Is UNI’s TVL a victim of miscalculation? The Uniswap founder stated that…

- Uniswap founder clears confusion around TVL

- Activity on Uniswap declines along with the revenue being generated by the DEX

In a recent tweet made by Hayden Adams, the founder of Uniswap, it was stated that the TVL being recorded for Uniswap could be misleading. This is due to the fact that the TVL being recorded on most platforms did not account for uncollected fees on v3.

Difference is our TVL does not track uncollected fees bc v3 fees are not really part of a pools liquidity

I can see why this is confusing but its not a bug

I'm generally not a fan of TVL as a stat bc of how misleading it can behttps://t.co/lMv2zfjiW9

— hayden.eth ? (@haydenzadams) January 1, 2023

Are your UNI holdings flashing green? Check the profit calculator

A slow decline

At the time of writing, the overall TVL collected by Uniswap stood at 3.29 billion according to DefiLlama. The declining TVL being recorded may not be giving a clear picture of the current state of Uniswap.

However, there were other factors that suggested that Uniswap’s popularity was waning.

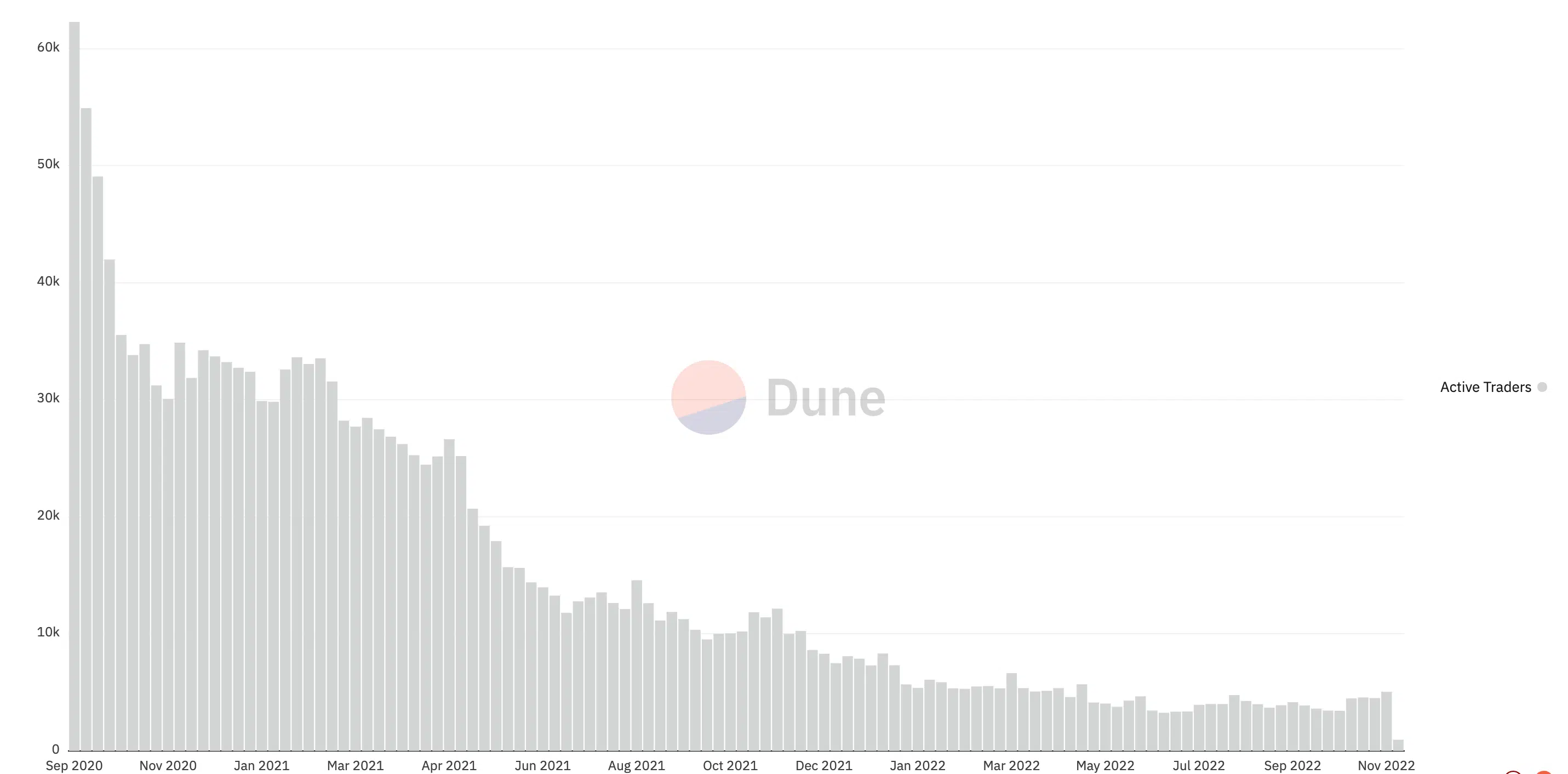

For instance, the behavior of UNI’s airdrop recipients was indicative of declining interest in the DEX. According to data provided by Dune Analytics, the majority of the recipients of the airdrop ended up dumping the token.

