How miner revenues are shaping Bitcoin’s July prospects

- Bitcoin miner revenue reflects the improving state of BTC but slow phases are expected.

- Bitcoin miner sentiments improve in favor of the upside.

Is Bitcoin headed for another low volatility phase? That might be the case now that Bitcoin miner revenue is tanking. This is contrary to what we have seen in the last few months during which Ordinal Inscriptions fueled robust miner revenue growth.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Glassnode research revealed in the last 24 hours that Bitcoin percent miner revenue generated from fees fell to a 4-month low. Ordinal inscriptions and volatile demand previously ensured higher fees due to more market activity, hence more miner revenue. This was particularly the case in May and June.

? #Bitcoin $BTC Percent Miner Revenue from Fees (7d MA) just reached a 4-month low of 2.075%

View metric:https://t.co/NphJIZNcsL pic.twitter.com/3LsX5UniQh

— glassnode alerts (@glassnodealerts) July 10, 2023

Miner revenue has historically been a healthy indicator of market activity. But can be even more useful when combined with other miner data. For example, it can be combined with miner flows and miner revenue to determine miner sentiment. So, what is the current state of these metrics?

Miner activity improves from June lows but miner flows indicate that…

Miner revenue shot back up at the end of May and early June after a previous downward slope. This spike confirmed a bit of a sentiment change but the miner reserves have slipped slightly from June highs. However, it was worth noting that miner reserves are now higher than early March levels.

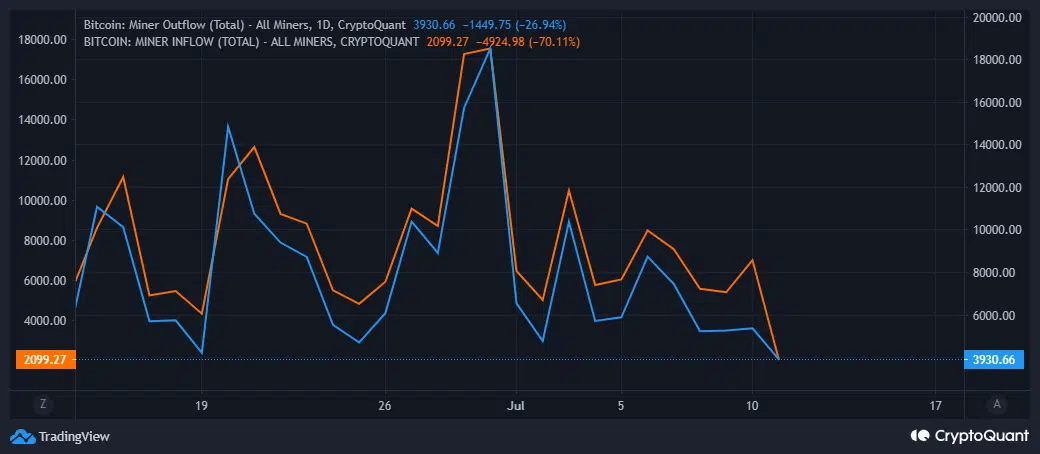

While Bitcoin miner flows are maintaining healthy levels compared to the last few months, miner flows have shrunk. Both miner inflows and outflows were at a monthly low. Nevertheless, it was worth noting that miner outflows were slightly higher than inflows at press time.

So far, we can conclude that miner flows are low enough to not have an impact at current levels. Perhaps an indicator that Bitcoin’s current level and prevailing market conditions may not necessarily point to a lack of confidence. On the contrary, it reflects a return of some confidence since June. In other words, the current miner data suggests that miners are leaning more towards the side of hodling.

How many are 1,10,100 BTCs worth today

Perhaps the above findings are because of the recent accumulation that we have seen in Bitcoin’s case. Especially from institutions. As such, we have seen a drop in the amount of BTC on exchanges. Glassnode data recently revealed that Bitcoin balances on exchanges have now dropped to 5-year lows.

? #Bitcoin $BTC Balance on Exchanges just reached a 5-year low of 2,251,571.825 BTC

Previous 5-year low of 2,251,575.975 BTC was observed on 08 July 2023

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/NYZDoH46J3

— glassnode alerts (@glassnodealerts) July 10, 2023

A lower balance on exchanges reflects the state of healthy accumulation that has prevailed for the last few weeks. While these developments have fueled a recovery above the $30,000 price range, it does not necessarily guarantee the sustainability of these levels.