Going short on ApeCoin [APE]? You should read this before you trade

![Going short on ApeCoin [APE]? You should read this before you trade](https://ambcrypto.com/wp-content/uploads/2022/12/ape-scaled-e1669991318512.jpg)

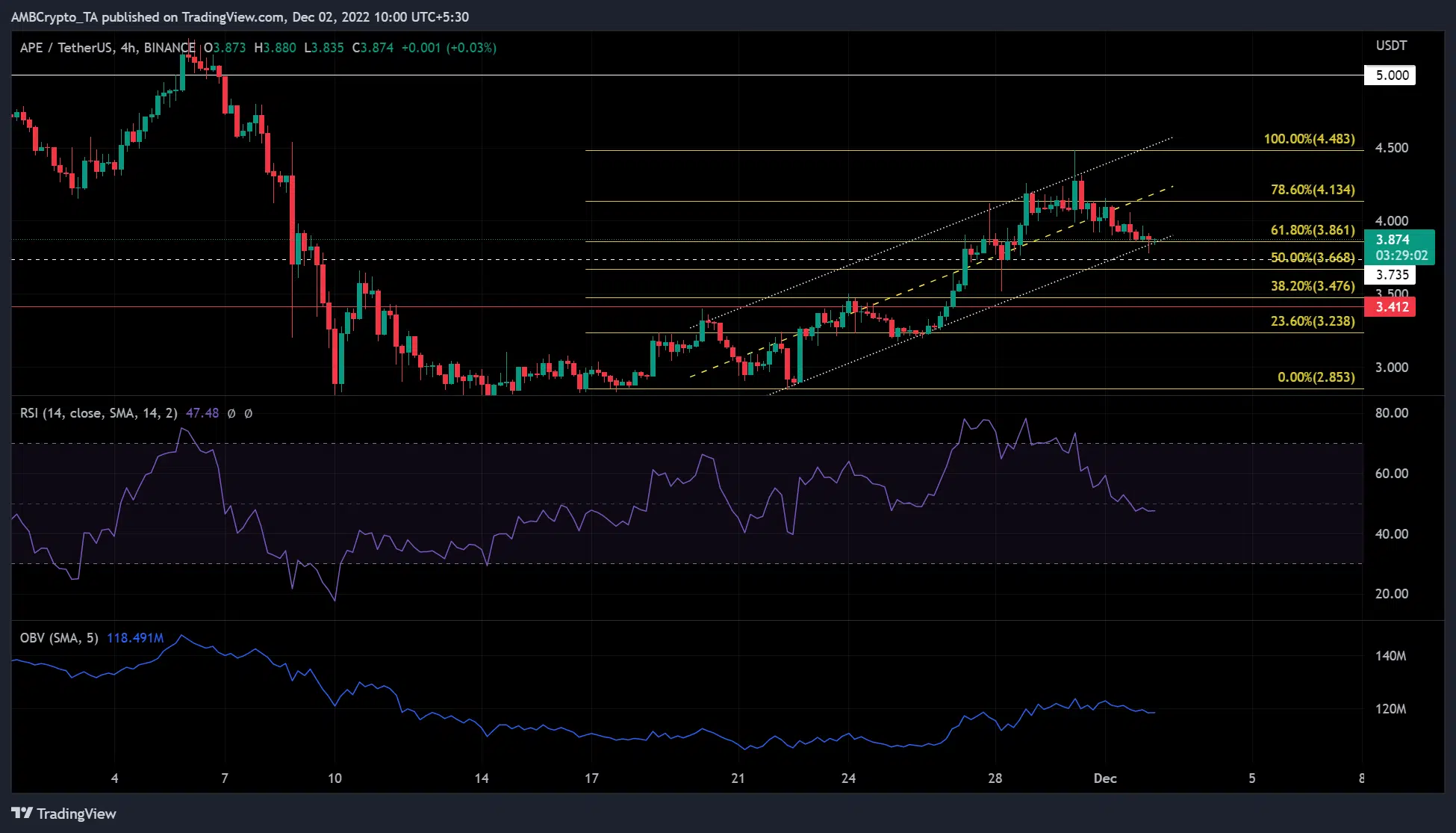

- The price action of APE was limited within a rising channel

- A possible breakout to the downside could send APE falling toward the 38.2% Fib level, or $3.412

- APE saw a decline in Open Interest in the futures market

ApeCoin [APE] fell below $3.954 after BTC lost $17.11k. It is worth noting that the price of APE was on a rising channel since 21 November, which is a typical bearish pattern.

At press time, APE was trading at $3.874. Its sensitivity to BTC could lead to a bearish breakout if BTC continues its downtrend. In other news, APE will launch a pre-staking service on 5 December.

APE chalked up a rising channel: Will the bears take control?

Over the past two weeks, APE’s price movement formed a rising channel with the highest point at the 100% Fib level ($4.483). At the time of publication, the price was moving in the lower range, approaching a possible breakout to the downside.

In particular, the Relative Strength Index (RSI) moved down, out of the oversold territory, and fell below the neutral 50-level. This showed that buying pressure had steadily eased, and sellers may gain influence in the current market structure.

The On Balance Volume (OBV) was also down, showing a decline in ApeCoin’s trading volume and demand. These indicators suggested that APE could trend downward, implying a possible downward breakout from the rising channel.

In this case, the target for a downward breakout would be $3.412, based on the height of the rising channel. Moreover, additional support could be at the 50% and 38.20% Fib levels.

However, a trading session close above the mid-point of the rising channel and the 78.6% Fib level ($4.134) would render the above bias null.

A decline in Open Interest

According to Coinglass, APE posted a steep decline in open interest with the advent of December. However, it turned into a steady and smooth downward slope at the time of writing. This indicated that money had flown out of APE’s derivatives markets at the end of November.

However, since 1 December, this outflow gradually decreased. Although this could be an indication of a declining bearish outlook in APE’s derivatives market, the structure is rather neutral, without a convincing and concrete direction.

Therefore, APE short-term investors should closely monitor the performance of Bitcoin. Bearish sentiment in BTC could cause a downside breakout from the rising channel. However, a bullish stance in BTC will cause APE to move within the rising channel in the short term.