Is this the right time to enter Bitcoin derivatives market

Bitcoin had a strong 26.7% rally (as of press time) that made spot trading very profitable for investors, but the interesting fact is that this rally benefited the derivatives markets as well. Observing on-chain metrics show that Bitcoin Futures and Options performed as well. The most interesting fact was the sudden rise in one particular metric which validated the rally.

Bitcoin Derivatives rising

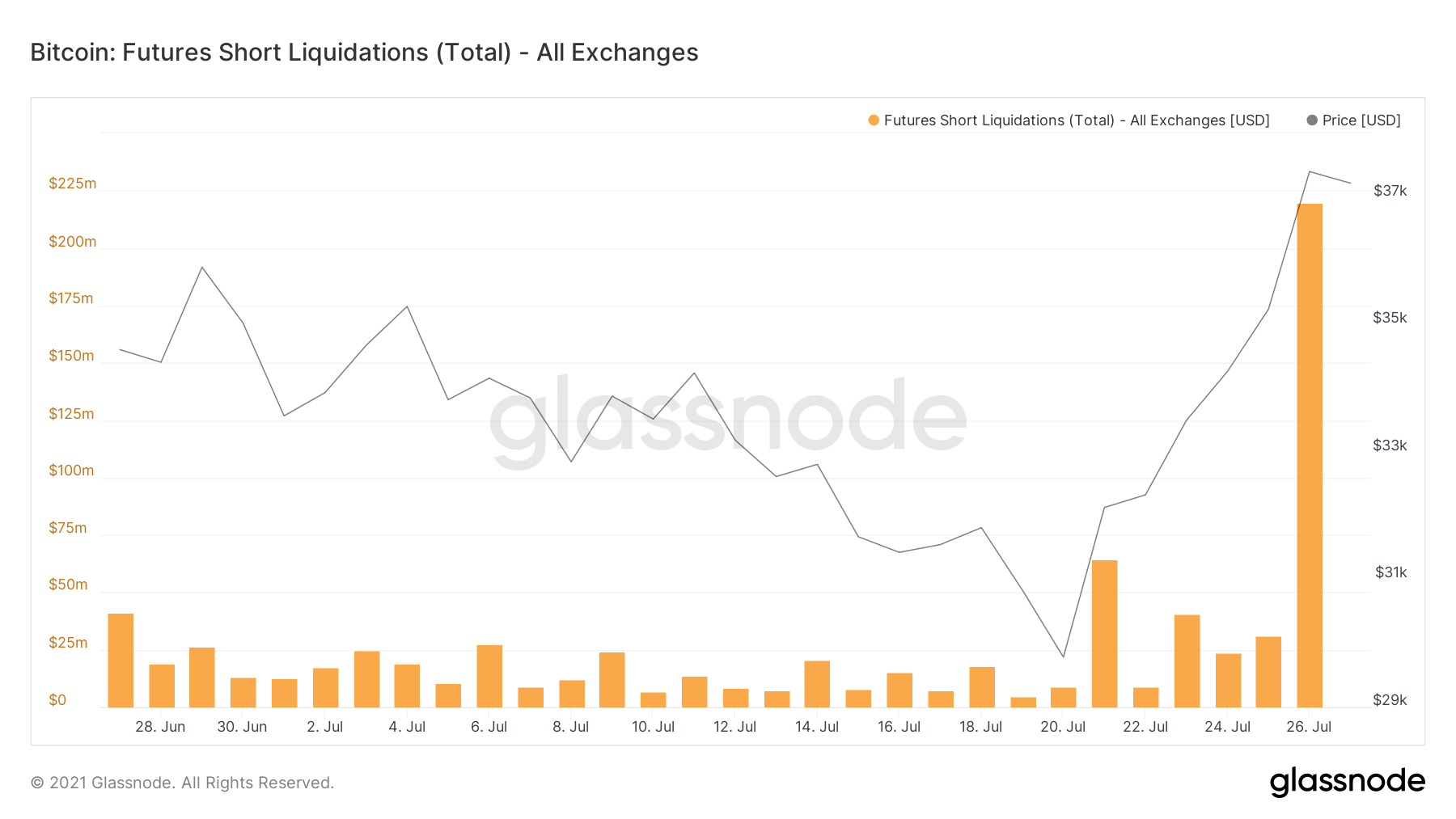

For the first time in a month, Futures Short Liquidations saw such a significant spike. The yellow bar reached a high of $219 million which showed the total amount of shorts liquidated on July 26. This spike confirmed one thing – the primary cause for the recent rally was in fact this short squeeze.

