How Bitcoin, Ethereum turned the crypto market around

- Bitcoin grew 93% in comparison to gold in 2023.

- In contrast to Bitcoin’s triple-digit growth rate in 2023, the altcoins could only grow by 37%.

Putting the pain of the crypto winter behind, the digital assets market, led by Bitcoin [BTC] and Ethereum [ETH], posted a strong recovery in 2023.

While the king coin has more than doubled in value since the start of the year, the king of alts accumulated gains of more than 50%, according to CoinMarketCap. And although the last two quarters were relatively calm, the signs of a bullish market were stronger than ever at the time of publication.

How much are 1,10,100 BTCs worth today?

‘Digital gold’ beats real world counterpart

The 2023 boom pushed the digital assets market far ahead of traditional market bellwethers.

According to a report published by on-chain analytics firm Glassnode, Bitcoin grew 93% in comparison to gold. Similarly, ETH appreciated almost 40% relative to the most popular store of value.

On a closer examination, it became evident that the momentum in crypto market accelerated since mid-October. Optimism over approval of half-a-dozen odd spot BTC exchange-traded fund (ETF) applications was the major catalyst.

What would be of particular interest to prospective investors was that the rally came amidst a period of global uncertainty. The conflict in the Middle East induced concerns over the macroeconomic health of countries and caused traditional markets to shiver.

However, the unhindered growth of digital assets could pitch them as attractive investment bets, resulting in a flow of investors from TradFi to the crypto realm.

Despite these invitations, interested investors should perform due diligence before entering the crypto market, for its brief history has been marked by unexpected swings.

Even in the current example, it can be seen that both ETH and BTC had much stronger price moves in either direction. Gold, on the other hand, was far less volatile.

Apart from the advantages over traditional asset classes, some other noteworthy developments may result in increased capital flows into the digital asset market.

What did ETH’s market signal?

Ethereum, the second-largest crypto asset, breached the $1,800 barrier recently. As per Glassnode, this was 22% above ETH’s Realized Price of $1,475. This meant that an average ETH holder was realizing a profit of 22%, an enticing signal for a prospective buyer.

