Exploring MATIC’s long-term potential post Ethereum ‘Merge’

Ethereum’s Merge date is days away and the countdown has many people wondering about the fate of layer-2 scaling solutions.

You may have noticed Ethereum-associated cryptocurrencies and tokens such as MATIC are up substantially in the last few weeks.

However, the move to proof of stake will solve some of the scalability issues associated with Ethereum, thus the curiosity about the future of L2s.

Polygon is one of the layer-2 solutions whose future might be at stake due to the Merge.

However, that will most likely not be the case.

Here’s why

Although one of Polygon’s benefits is the rapid transaction count which is miles ahead of the Ethereum mainnet. Even so, Polygon also provides significantly lower fees.

Congestion and high ETH prices are the main reasons for expensive mainnet fees.

ETH’s price has gone up ahead of the Merge and will likely continue rallying. This means the transition to the PoS (Proof of Stake) consensus mechanism will do little to lower gas fees.

Polygon and other layer-2 solutions will continue operating to provide lower fees, hence MATIC will still be in demand.

Nevertheless, there is more to Polygon than meets the eye.

Partnerships with major enterprises such as Disney and Mercedes Benz are just the tip of the proverbial iceberg.

Polygon plans to become the bridge for the transfer of liquidity from traditional finance to crypto.

These developments might trigger an exponential increase in the demand for MATIC. Thus, aiding its long-term price action.

MATIC’s price action

MATIC was up by 163% at press time on 4 August, from its bottom in June. It has been ascending within a support and resistance range, which is currently approaching the support line.

MATIC’s price action was headed upwards towards the end of last week.

However, its price action saw a significant pullback which kicked off at the end of July.

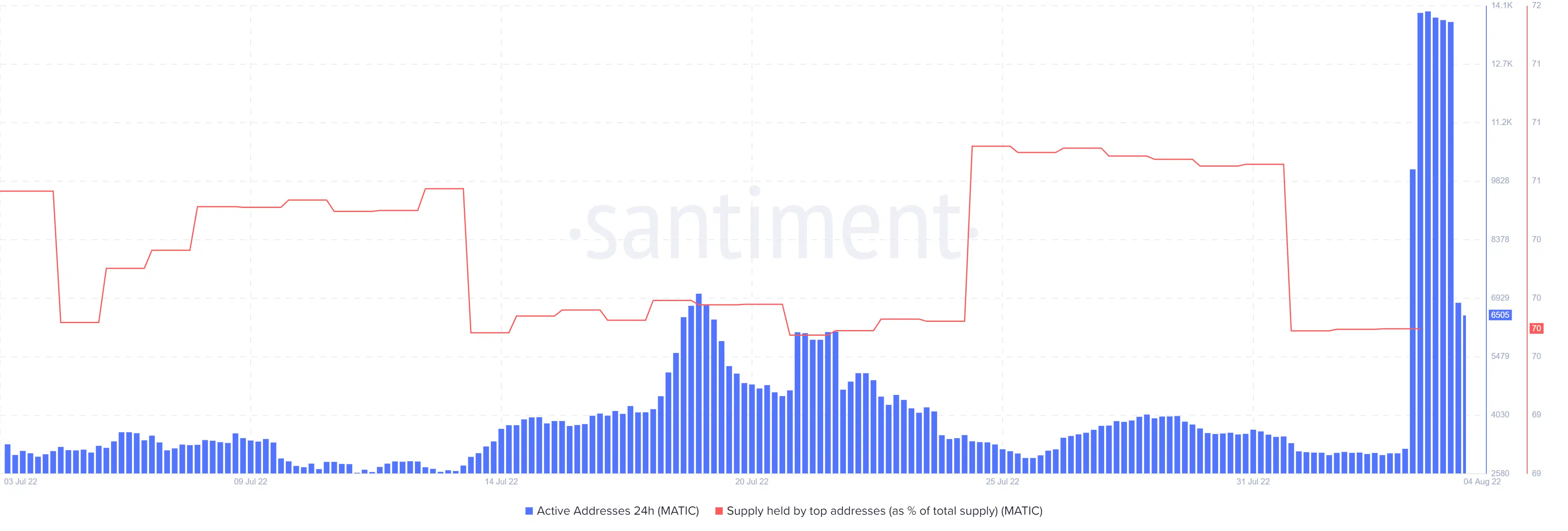

This is consistent with sudden and heavy outflows from the supply held by top addresses.

