Filecoin [FIL] market weakens, but investors can still profit here

![Filecoin [FIL] market weakens, but investors can still profit here](https://ambcrypto.com/wp-content/uploads/2022/12/traxer-OBn6Z2WXgEc-unsplash-scaled-e1671801532375.jpg)

- FIL faced price rejection at $3.024.

- A possible price recovery could set FIL to settle at $2.951.

- A break above $3.024 will negate the above forecast.

Filecoin (FIL) rallied on 20 December, recording over 9% gains for investors after hitting a high of $3.084. However, price recovery followed, clearing about half of the profits. Recent rally attempts haven’t helped investors recover their losses, but there could be an opening.

At press time, FIL was in a price pullback that could settle at $2.951 if the momentum persisted. This could offer a short-selling opportunity.

Read Filecoin (FIL) price prediction 2023-24

Will FIL drop lower?

At press time, FIL was hanging loosely between 78.6% and 61.8% Fibonacci retracement levels and seemed poised for a further downtrend. Although the Money Flow Index (MFI) indicator showed a sharp rise, the accumulation phase could be interrupted, given the drop in trading volumes and increased selling pressure.

In particular, the Relative Strength Index (RSI) had a gentle downtrend after a recent smooth rise. It was at 44, slightly shy of the 50-neutral mark. This indicates that buying pressure increased recently but faced opposition as selling pressure increased by the time of publication.

The On Balance Volume (OBV) also recorded a gentle downward trend, indicating that volumes dipped slightly. Such a dip could undermine buying pressure and give more leverage to sellers.

As such, sellers could push FIL down to the 13-period EMA of $2.971, 61.8% Fib level of $2.951, or retest previous support at 50% Fib level ($2.899). These can act as short-selling targets with the stop loss at the 78.6% Fib level ($3.024).

A move beyond $3.024 will invalidate the bearish forecast. Such a move will give the bulls a new resistance target at $3.084.

How much Filecoin (FIL) can I get for $1?

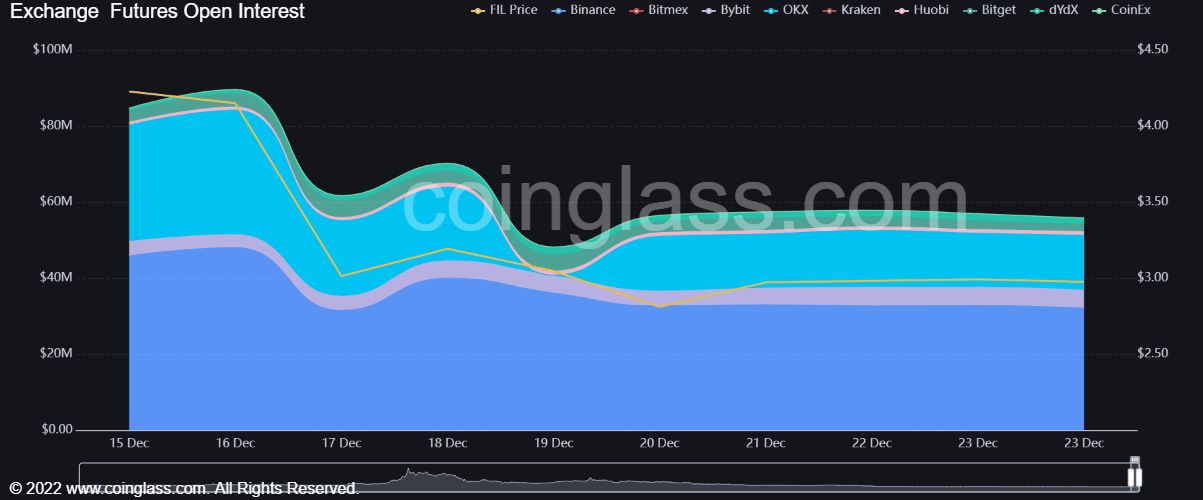

FIL recorded a drop in demand in the derivatives markets

The demand for FIL in the derivatives market dropped sharply from 16 December as per Coinglass. FIL’s open interest had fallen from about $90M to below $60M within a week. That translates to about a 30% demand drop across major exchanges, with Binance taking the most significant hit.

FIL’s open interest in Binance went from about $48M on 16 December to below $33M on 23 December. Put differently, about $15M flowed out of FIL’s derivative markets in the Binance exchange alone.

If the trend continues, selling pressure could push FIL lower. But a bullish BTC can reverse the direction and move FIL towards the 26-period EMA of $3.027, that almost coincides with the 78.6% Fib level of $3.024.