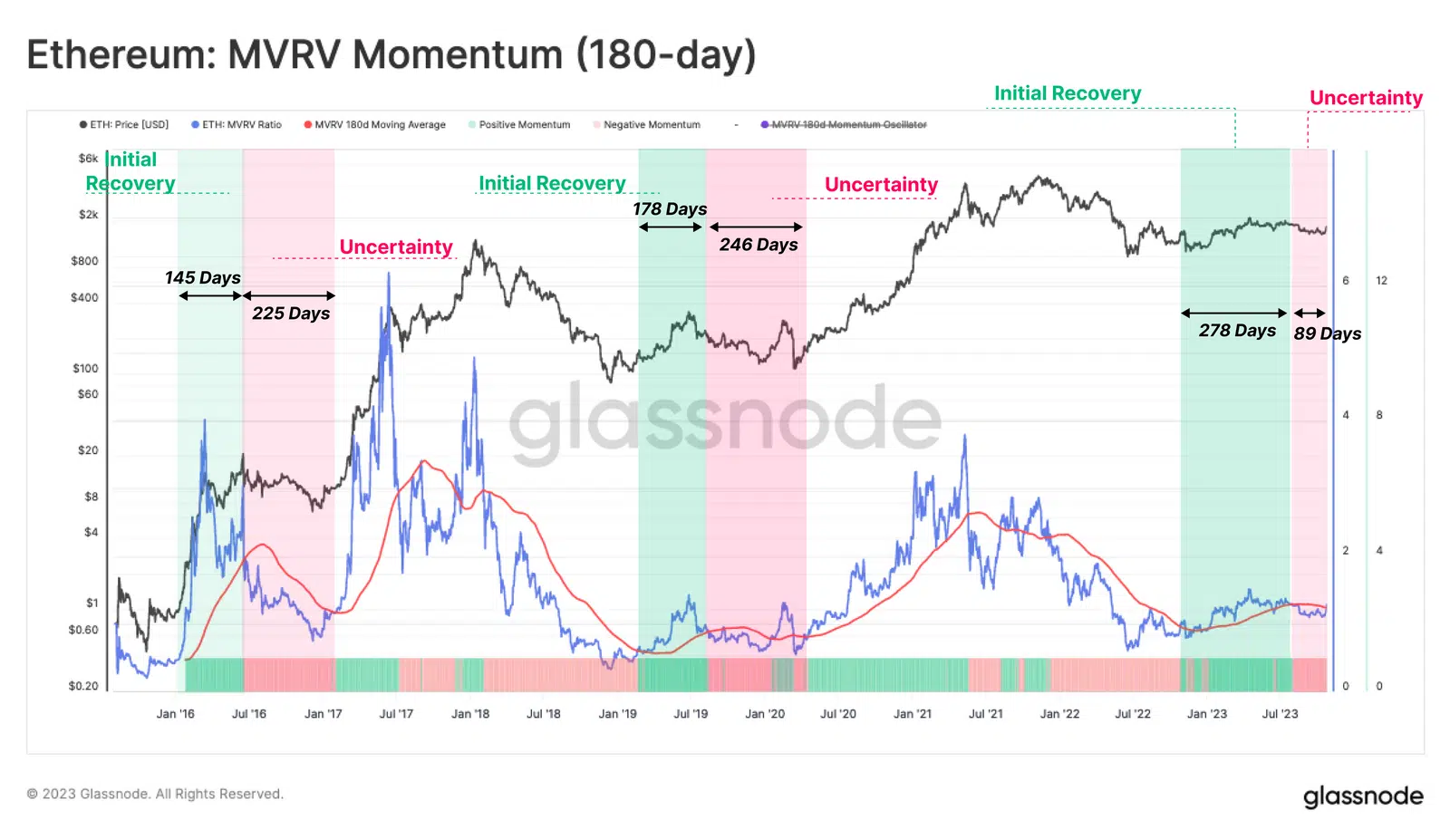

However, the MVRV Ratio, which is defined as an asset’s market cap divided by realized cap, revealed conflicting results. The MVRV has been below the 180-day moving average for nearly three months, suggesting a negative market.

Having said that, a marked shift in investor sentiment came to light when one looks at the Investor Confidence in Trend indicator. According to the data analyzed by AMBCrypto, the market was transitioning towards a bullish market.

Altcoins pump but BTC still the king

While the sentiment around cryptos in the top-tier was improving, the rest of the market didn’t stay far behind. The total altcoin market cap, which excludes BTC, ETH, and stablecoins, logged a 21% increase in October.

Only six trading days recorded a larger percentage change before, with five of them coming during the bull market of 2021.

Although the altcoin sector made impressive gains, it was worth noting that the BTC along with ETH, accounted for more than half of the total crypto market cap.

The was exemplified by looking at the gains made by the two sets of cryptos on a year-to-date (YTD) basis. In contrast to Bitcoin’s triple-digit growth rate in 2023, the altcoins could only grow by 37%.

Therefore, one can conclude that while altcoins outperformed fiat currencies like USD comfortably, it was Bitcoin which remained the king within crypto circles.

Read ETH’s Price Prediction 2023-24

The crypto market cheered the decision of the U.S. Federal Reserve (Fed) to keep the benchmark interest rates unchanged. At press time, BTC and ETH were up 2.80% and 1.76% respectively in the 24-hour period.

The upside potential of the market looked strong considering other developments as well. In a comment shared with AMB Crypto, Shivam Thakral, CEO of Indian crypto exchange BuyUcoin, noted.

“Invesco Galaxy spot Bitcoin ETF has been listed along with BlackRock on the DTCC site, adding to the existing euphoria around Bitcoin ETFs. The market will remain volatile in the coming days due to the rapidly evolving macroeconomic conditions.”