HBAR long-term traders should read this before making an exit

Traders or investors that hold HBAR in their portfolio are likely disappointed by its recent performance. Many top cryptocurrencies experienced a significant upside in the last week of October. Meanwhile, HBAR achieved a modest rally but has remained stuck within the lower range.

Here’s AMBCrypto’s price prediction for HBAR

HBAR’s underperformance may not necessarily reflect the state of the Hedera network. Some of its latest highlights do indicate that it is continuously focused on offering more utility. For example, it recently announced that users can now send NFTs and fungible tokens to anonymous alias addresses generated within its network.

?HIP-542 enables the ability to send fungible tokens and #NFTs to aliases that do not exist on the network. Previously, only $HBAR could be sent to aliases to auto-create an account. @ridley___ explains and showcases the newly implemented functionality ⬇️ https://t.co/onEptjwdur

— Hedera (@hedera) November 1, 2022

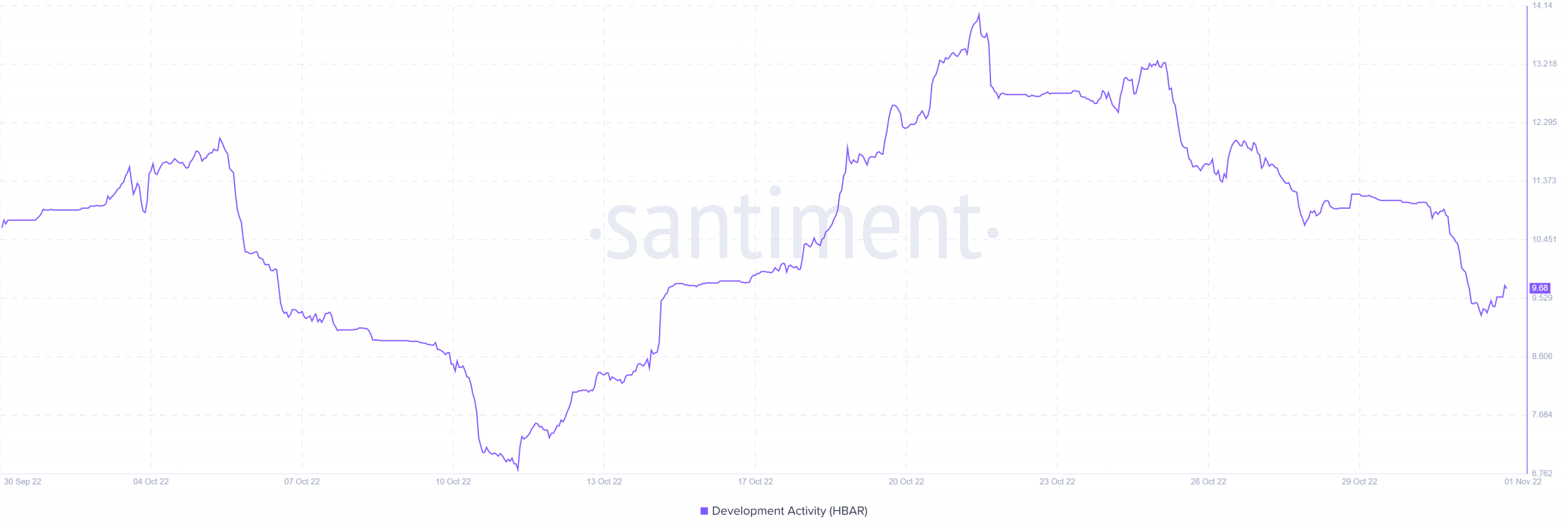

This development was courtesy of its recent HIP-542 upgrade. Despite this, Hedera experienced a drop in its development activity metric since 21 October. Investors should however note that the network has maintained healthy levels despite the drop in the metric.

