Ethereum: Two months after EIP-1559, what’s yet to come

The first week of August 2021 featured the monumental EIP-1559 upgrade for Ethereum, which was highly anticipated by the collective Ether community. While the initial change in the mechanism had been integrated, further developments were set to take place over the coming months.

More recently, it was revealed that the Consensys teams had accomplished the transition of a multi-client devnet from proof-of-work to proof-of-stake. This meant that Eth1 execution clients and Eth2 consensus clients had successfully merged to create a network capable of processing transactions.

The aforementioned news was widely applauded across the market and more so because it came soon after the announcement of Altair’s coming upgrade on October 27.

The Altair upgrade is said to be a crucial step in the transition to proof-of-stake, giving developers a ‘low stakes warm-up’ and adding functionality on the Beacon Chain. Thus, as the transition to proof-of-stake seems closer, it’ll be interesting to see what the upgrade will change and what will stay the same.

The A-Z of Altair upgrade

The transition to PoS allows validators to propose and validate blocks without using the energy currently required to mine these blocks, thus making the process more energy-efficient.

Additionally, it also enables transition away from economies of scale, even though it will almost always arise, PoS allows users with smaller initial investments to become validators on the network. In theory, this can add increased security as validators become diverse, thus countering centralization.

Further, the emission rate is expected to fall below the 2 ether block reward currently issued under proof-of-work. However, developers claim that with the merge transaction cost and speed won’t change. However, the upgrade will lay the groundwork for sharding, which “spreads the network’s load across 64 new chains” and is a key part of Ethereum’s roadmap to scalability.

What are the loopholes?

Notably, however, ETH transactions are comparatively tricky when it comes to fees, in fact, recently an Ethereum user paid $430,000 in transaction fees for a failed payment.

This triggered a social media backlash as users called out the network’s inability to handle multiple addresses at a time to be “a huge problem with the platform.” However, there are hopes that such issues could be better dealt with as upgrades take place.

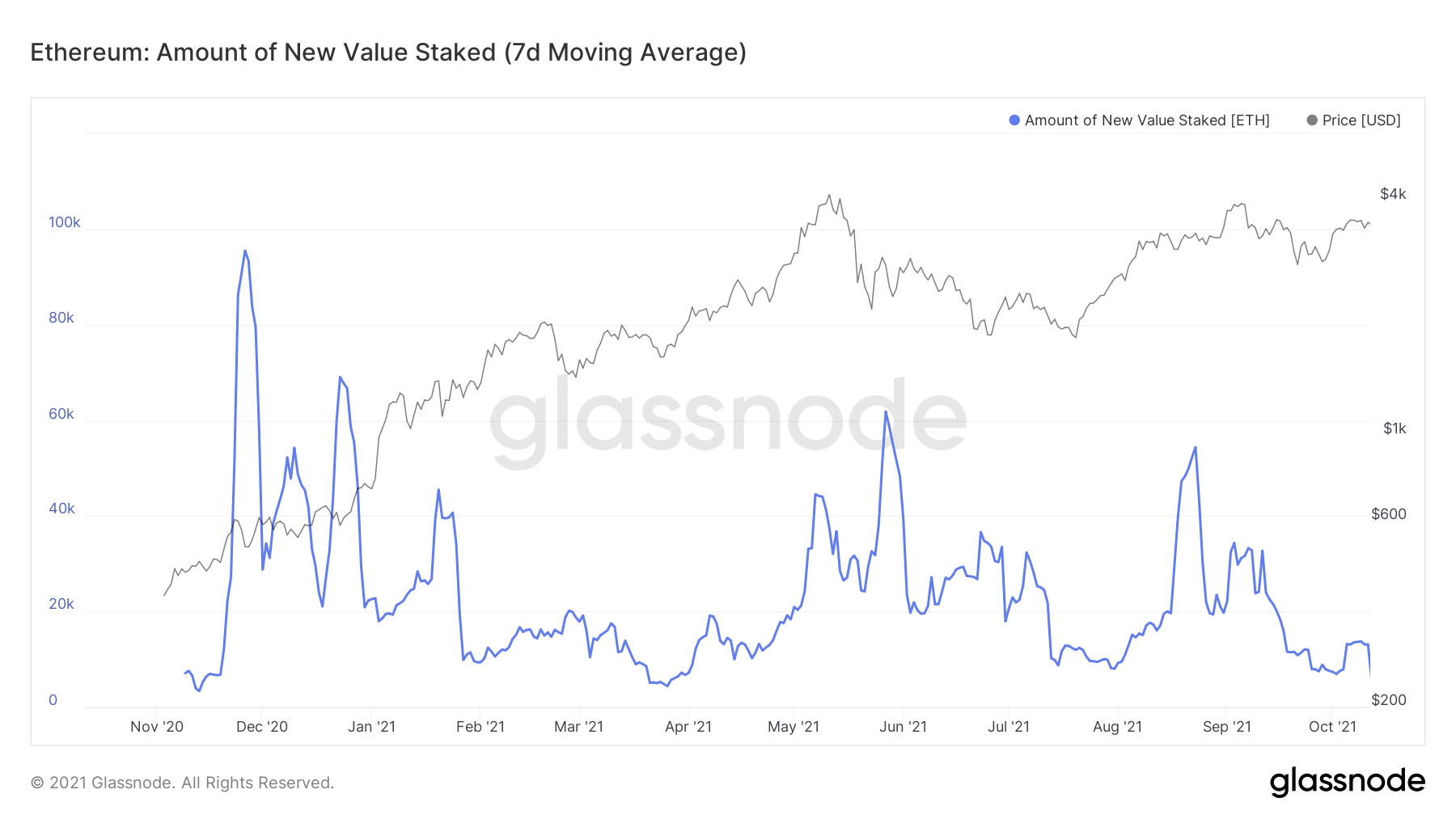

Additionally, New Value Staked presenting the amount of ETH transferred to the ETH2 deposit contract also saw lower values even as the network saw growth.

What about ETH’s price?

For one month in spite of ETH’s network growth, its price has seen considerable resistance at $3650. However, at the time of writing, amid high price anticipation from ETH, the coin saw considerable gains. This was after American billionaire, Mark Cuban advised beginners in the crypto world to select Ethereum as an investment choice,

ETH finally seemed to have gained momentum in spite of the pros and cons of EIP-1559, as the token saw close to 10% daily gains. Seemed like the hype around the Altair Beacon Chain upgrade on October 27 may have fueled the alt’s price. Nonetheless, with its network heating up and prices on a rise seems like interesting things were coming up for the top altcoin.