Grayscale’s decision to withhold proof of reserve data could mean this for BTC

- Grayscale’s recent statements puts Bitcoin at risk of another crash or subdued performance

- BTC drops below $16,000 for the first time in two years

The FTX crash was a wakeup call for exchanges and crypto companies to adopt more transparency. As a result, many have embraced the idea of providing proof of reserve. It thus, came as a surprise when Grayscale, one of the top crypto investment companies, revealed that it had no intentions of going down that route.

Read Bitcoin’s [BTC] price prediction 2023-2024

Grayscale revealed that it will not be releasing proof of reserve information in a recent report. The latter addressed user inquiries regarding the state of their investments after the latest market events. Grayscale revealed that it did not intend to release proof of reserve information for security purposes.

6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

— Grayscale (@Grayscale) November 18, 2022

It did however note that Coinbase Custody Trust Company, LLC had custody of all the digital assets, including Bitcoin owned through Grayscale. In addition, the company noted that it had laws that prevented assets under its management from being let out on lending protocols.

The risk of investor pullout

Proof of reserve reveals whether the underlying protocol or company has enough assets to facilitate withdrawals. Grayscale’s announcement meant that it was walking a tight rope for refusing to provide proof of reserve. Such a move may spoof investors, especially institutional participants that constitute the lion’s share of Grayscale’s clientele.

Furthermore, Bitcoin already demonstrated some price slippage in the last 48 hours. This indicated a return of sell pressure. It traded at $16,220 at press time after recovering slightly from its brief dip below the $16,000 level.

The price action confirmed the dampened investor sentiment. However, if the same outlook prevails, then we might see BTC drop into the oversold territory. In other words, there was a significant probability of Bitcoin spending some time below $16,000.

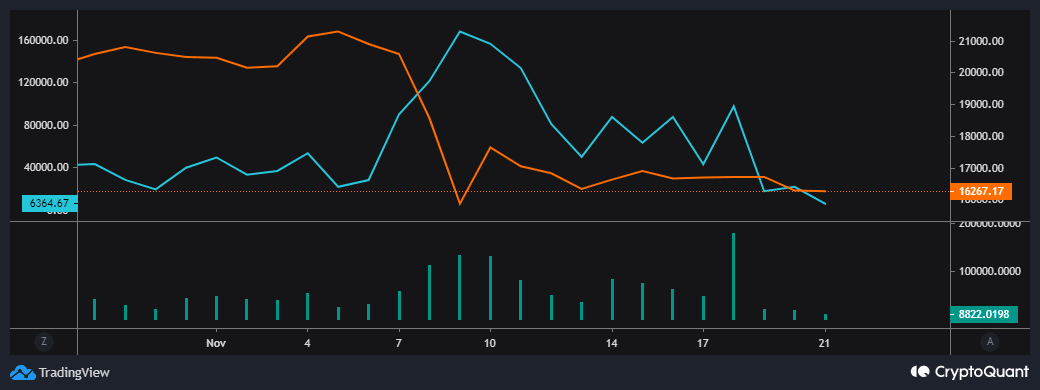

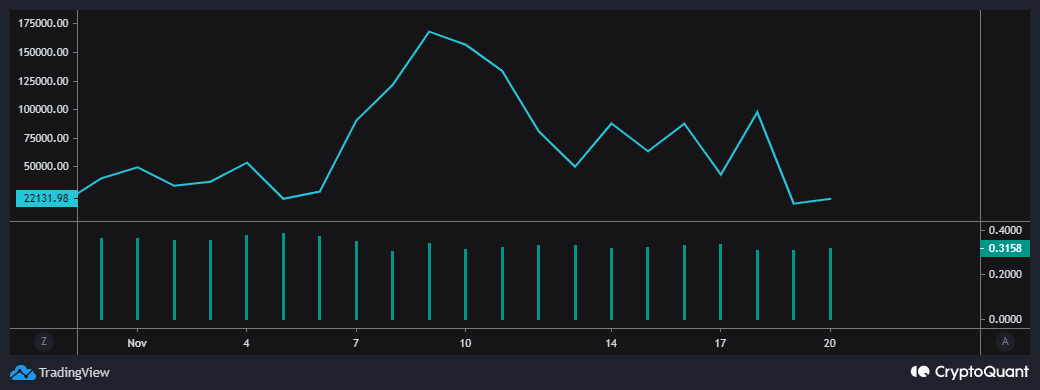

Current exchange flows revealed that the amount of Bitcoin flowing to exchanges was lower than the exchange inflows. This confirmed that there could be currently higher sell pressure in the market.

In addition to the lower exchange outflows, investors were notably executing fewer leveraged positions. This was confirmed by the estimated leverage ratio which recently dropped to four-week lows. This outcome is expected because of the increased risk levels associated with the current market conditions.

