Ethereum: ‘Solid sign of upcoming bounce’ with ‘Merge’ being pushed further

Could Ethereum do the pull-up that’s necessary to get it started on a rally again? Despite the market swimming in red, there’s some evidence in favor of this scenario. Let’s take a closer look at the metrics.

At press time, ETH was trading at $3,094.04 after rising by 1.27% in the past 24 hours, but dropping by 3.62% in the last week.

A turning tide

Early on 13 April, ETH was above $3,100. Many bullish investors took this as a hopeful sign that the top alt’s descent was finally slowing. Adding to that, Santiment’s ratio of on-chain transaction volume in profit to loss revealed signs of capitulation, which can hint at a future rally.

? #Ethereum's market value is back above $3,100 after bottoming out at $2,960 to start the week. Our new 'Ratio of On-Chain Tx. Volume in Profit/Loss' ratio revealed that $ETH traders were selling at the bottom, a solid sign of an upcoming bounce. https://t.co/HtF42wNOiD pic.twitter.com/o9UffvxkuU

— Santiment (@santimentfeed) April 13, 2022

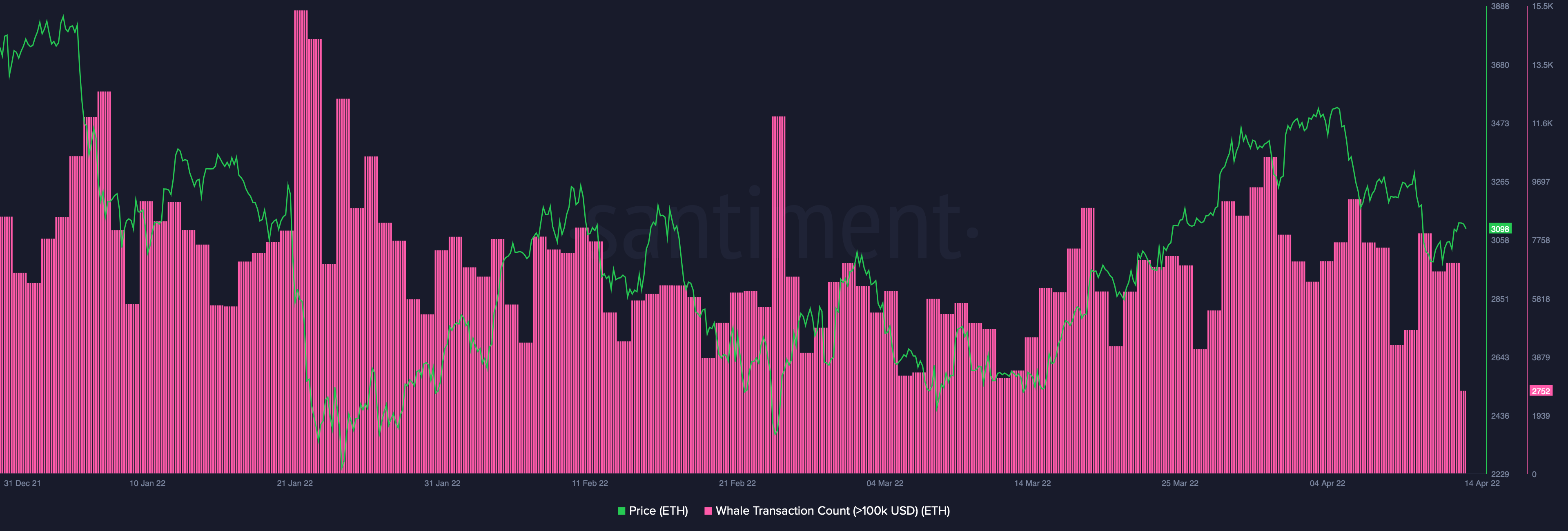

That said, one possible reason for the fall in price could be due to the much-anticipated Merge being pushed from this summer to autumn instead. That being said, a new series of whale transactions have been picking up from around 10 April, suggesting that larger players are making their moves – but nothing too dramatic. Caution appears to be the key word.