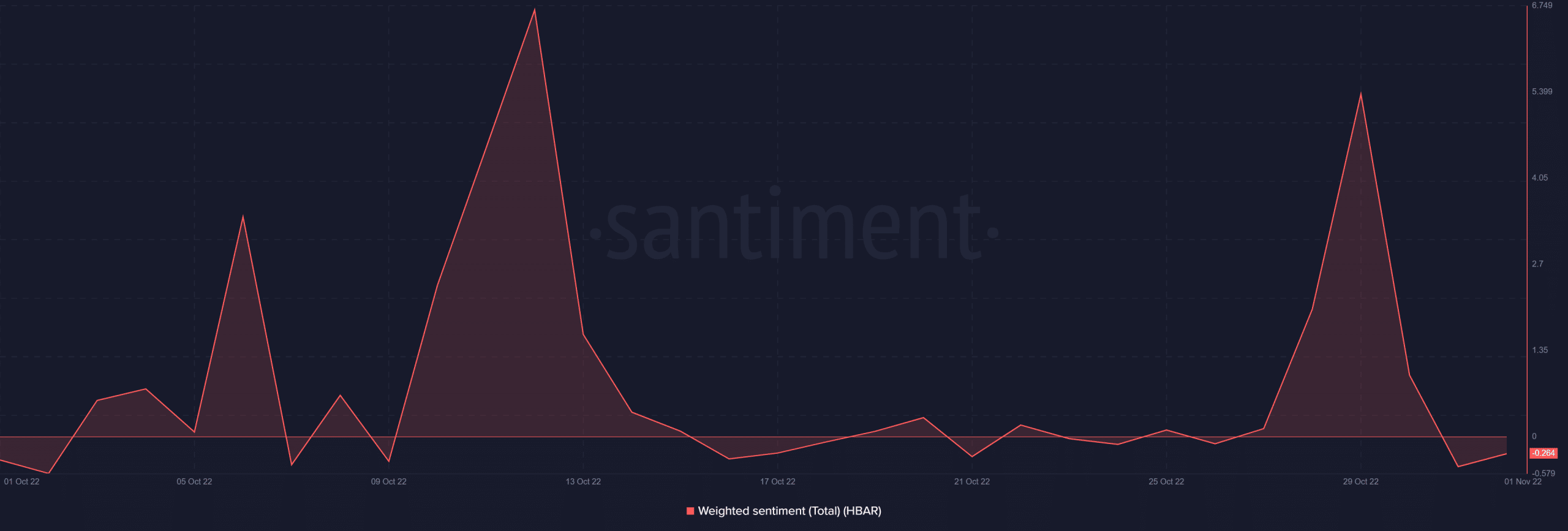

Lower development activity often affects investors’ sentiment. We did observe a surge in weighted sentiment towards the end of October before reverting back to the lower range. This may indicate some correlation with the drop in development activity.

