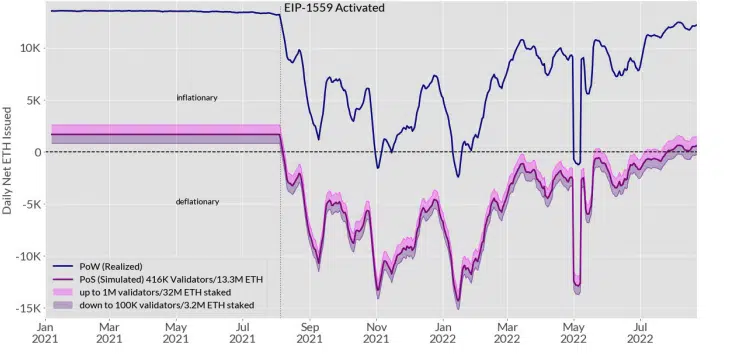

While noting that the ETH supply issuance has changed over the years, the deployment of EIP-1559 in August 2021 completely neutralized the previous changes. So ETH’s net issuance could fall to zero, resulting in high transaction fees on the Merge day.

Another aspect the report took into consideration was the daily average ETH burn under PoW.

For CoinMetrics, the 13,500 ETH issue daily for burn may decrease drastically due to the transition. As for the staking procedure, the PoS mechanism may lead ETH to a deflationary trend rather than an inflationary stance on PoW.

As a precautionary method, CoinMetrics advised investors to halt transactions because the mempool may find it difficult to withstand the pressure.

Hence, this could lead to reversals or price discrepancies across Decentralized Exchanges (DEXes) and ETH lending markets. Despite the fears, the research firm maintained its stance that the Merge was a necessary shift for Ethereum.

Necessary measure maybe

The CoinMetrics report was not the first notification of risks pertaining to transactions. A few weeks ago, Binance announced to its community that ETH withdrawals and deposits would be suspended all through the transition period.

Besides that, investors may also need to consider other factors to watch before the Merge takes place.

As for the ETH price, it did not seem as if it was gearing up for the event. As per CoinMarketCap data, the price had declined 2.60% over the last 24 hours.

This was also followed by a decreased volume with predictions of a fall to $1,000. ETH investors’ expectations as the Merge draws closer may need to be at its lowest.