Cryptocurrency exchanges are the gateway to the cryptocurrency space, and one of the leading contributors to the adoption of Bitcoin [BTC] and other cryptocurrencies. However, even though they play a vital role in the space, there is only a handful that has managed to gain the trust of traders and investors.

The two main reasons for this is believed to be a lack of security, which has resulted in numerous exchanges being hacked, and trading options.

Even today, Mt. Gox, the most notable exchange platform, continues to haunt the cryptocurrency space. This is because the exchange platform lost over 7% of Bitcoins that were under circulation due to a hack. It was known as the biggest Bitcoin exchange as it managed over 70% of all cryptocurrency transactions in the world in 2014. Its next bankruptcy hearing is scheduled for Q1 of next year.

The second most important factor is the trading products offered to customers as traders are known to play a vital role in the cryptocurrency market in terms of price and adoption. Hence, it is an absolute necessity for an exchange to ensure that their platform tends to the needs of traders.

In the current scenario, margin trading has become the priority for traders. It allows users to invest and trade with borrowed currency. Additionally, the more leverage provided by an exchange, the more customers it attracts. With margin trading, traders can opt for a long position or a short position, depending on market trends. This allows users to enhance their profits if their forecast on the market is correct or magnifies their loss, if incorrect.

This space is currently ruled by BitMEX, Bitcoin Mercantile Exchange, one of the leading trading platforms around the globe. The exchange provides 100x leverage to its users, which means that a user can purchase 100 Bitcoins and back it up by only 1 Bitcoin.

However, the exchange is seen scrutinized time and again. This is because of an issue that occurs when trading traffic become too high for the exchange to handle; system overload. System overload occurs when there are too many trades for the matching engine to handle. It can make users unable to close active trades, make new trades, and even login. The problems have resulted in a majority of the traders looking for other exchange platforms that meet the best qualities of BitMEX, but with fewer hurdles.

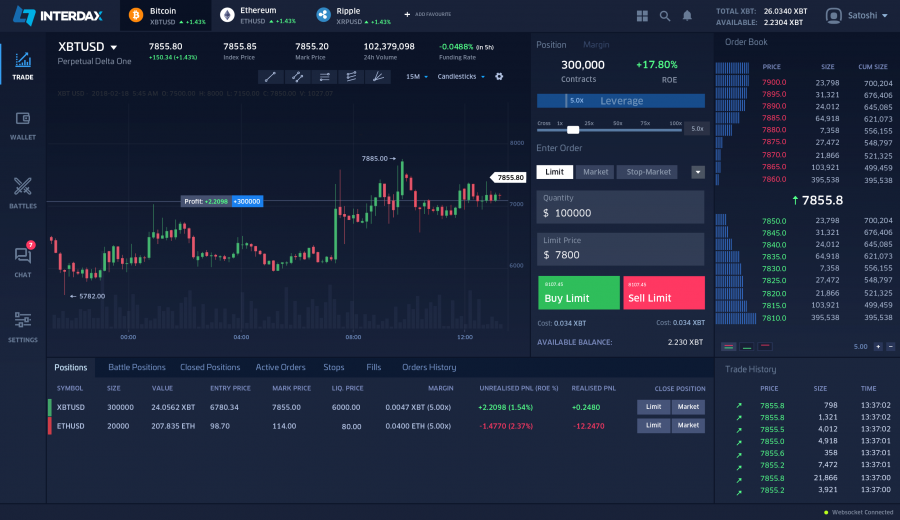

International Digital Assets Exchange, Interdax, is stepping into the space to provide users with all the best trading services, ranging from futures to derivatives. The exchange aims to fill the current gap in the trading ecosystem, along with placing the platform’s security as their top priority.

The exchange also has several similarities with BitMEX; one of them is the trading technology deployed by the platform, KDB+/q. This technology is hailed to be the best even in the traditional financial market, with only the top-notch players seen utilizing it.

In terms of technological advancement, the exchange did not stop here. The platform’s matching engine has the capacity to handle around 300,000 transactions per second, making it one of the fastest exchanges in both financial and traditional markets.

Additionally, the exchange was coded from scratch in highly optimized C++ and has been worked on by a team of professionals for the past 18 months. The team that is involved in the development of the exchange includes top-notch players from Nasdaq, NYSE Technologies, Goldman Sachs, JP Morgan Chase, IMC, Citadel, Optiver, Lloyds, and other major institutions.

To add to the traders’ delight, Interdax is introducing trading battles, wherein traders can battle each other to see who the better player is in this game of charts. This is one of the key features that differentiates the exchange platform from the rest. The team has decided to launch the Testnet and Mainnet with a battle, which will each last for over a month. The Testnet launch is scheduled for January 2019 and the Mainnet will hit the space anytime between February and March.

For the Testnet battle, the team has allotted $100,000 towards the prize pool and traders who wish to participate are required to pre-sign-up on the platform. Participants will start the battle with 10 demo Bitcoins.

The Mainnet battle, however, is going to be much more intense as the prize pool is $1 million, making this the largest cryptocurrency event to take place in the space. Users will not be required pay fees to partake in the tournament, but a trading stack is required.

After the launch of the exchange, users will be able to host their own battle, which will be publicized by Interdax on its official website. Additionally, the user who hosts the game will have control over the game, in terms of laying down conditions related to the number of participants, the name of the battle, the duration of the battle, trading stack, and the wager amount. At the end of the game, the participant with the highest amount will be declared the winner. The host of the battle will receive a 1% commission after the battle begins, and 1% commission from the total sum of the wager amount.

Notably, Interdax has introduced their very own token, IDAX, which has two main use cases. First, the token can be used to pay transactions fees. If a user does not own the token while initiating a trade, then the system will buy the corresponding fees in IDAX. Second, it is the only token that can be used to wager within a trading battle. This ensures that the token has enough liquidity against Bitcoin in the market right from the start.

The exchange is also introducing a referral program in order to promote the adoption of the exchange. The competition prize amounts to a total of $100,000, wherein users will have to use their email to sign up and later on, share their unique URL. At the end of the competition, the top 10,000 participants will be rewarded in the following order:

1st will receive 10 BTC and 1,000,000 IDAX

2-10 will receive 1 BTC and 100,000 IDAX tokens each

11-100 will receive 0.1 BTC and 10,000 IDAX tokens each

101-7,000 will receive 1,000 IDAX tokens each

7,001-10,000 will receive 100 IDAX tokens each

To know more about Interdax, click here! To get the most recent updates, follow them on Twitter here!