Is Bitcoin’s downtrend ending? 4 factors tell you why…

- Majority of Bitcoin holders were in loss indicating a potential for a possible bottom.

- Both bulls and bears got liquidated, as bullish sentiment persisted.

Bitcoin’s [BTC] downward price movement brought the rally of most cryptocurrencies to a standstill. Moreover, the price decline also impacted the profitability of most addresses.

Losses on the rise

New data indicated that the Bitcoin Realized Profit/Loss Ratio has dipped below 1, implying that investors were encountering more losses than profits. Historically, this pattern has signaled a potential local bottom for BTC within the past six months.

Essentially, when investors start realizing more losses than profits, it can indicate a market sentiment shift towards capitulation or exhaustion among sellers.

In the past, these periods of heightened selling pressure have sometimes been followed by a stabilization or even a reversal in Bitcoin’s price trajectory.

Therefore, while the current scenario may reflect short-term pessimism, it could also pave the way for a potential rebound or consolidation phase for Bitcoin in the near future.

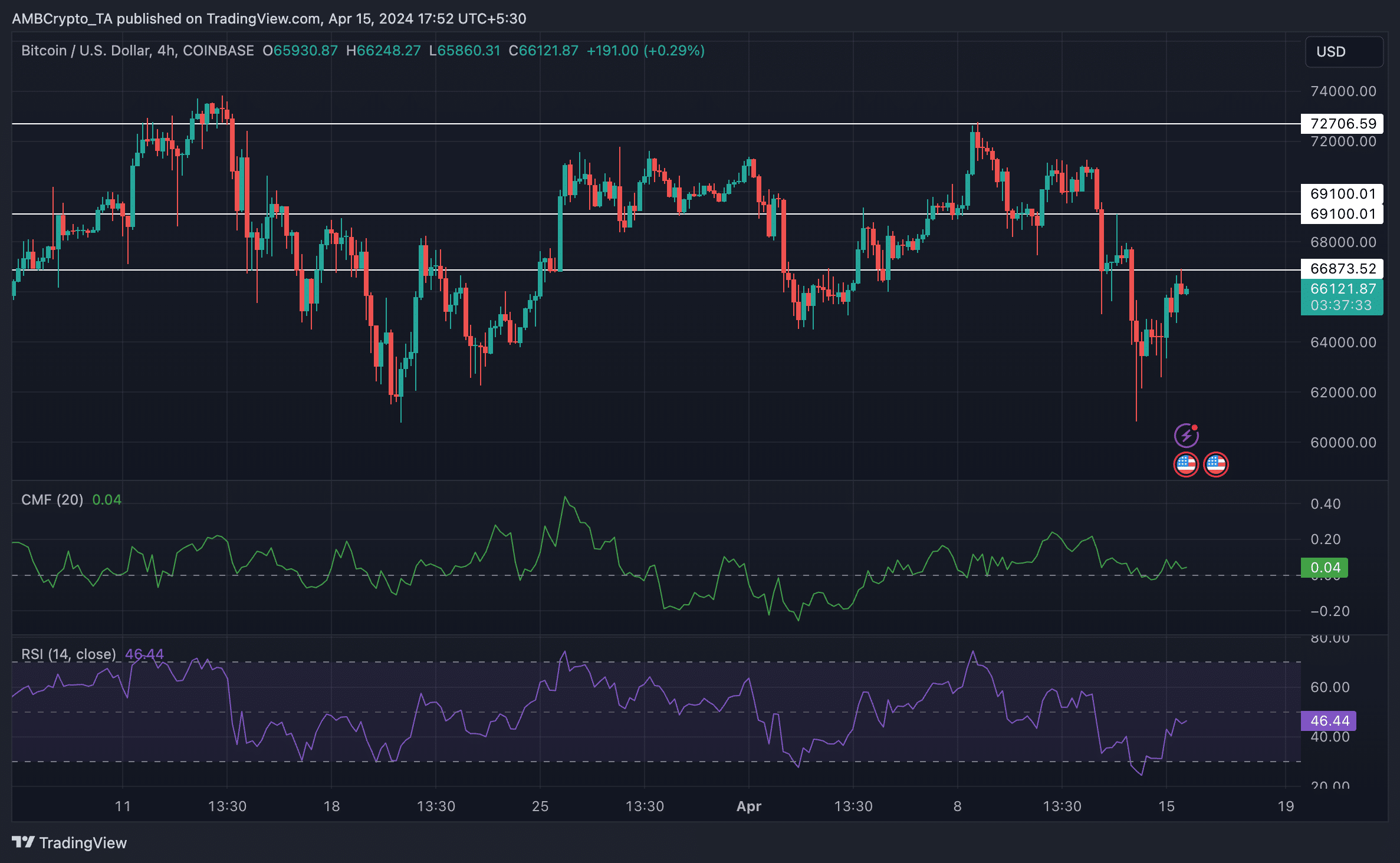

BTC showcased multiple lower lows and lower highs over the last 24 hours. This indicated that Bitcoin was still in a bearish trend and that it needs a prominent price surge to break the trend.

The Relative Strength Index (RSI) for BTC was at 46.44. A reading of 46.44 suggests that Bitcoin’s price momentum is neither strongly bullish nor bearish at the moment.

However, the Chaikin Money Flow (CMF) was at 0.4, which implied that there was a slight positive money flow into Bitcoin, suggesting probable increased buying pressure and potential bullish sentiment in the market.

Liquidations continue

Despite the bearish trend, BTC’s short-term price movement caused the most pain to the bears. Over the last 24 hours, $36.20 million worth of short positions were liquidated.

However, $2.34 million worth of long positions were also liquidated during this period.

Is your portfolio green? Check the Bitcoin Profit Calculator

Despite being liquidated in the last 24 hours, many bulls decided to go long on BTC. AMBCrypto’s analysis of coinglass’ data revealed that the percentage of long positions for BTC had grown to 54.2%.

It remains to be seen whether this time the bulls turn out to be right and whether BTC reaches new heights.