Source: Santiment

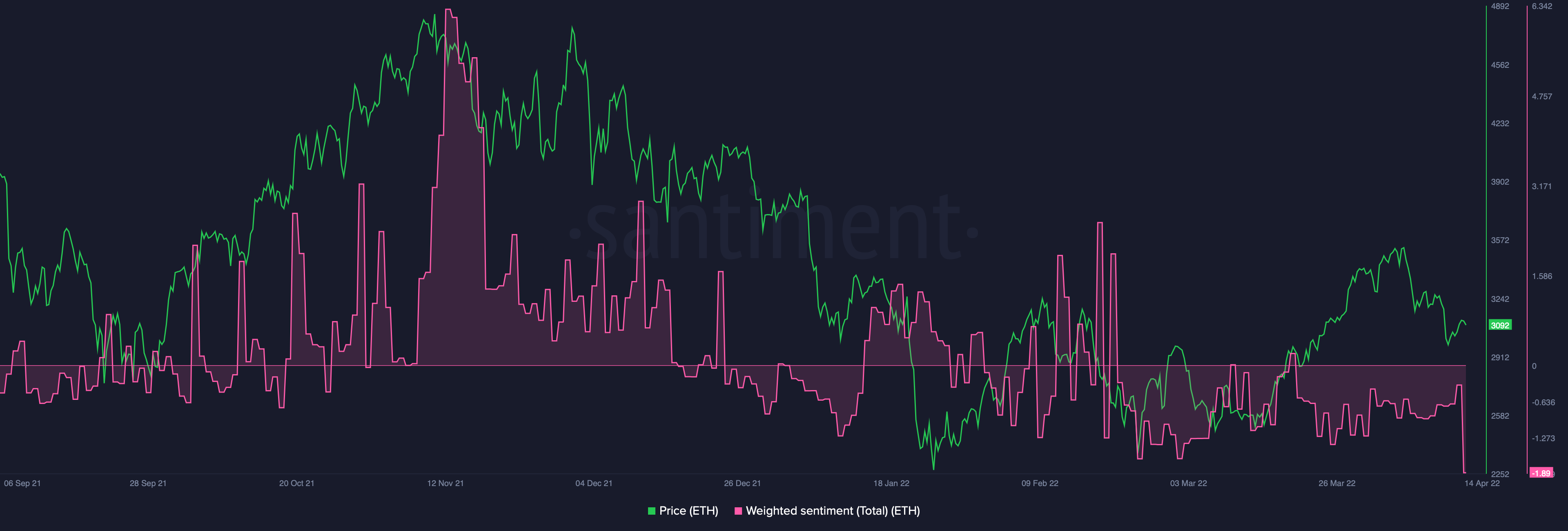

However, another factor to note is that weighted sentiment for Ethereum was very low. In fact, it reached a low of -1.89, which was last crossed in February 2021. While this might seem like an ominous sign, continued negative sentiment could also help trigger a price rally.

Source: Santiment

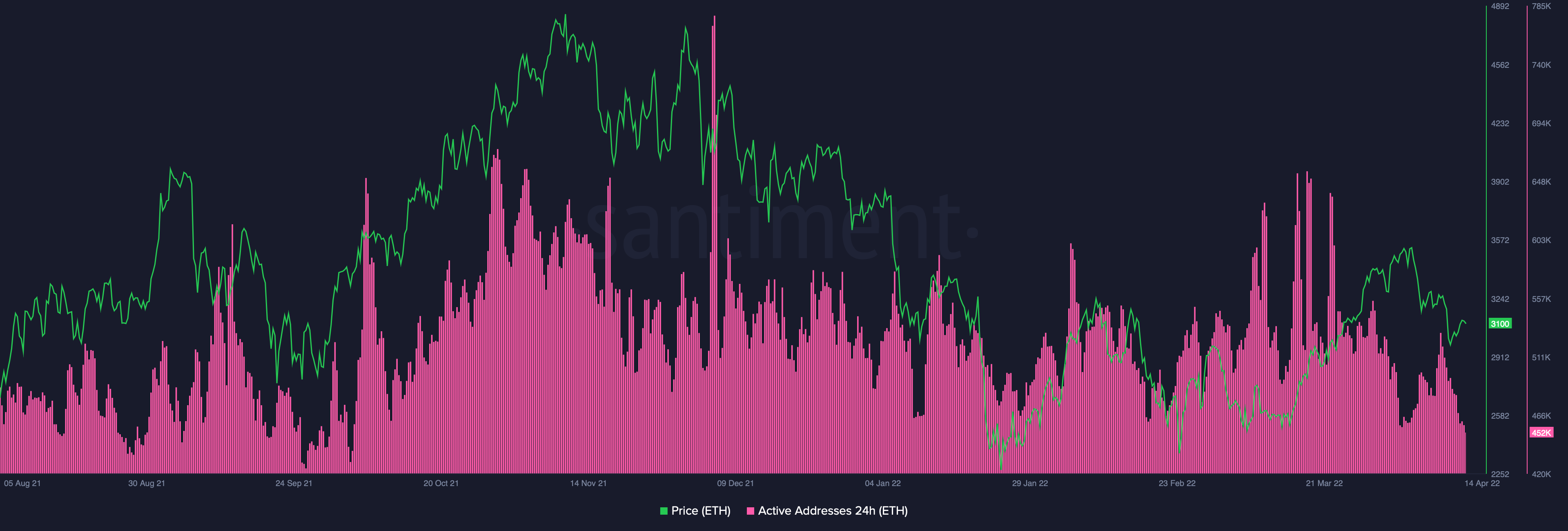

On the other hand, one point of concern was the fact that Ethereum active addresses were dropping off the charts at a fast rate. The last time this happened, in early April, it corresponded with a drop in Ether’s price. It remains to be seen if Ether’s latest rally will meet with the same fate or form a green candle instead.

Source: Santiment

A friend in need. . .

While Ether’s movements might be a source of confusion at the moment, data from Arcane Research revealed that Bitcoin and Ether were still seeing high levels of correlation. In fact, Bitcoin’s 90-day correlation with ETH was 0.91, which is a high last seen in the summer of 2020.

For that reason, an investor who wants to cover all bases could keep an eye on Bitcoin’s metrics as well.