Bitcoin Futures short liquidations | Source: Glassnode – AMBCrypto

In addition to the increased short liquidations, Futures Open Interest (OI) too made some gains. After the May sell-off, OI had maintained a flat movement ranging between $10 billion and $12 billion. This pattern finally witnessed a change as Futures OI went up by $1.4 billion just this week. Such elevated OI often increases the probability of a volatile leverage squeeze taking place. With the OI rising Futures volumes didn’t lag behind either.

Bitcoin Futures Open Interest | Source: Glassnode

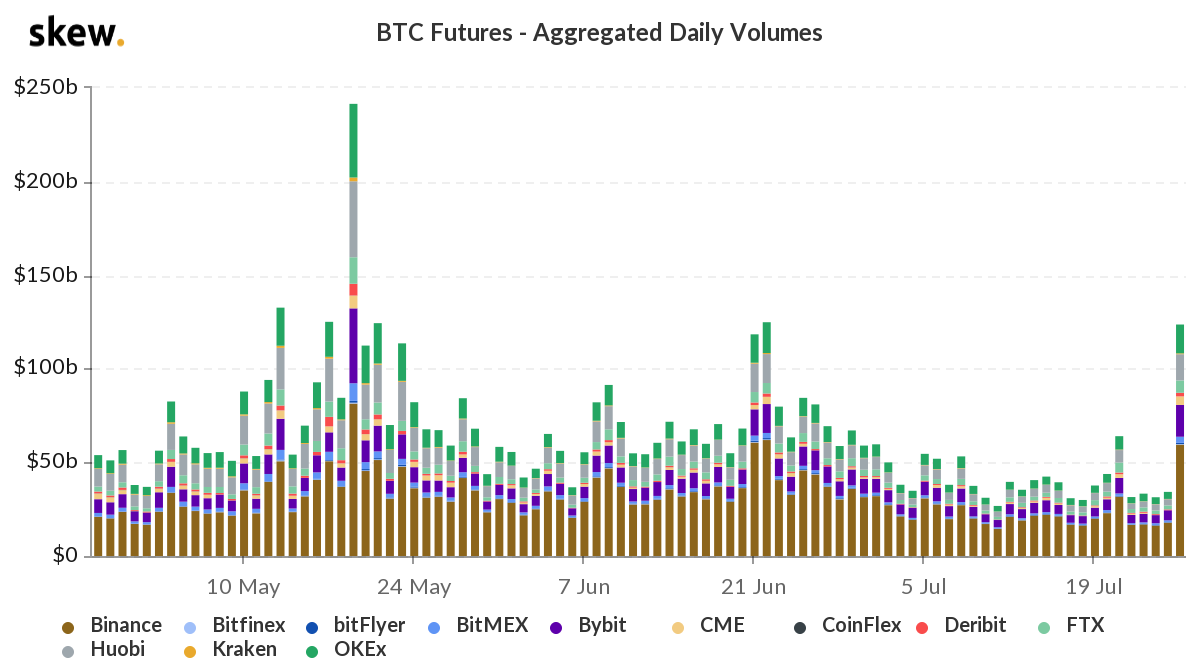

Futures volumes for the first time in over a month displayed such high daily volumes of Futures contracts in the Bitcoin market. On July 26, in only 24 hours, volumes rose by $90 billion standing at $120 billion. This is proof of the increased participation in the derivatives market.

Bitcoin Futures volume | Source: Skew – AMBCrypto

Adding to the same is the Options volume which was also up by $1.1 million on July 26. With the options volume at 1.2 million, the market seems to be stronger than ever at the moment.

Is the hedging for or against the market?