Why HBAR’s upside remains relatively limited

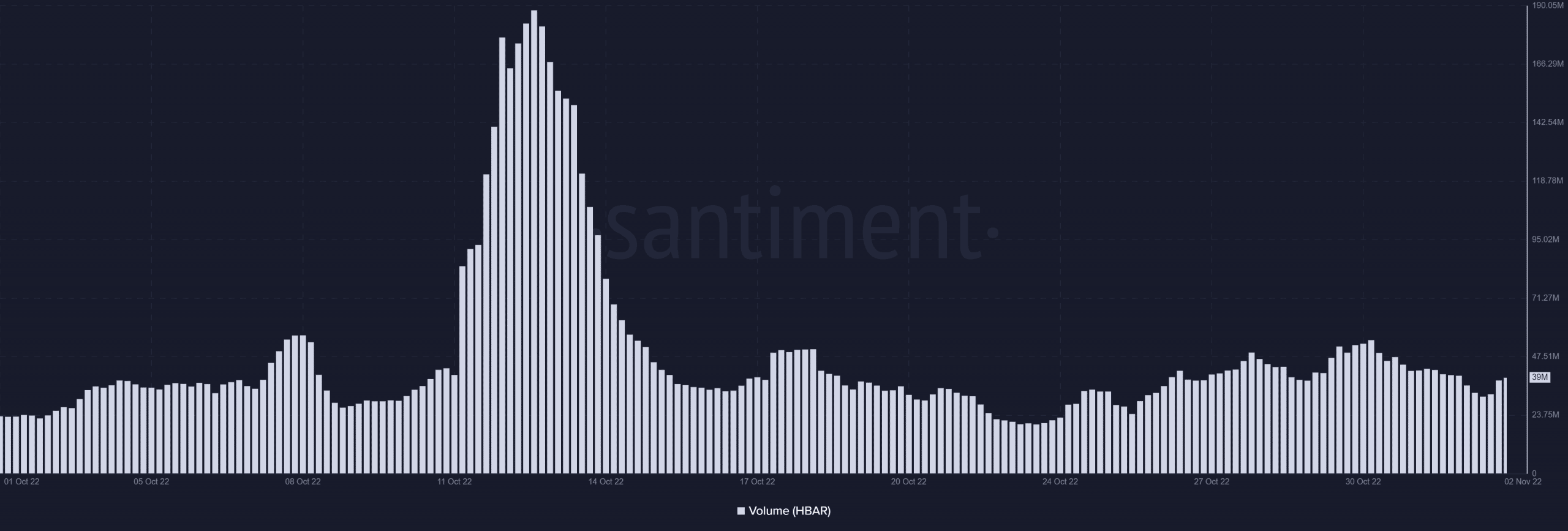

One potential reason for HBAR’s limited upside towards the end of October could be low demand. This is evident by the limited increase in volume observed during the last week of the month. HBAR’s largest volume spike occurred just before mid-October.

Volumes dropped off despite the slight upside, confirming that there was low demand. It was not all gloom and doom though for Hedera. NFT trades volume improved towards the end of October and it managed to achieve its second-highest spike in the last four weeks, at the start of November.

For clarity, NFT trade volumes on 1 October peaked at $1.76 million. For reference, it clocked its lowest 4-week volumes at $71,052. These observations are a healthy sign as far as organic network utility is concerned.

HBAR price action

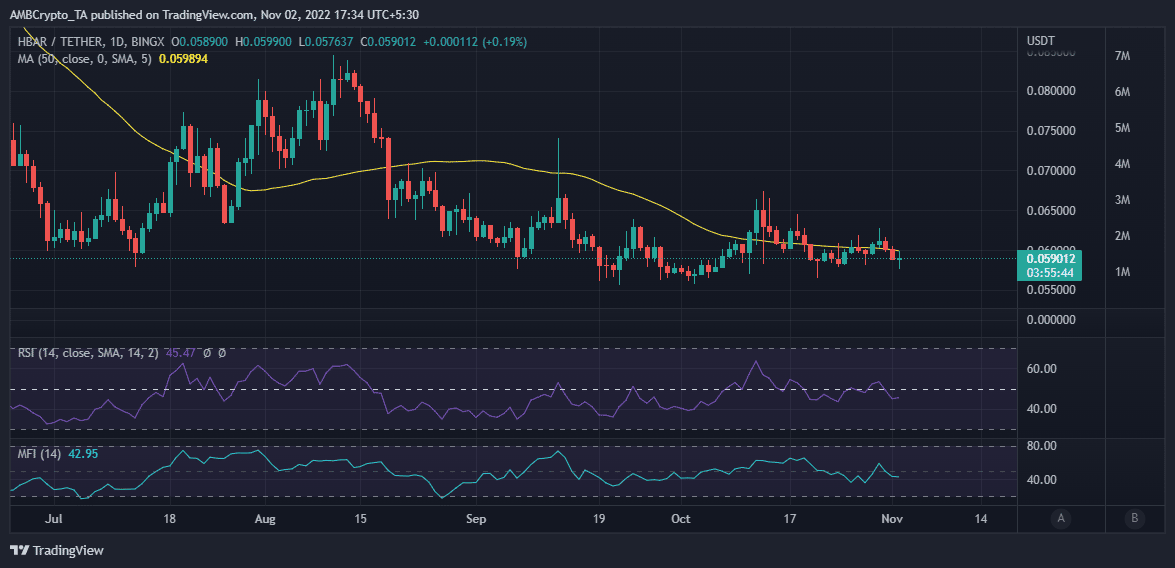

HBAR’s $0.059 press time price level represented a significant discount compared to its October highs. On the other hand, at press time, it was at a slight premium from its lowest level in the last four weeks. Its price action has been oscillating within the 50-day moving average at least for the last three weeks.

HBAR’s current price level is still notably within the lower 2022 range. Unfortunately, low demand for cryptocurrency has ensured that it remained within this range. We might see improvements if the macroeconomic outlook improves in favor of risk-on assets.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)