How are Bitcoin whales responding to this?

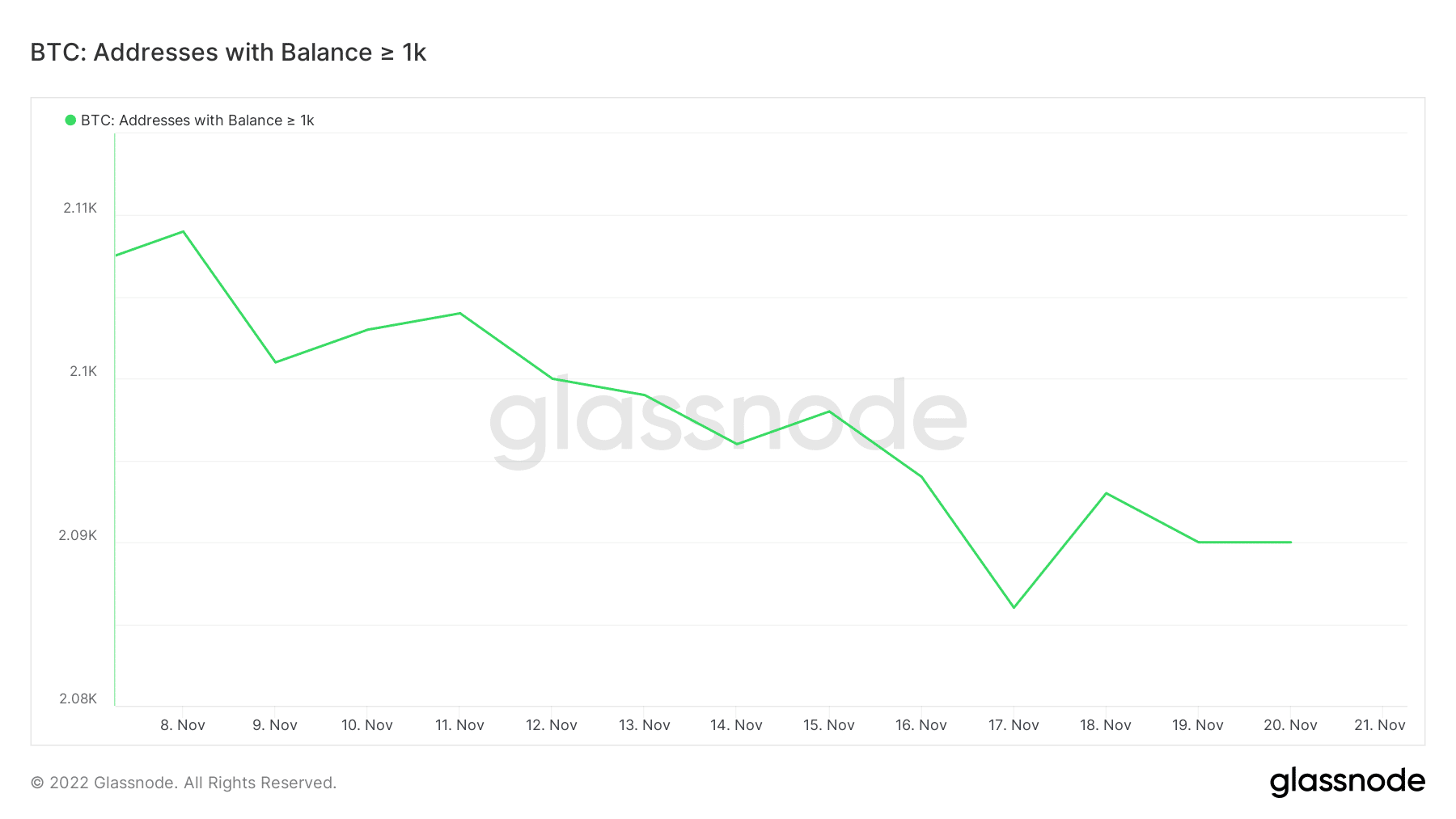

The response by whales may help provide some clarity regarding the state of the market. Addresses holding over 1,000 BTC have been selling for the last four weeks, contributing to sell pressure. However, the same metric indicated some accumulation on 17 November, after which we saw a bit of an uptick in addresses.

The same metric witnessed some leveling out in the last two days. This indicated that whales were waiting for the market to provide more clarity of direction.

Bitcoin’s press time price was relatively low, which meant long-term holders could likely avoid selling. The lower the price goes, the more difficult it will be to continue dropping further as the discount becomes more attractive to investors. Nevertheless, Grayscale’s current situation might contribute to more FUD that will likely subdue BTC’s price action.