How SingularityNET [AGIX] built momentum amid rising ChatGPT traction

![SingularityNET [AGIX] news](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-07T130940.839.png.webp)

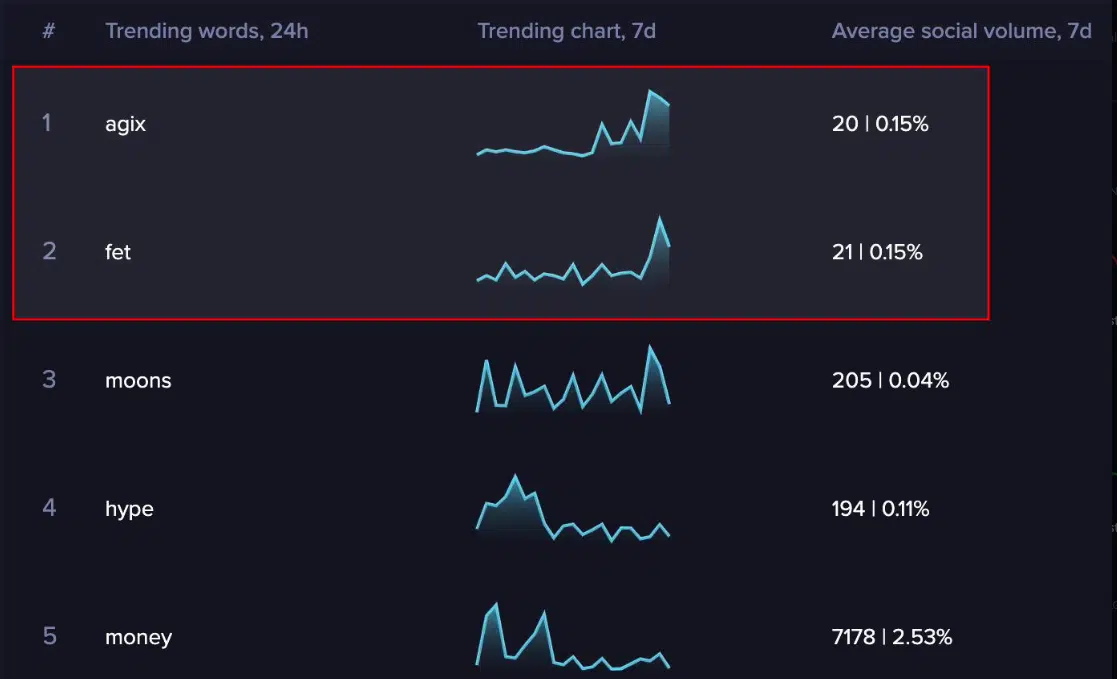

- AGIX topped social volume among all assets in the seven days.

- The token direction might continue in an upturned despite being overbought.

Blockchain-powered AI token SingularityNET [AGIX], on the premise of the ChatGPT adoption, increased 680% in the last 30 days. Yes, the surge in value may not be surprising as it’s not the first time that breakthroughs in other sectors impact tokens linked with them.

Read SingularityNET’s [AGIX] Price Prediction 2023-2024

Interestingly, other AI-linked tokens like Fetch.ai [FET] and Ocean Protocol [OCEAN] have trended similarly.

AI tokens are here to get their due

In analyzing recent behavioral trends, Santiment pointed out that AGIX might not leave the trendy list sometime soon. According to the on-chain analytic platform, AGIX topped the trending chart per social volume in the last 24 hours.

In addition, attention has been drawn to the token as Santiment noted that investors added AGIX to their watch lists. But the on-chain insight asked investors to remain watchful, as there might be better periods to go long on the token.

It is noteworthy to mention that SingularityNET has a globally accessible marketplace where users can create, share, and monetize AI services. Meanwhile, the AGIX token allows users to vote on the network’s operations with the option to stake.

According to Lookonchain, the top 20 holders of the token held about $345 million worth of it. This represented 55.4% of the total AGIX supply.

6.

The top 20 holders hold a total of 616M $AGIX($345M), accounting for 55.4% of the total supply. pic.twitter.com/WRkWkTbVKZ

— Lookonchain (@lookonchain) February 7, 2023

So, this means that whales mostly determine the AGIX buying or selling pressure. As expected, some whales have sold no part of their holdings. But does this mean AGIX has a high potential to proceed further in the upward direction?

FET: Still aiming for the moon?

As of this writing, the Bollinger Bands (BB) revealed that AGIX’s volatility was extreme. But there were chances that the token could be overbought since the price hit the upper volatility band.

The condition then aligns with Santiment’s opinion for investors to be cautious about expecting a further increase. Hence, a price reversal could be at hand.

However, AGIX’s direction, according to the technical indicators, seemed to have other plans. At press time, the Directional Movement Index (DMI) displayed a likely uptrend rather than a reversal.

Per the chart displayed below, the positive DMI (green) was 52.18. It also had the support of the Average Directional Index (ADX) which gauges directional strength.

How much are 1,10,100 AGIXs worth today?

At the time of writing, the ADX (yellow) was 62.59 — this value signaled incredible strength for the AGIX upward direction. The negative DMI (red) at 3.71 meant that a decline in value could be out of the question.

With Micrsosft investing in ChatGPT and other AI tools springing up, it is likely that the AI token hype might not subside soon.