Is Bitcoin on track for $300K by year-end? Here’s this analyst’s take

This past week saw most of Bitcoin’s price action being governed by crowd sentiment. While HODLers have for long been a critical part of the narrative, whales, retail traders, and institutions have been so too. All of these entities have together triggered what is the bull market for Bitcoin and the larger crypto-market.

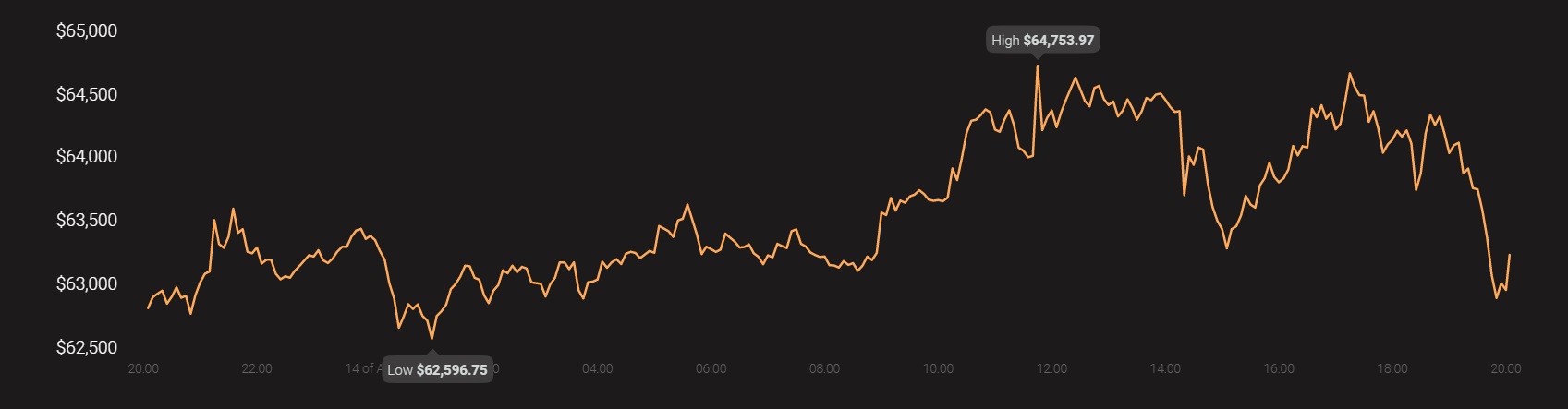

Source: Coinstats

The same was the subject of discussion between Peter Brandt and Willy Woo on the latest edition of the Unchained podcast.

“Bitcoin (BTC) is about halfway through its current bull market, one which originated around the March 2020 price low,” according to Peter Brandt, a veteran analyst. The CEO of Factor LLC is well-renowned for correctly predicting Bitcoin’s steep price correction in 2018.

The analyst went on to add that the long-term BTC bull market remains intact, with the author’s technical analysis suggesting that BTC could continue to rally, albeit with corrections along the way.

Brandt’s views on Bitcoin can be best highlighted by his recent tweets, with a tweet dated a few months ago underlining the parabolic movements of BTC on the arithmetic and log scales.

Big picture $BTC

Bitcoin is undergoing its third parabolic advance in the past decade. A parabolic advance on an arithmetic scale is extremely rare – three on a log scale is historic pic.twitter.com/fyyM5Ws6N5— Peter Brandt (@PeterLBrandt) February 16, 2021

“Extremely rare” is an interesting expression he used. In the aforementioned podcast, he said,

“If somebody would have told me that there would be a market during my lifetime that would not only experience a parabolic advance, but experience four parabolic advances, not just on an arithmetic scale, but on a log scale, I would have bet my life against that. This is just unbelievable.”

He added,

“People get caught up in the daily motion and the daily moment of Bitcoin without realizing we’re seeing a market advance, unlike anything we’ve ever really seen before. To have four parabolic advances on a log scale in the course of a ten-year period is just unheard of”

Willy Woo, a prominent Bitcoin on-chain analyst, chimed in on the subject too, with the trader predicting that Bitcoin would go above $300,000 by the end of the bull run this year.

Woo, who is also the author of the “The Bitcoin Forecast” said,

“Currently, that top target is launching upwards and at the start of this year January, it was zoning into an area of $200,000 to $300,000. And December of this year is typical to what we would expect from the end of a bull market.”

The steady hike in the price of Bitcoin is evidence of greater inflows of both institutional players and high net individuals into the crypto-space. This set of people moves large amounts of Bitcoin from exchanges and locks them away with no history of selling, showing that more people are recognizing the cryptocurrency as a good store of value.

The high rate of purchase of Bitcoin by institutions and corporate firms without selling has also led to a Bitcoin supply shock, a mismatch between demand and supply, reducing the number of coins available. The surge of institutions into the crypto-ecosystem is not surprising, however, with the same stressed upon by Brian Armstrong, CEO of Coinbase, who also touched upon the same.

With all the fuss around Bitcoin, there’s a very obvious question going around – Is Bitcoin a bubble?

According to Brandt,

“There are characteristics of a bubble. One of them is that markets go up fast with bids. There are aggressive bids that take place in the late stages of a bull market that kind of blow it off. And all those bids come in and chase the markets FOMO.

He added,

“This market is very different. What I’ve noticed is the market’s not necessarily going up on aggressive bids. What’s happening is an offer comes in and just immediately gets taken. And, so, whenever something is offered, it’s just taken immediately by somebody who’s willing to take the offer. So rather than going up on bids, it’s going up on higher offer prices, higher and higher offer prices.”

Curiously, a recent BofA Global Fund Managers survey found that 74% of the respondents still feel that Bitcoin is a bubble.

Bitcoin? Definately a bubble… #FMS pic.twitter.com/uOgpZMCnOj

— durk veenstra (@durkveenstra) April 13, 2021