Here’s what you should know before buying Bitcoin right now

Bitcoin has been holding itself around the lower ranges of its chart for quite some time now. This consolidation has resulted in a weird pattern being repeated, one which has made investors question their decisions. Does this mean they will begin accumulating or are they about to dispose of their BTC?

These metrics will help you find that out and also understand the right levels to buy the king coin at.

Bitcoin is undervalued

Recently, Crypto Capital Venture discussed how Bitcoin is heading into the oversold zone on the daily RSI. Historically, this marks a period of accumulation and eventually results in a bull run. At the moment, the market is kind of following that pattern. Trading under $30k at the time of this report, the cryptocurrency had created more than enough space for being deemed undervalued.

Now, while the situation looks bad, it is actually an advantageous position for new investors to enter the market. Observing the Reserve Risk (RR) metric will make this easier to understand. Simply put, this indicator describes when BTC is undervalued [green zone] and underlines the time when an investor’s confidence may be high in the asset.

At the time of writing, the indicator was a tad bit away from falling into the undervalued region. Even so, the cryptocurrency can be seen as a very attractive option for new investors.

Bitcoin Reserve Risk showing BTC undervalued | Source: Glassnode – AMBCrypto

The same can be supported by the findings of the MVRV ratio, an indicator that marks a trend reversal every time it falls to an extreme low. Like the RR, this metric seemed to be close to the critical line. However, while a trend reversal might not be immediate, it goes on to verify BTC’s ongoing undervalued status. This, like said before, results in a period of accumulation for BTC.

Bitcoin MVRV ratio | Source: Glassnode – AMBCrypto

Who supports this period?

This period is especially beneficial for those investors who are looking for a strong entry point into the market right now. At the moment, big pocket players are shelving their BTC, something evidenced by the falling number of addresses. On the other hand, smaller wallets holding fewer BTCs have been rising at a strong rate across the board.

Bitcoin whales and institutions exiting BTC market | Source: Glassnode – AMBCrypto

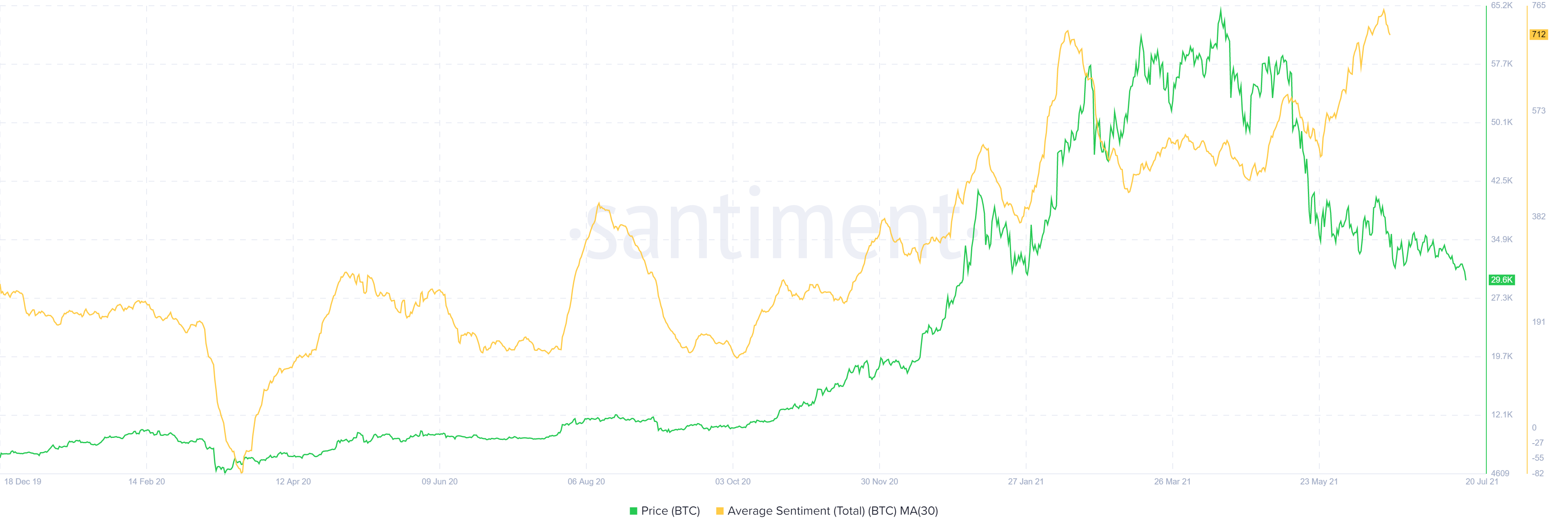

Finally, the only thing actually matters is how the investors feel about an asset. And at the moment, it looks like people want nothing more than BTC. Bitcoin’s social sentiment is absolutely positive. Despite the falling prices, the coin still holds a lot of value in investors’ minds. Even so, it’s worth noting that this also rears the likelihood of a reversal on the cards.

Bitcoin’s soaring social sentiment | Source: Santiment – AMBCrypto