Is this development likely to affect Ethereum’s rally

Just a day back, Ethereum’s price managed to climb above the $3k mark. The value of the market’s largest alt rose by 21% over the past week. At press time, its value explicitly stood at $3142.86. The recent uptick in crypto prices has brought institutional products like private investment funds back to the limelight.

Institutional investors usually choose funds like Grayscale’s ETHE and GBTC to shield their portfolios from the crypto market’s volatility and risk. Goes without saying that the rise or fall in institutional demand affects the way the crypto market performs as a whole.

Ethereum’s RoI has been overshadowing that of ETHE’s for quite some time now. The alt’s price rose by 46.34%, 660.99%, and 329.94%, in the monthly, YTD and yearly time windows, respectively. ETHE’s surges, on the other hand, restricted themselves to 19.6%, 77.55% and 131.7% respectively, over the same timeframes.

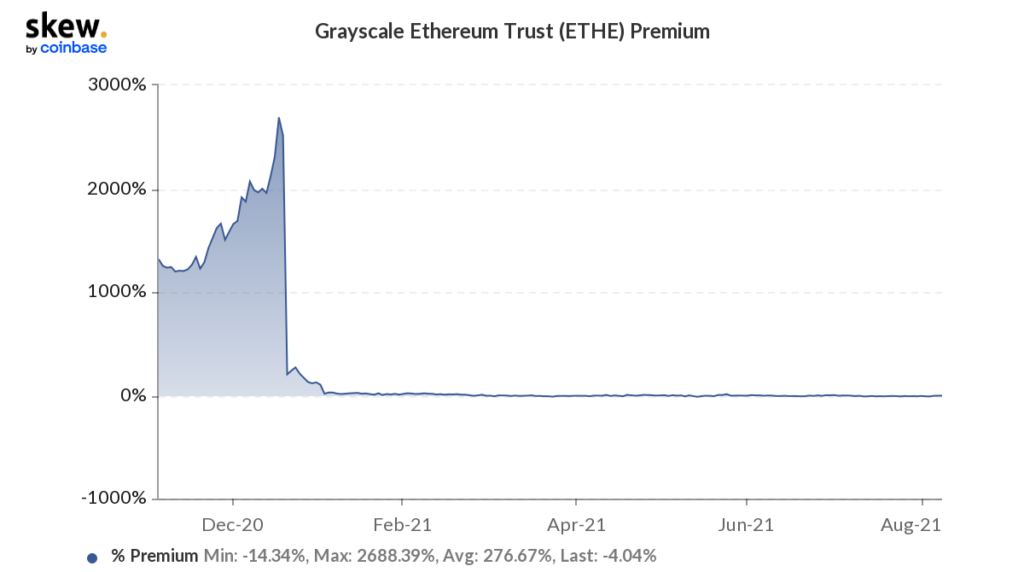

Additionally, as seen from the chart attached above, ETHE’s premium has massively fallen since the beginning of this year. At this stage, it is important to note that trust does not dictate the premium, but buyers and sellers of the market do.

ETHE’s premium stood at a massive 2513.86% during mid-December last year, however the same while writing reflected a negative value of 4.04%. Now, this essentially implies that the institutional interest is gradually fading away.

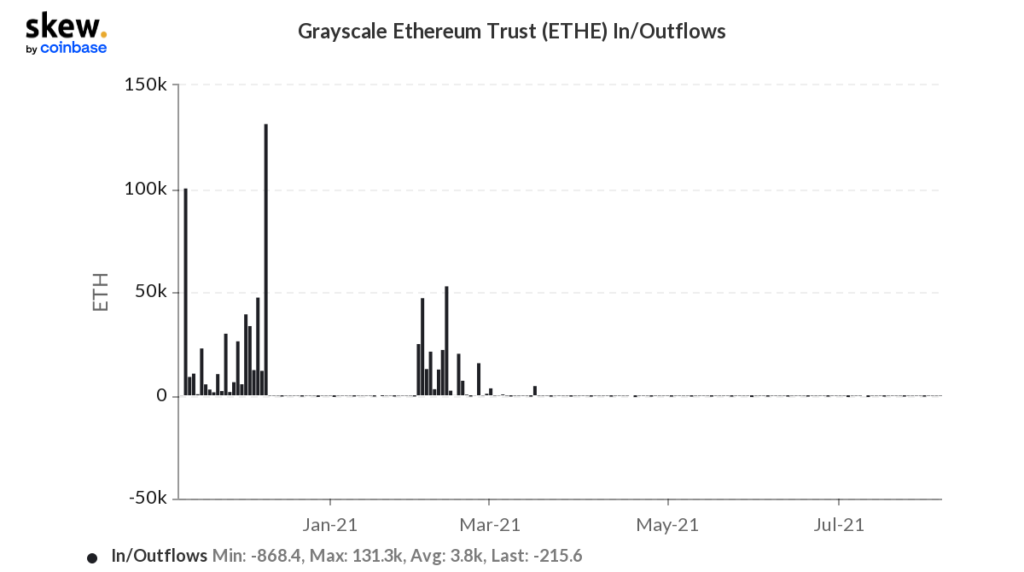

Over the last couple of months, the AUM of the Grayscale Ethereum fund has shrunk. The fund currently holds $9 billion worth of assets while the same during mid-May stood at $13 billion. Furthermore, as seen from the chart attached below, the trust outflows were, by and large, dominating the inflows.

The daily volume, however, has started picking up pace of late. The reading of this metric typically revolved in the $60m to $90m bracket duding mid-July. The same, at the time of writing stood well above the $200m mark.

Looking at the state of the fund over the past few months and the independent rallies that ETH has experienced of late, it can be concluded that the negative premium is not necessarily indicative of ETH’s low price sentiment. For now, ETH’s bullish momentum is gaining steam and irrespective of how this fund performs, a rally can be expected in the weeks to come.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)