Forecasting MATIC’s fortunes for the upcoming week

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- MATIC’s decline below the $0.94-level manoeuvred the near-term trend in favor of sellers

- The crypto’s social dominance and network growth took a plunge.

The recent selling efforts pulled Polygon [MATIC] back into its bearish track as it witnessed a solid bearish rebuttal from the $1.2-resistance.

Read MATIC’s Price Prediction 2023-24

After slightly slowing down at the $0.87 support level, MATIC constricted its high volatility over the last few days. The sellers could aim to reclaim their edge in case of a bearish crossover in the near-term EMAs.

At press time, MATIC was trading at $0.893, up by 1.37% in the last 24 hours.

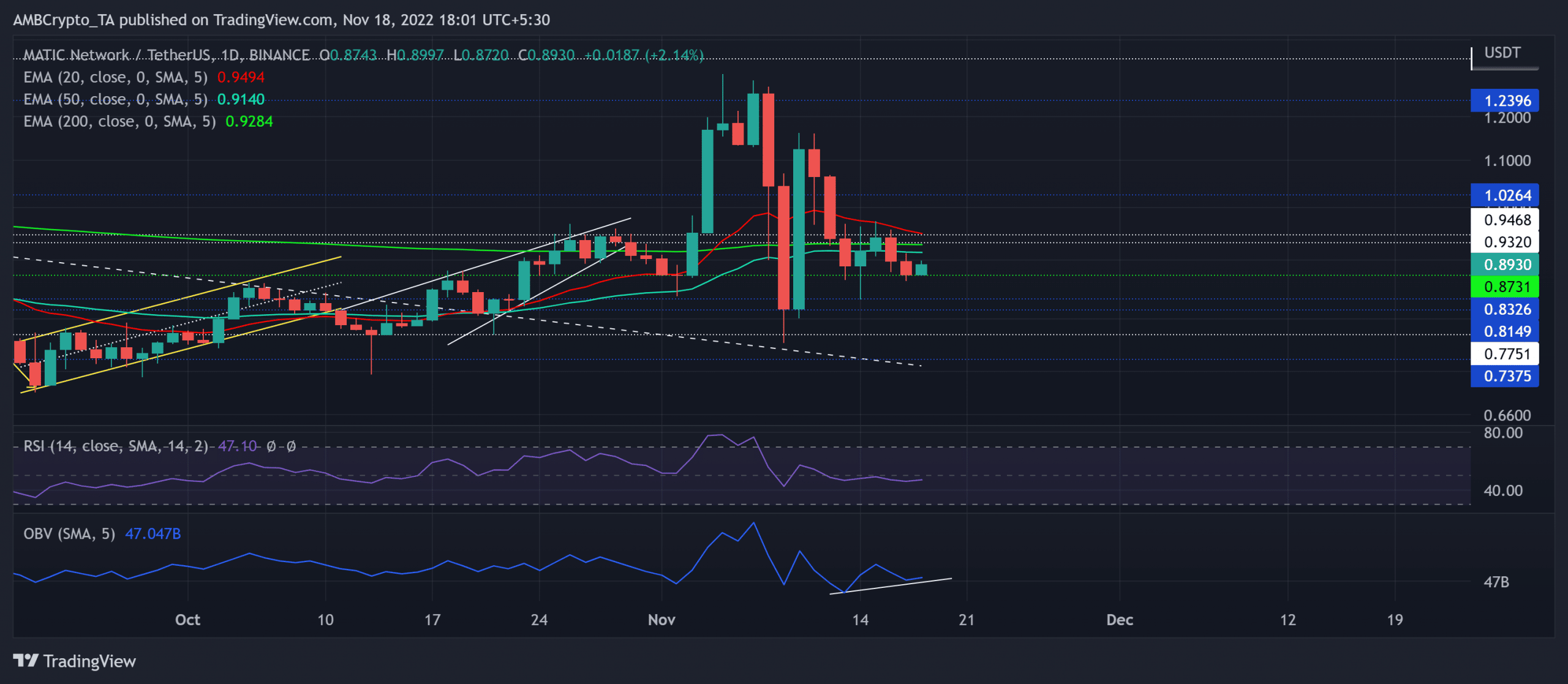

MATIC consolidated near its EMAs

Since breaking above the vital trendline support (white, dashed), MATIC has propelled numerous bull runs toward the $1.2-ceiling. The bearish engulfing candlestick on 8 November bolstered the selling pressure and pulled the coin below its 20/50/200 EMA.

In the meantime, MATIC lost a third of its value as it tested the $0.81-support last week. With the 20 EMA (red) looking south, a plausible death cross with the 200/50 EMA can delay MATIC’s near-term revival prospects.

Any reversal from the $0.93-$0.94 resistance range could extend the slow-moving phase in the coming sessions. A breach of the $0.87-support could propel a pulldown toward the $0.77-$0.8 range.

A potential/ immediate recovery from this support range could present buying opportunities. The first major resistance level would continue to be in the $0.94-zone. Any close above this barrier could inflict impressive gains while pushing MATIC above the $1 region.

The Relative Strength Index (RSI) stood near the equilibrium to project a rather neutral position. The buyers should look for a reliable close above or below the zero mark to gauge broader momentum.

Nonetheless, the On-Balance-Volume’s (OBV) higher troughs over the last five days bullishly diverged with the price action.

A decline in Network growth and Social Dominance

As per Santiment’s data, MATIC’s network growth registered a sharp drop from its mid-October peak. On the other hand, the price action gradually grew during the same time.

To top this off, the alt’s social dominance also marked a corresponding dip over the last two weeks. These readings highlighted a bearish edge for the token, but the targets would remain the same as discussed.

Finally, investors/traders must keep a close eye on Bitcoin’s movement as MATIC shares a nearly 30% 30-day correlation with the king coin.