For Grayscale, here’s the upside to the SEC’s Bitcoin ETF approval delay

The United States Securities and Exchange Commission [SEC] has at least a dozen applications for a Bitcoin exchange-traded fund [ETF] before it. And yet, none of them have been approved. Although the crypto-industry has reacted positively to SEC Chair Gary Gensler’s comment that it is about when and not if the BTC ETF will be approved, there is still no timeline in sight.

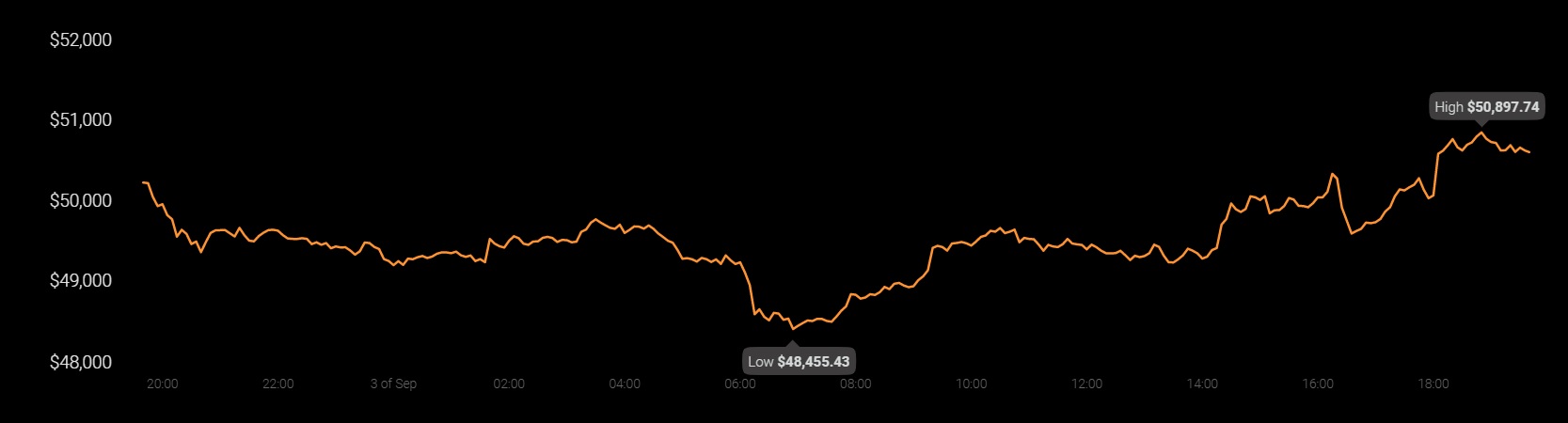

Source: Coinstats

However, this wait hasn’t been as torturous for some organizations. Rather, it has provided them with the “ability to focus on our organization which is well positioned and to execute our strategy on building an ETF business holistically,” according to Grayscale’s Global Head of ETFs.

Grayscale is the world’s largest digital currency asset manager with $25 billion in its Grayscale Bitcoin trust. The firm recently appointed Dave LaValle as its Global Head of ETFs, a newly created position which is its way to reaffirm “transparency, responsible growth, and converting its family of products into ETFs.”

With the SEC taking time to deliberate on approving BTC ETFs, Grayscale has been positioning itself as an asset manager for the next generation.

LaValle noted,

“We believe that offering exposures to cryptocurrencies is an aspect of that, but the way we envision marketing and supporting the products are all aspects of how we think we will be able to do things differently going forward.”

In fact, the exec also hinted Grayscale will look at products in a range of wrappers and different asset classes. This means Grayscale will be exploring equity-based products for its clients, with Bitcoin ETFs being “not the only thing.”

LaValle clarified,

“We certainly have a focus on digital assets but it doesn’t prohibit us from exploring other products that are equity based with a next generation feel to them.”

Grayscale has been one of the frontrunners in the Bitcoin ETF race. However, the competition has been tough. Nevertheless, the publicly-traded company already adheres to financial standards and is self-regulatory, something regulators will find pleasing. Grayscale VP Craig Salm shared a similar sentiment when he remarked,

“I think our firms are doing what we can to make these products transparent to investors.”

As Grayscale expands its reach to its clients, the SEC is yet to approve a BTC ETF. According to Gensler, currently, investor protection is lacking in crypto. However, the U.S. regulatory agency would be receptive to Futures-based Bitcoin ETFs.