Those outflows were arguably due to panic selling courtesy of the selling pressure in the last three days and thanks to MATIC’s vesting schedule.

There was also a sharp spike in MATIC’s active addresses in the last 24 hours of 4 August.

This is likely due to the return of investors who previously cashed out in anticipation of the sell pressure from the vesting schedule.

Investors are now buying in lower, now that the vesting has already taken place.

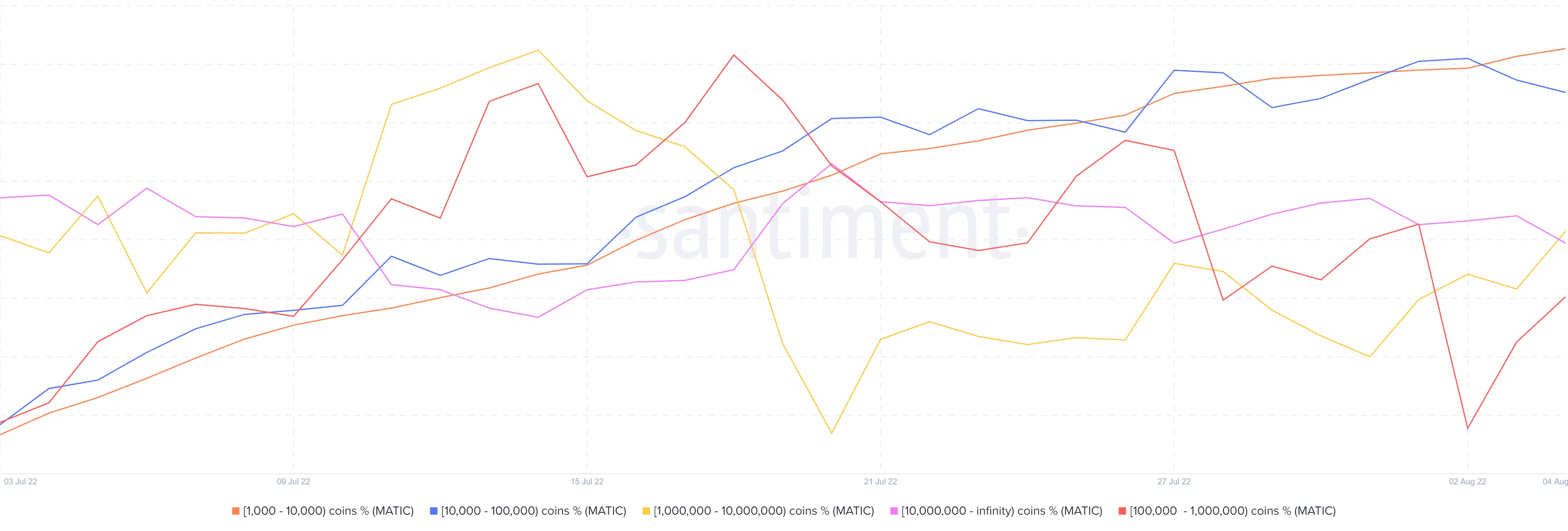

Even the top addresses have increased their balances in the last two days.

The quick re-accumulation just days later suggests that investors expect MATIC to continue rallying ahead of the merge.

Although MATIC currently looks bullish, investors should consider future vesting schedules which may suppress the price as more tokens are released into the market.