Going long on AVAX? Here is the “but” to this possible trend reversal

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- A trend reversal could be possible if support at $10.86 holds

- AVAX bulls could target immediate resistance at $11.39

Avalanche [AVAX] fell over 25% from a high of $14.14 on 13 December to a low of $10.54 on 30 December. However, AVAX broke out above $10.73 after Bitcoin [BTC] surpassed $16.49k.

Read Avalanche’s [AVAX] Price Prediction 2023-24

If BTC remains bullish and moves towards $17k, AVAX could target immediate resistance at $11.39, offering a potential gain of over 4%.

At press time, AVAX was trading at $10.93, with technical indicators suggesting that an uptrend could continue.

Will the support at $10.86 hold?

AVAX’s continued downtrend found a temporary stop at $10.86. But is the support strong enough to prevent the bears from lowering AVAX’s prices?

Technical indicators suggested that a support could hold. In particular, the Relative Strength Index (RSI) reversed after sinking closer to the oversold territory. This showed that though buying pressure eased, it recovered slightly.

The On-balance Volume (OBV) also increased, indicating an increase in trading volume, which helped the recovery of buying pressure.

In addition, Chaikin Money Flow (CMF) crossed above the zero mark, indicating an upward trend reversal.

Therefore, AVAX could retest or break the previous support at $11.39, representing a 4% increase from the $10.86 level. Thus, long positions could gain over 4% if the bulls maintain momentum.

However, a break below $10.63 would negate the above bullish forecast. Such a downside move could settle at $10.23 or $9.65, providing bears with a target for short selling.

Investors should therefore watch the Money Flow Index (MFI). A break of the MFI above the 50 mid-range would signal strong bullish momentum capable of retesting or exceeding $11.39.

How many AVAXs can you can for $1?

AVAX development activity declined in Q4, but demand in the derivatives market fluctuated

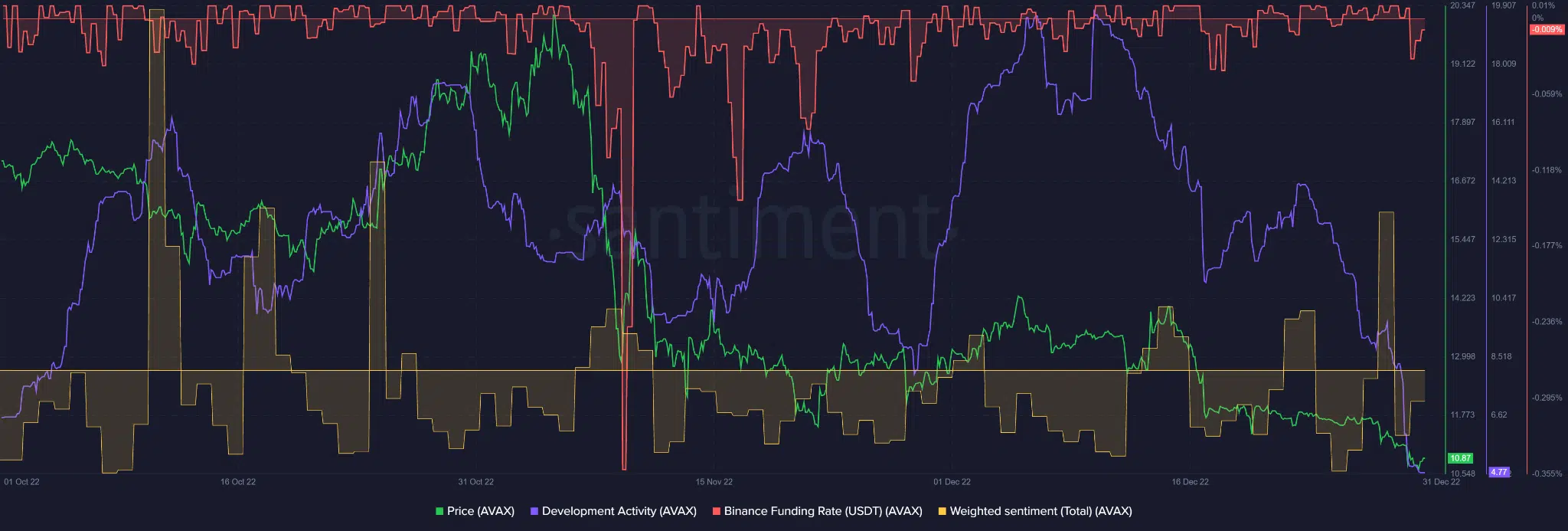

AVAX’s development activity fluctuated in Q4 2022. The development activity increased steadily increased in October but declined by the end of the month, with a significant upturn in the second half of November.

In December, development activity increased sharply but peaked in the first half before declining steadily thereafter. Throughout the period, prices correlated significantly with the development activity.

At press time, development activity had bottomed out, as had AVAX. Could this undermine the price reversal?

Nonetheless, investor confidence in the asset improved, as did the demand in the derivatives market, as evidenced by the improvement in weighted sentiment and Binance Funding Rates.

Improved sentiment could pump AVAX if its development activity remains flat. Therefore, investors should monitor BTC’s performance and AVAX’s overall sentiment with the advent of the new year.