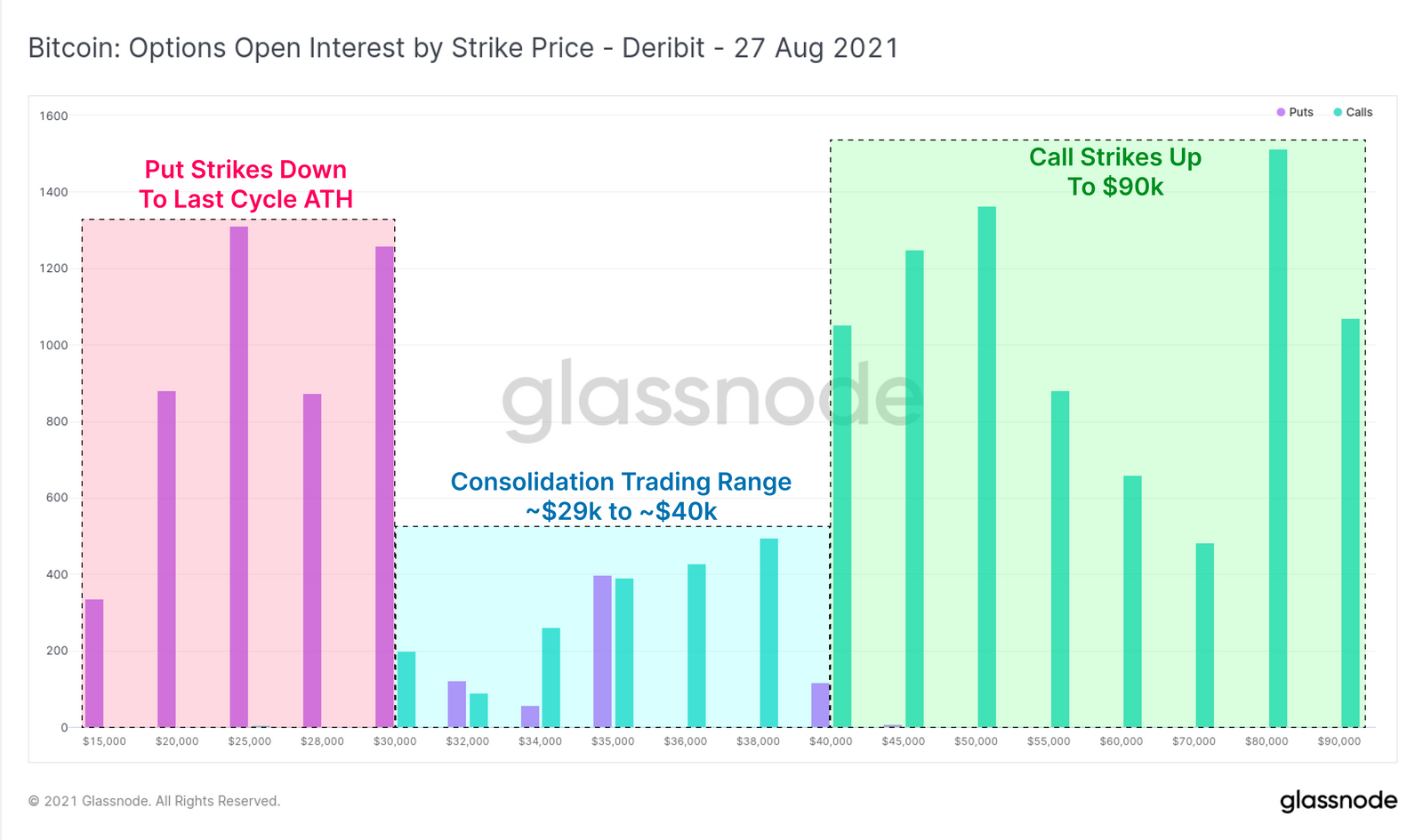

This is where it gets interesting. Technically put ratios always dominate call ratios and people hedge against the already suffering market. Until this happened recently. As of July 27, the call contracts were relatively higher than put contracts, with over 1,513 BTC in call contracts worth $80k. Although people are trading Futures at a higher price, some continued to play within the consolidation range of $29k to $40,000. Call strikes reaching up to $90k, serve as an affirmation to the optimistic outlook towards Bitcoin.

Bitcoin Options OI by strike | Source: Glassnode

Those looking to enter the derivatives market might find this to be the right time. Just make sure your exits fit the pattern that Bitcoin’s price action follows.