They also did not end up partaking in any sort of governance as well. As time went on, a lot of the airdrop recipients stopped being active users too.

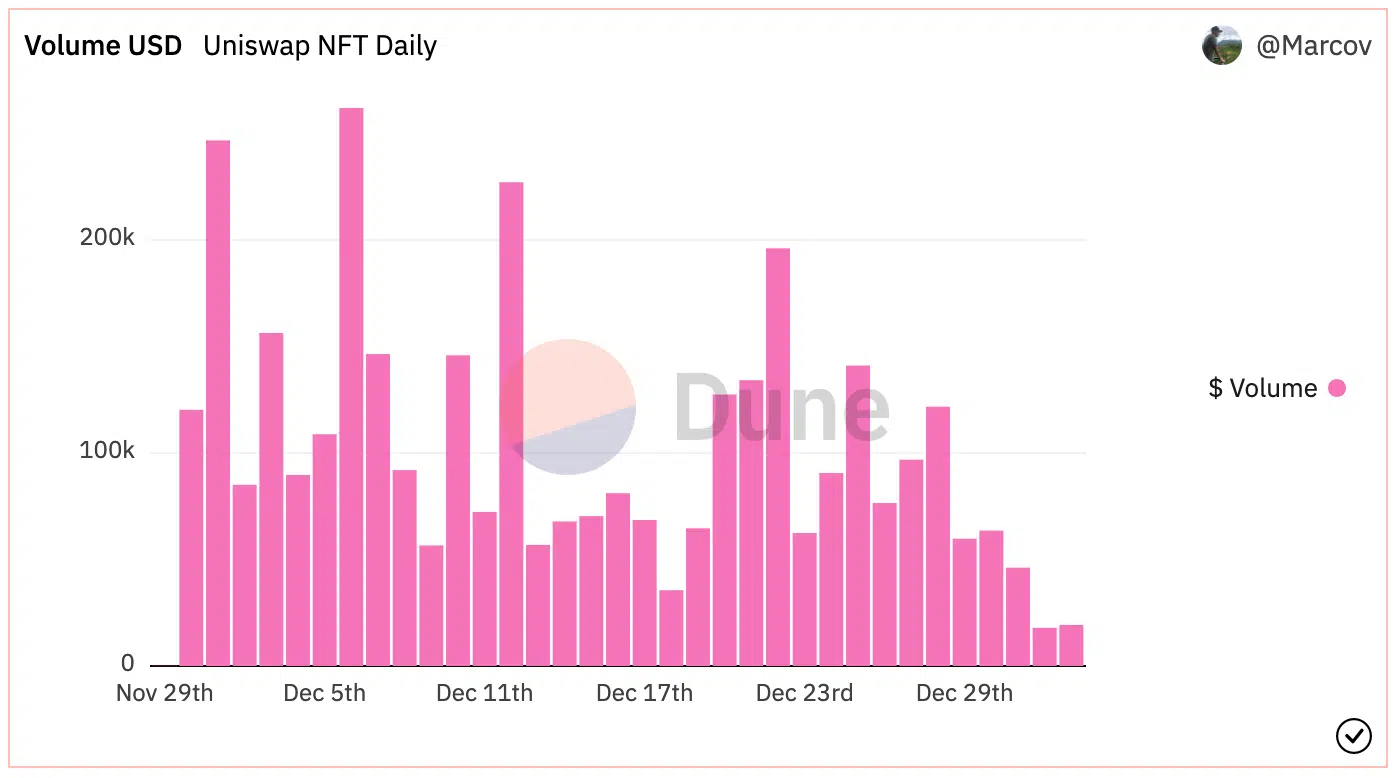

Another sign of dwindling interest in Uniswap would be the declining NFT volume on the DEX. The daily NFT volume for Uniswap declined massively over the last month.

The volume of daily NFT transactions on Uniswap fell from $246,565 to $19,243 in the span of 30 days. Subsequently, the number of transactions also declined from 440 a day to 19 a day during the same time period.

A quick look at the data at hand…

Due to this drop in activity and interest, Uniswap‘s revenue was also affected. According to data provided by Messari, the revenue generated by Uniswap declined by 52.84% in the last 30 days. At press time, the overall revenue generated by Uniswap in December stood at $2.05 million.

One of the reasons for the decline in revenue could be the decreasing number of unique users on the DEX. Based on the information provided by Messari, it was seen that the number of unique users on the protocol had fallen by 3.82%.

How many UNIs can you get for $1?

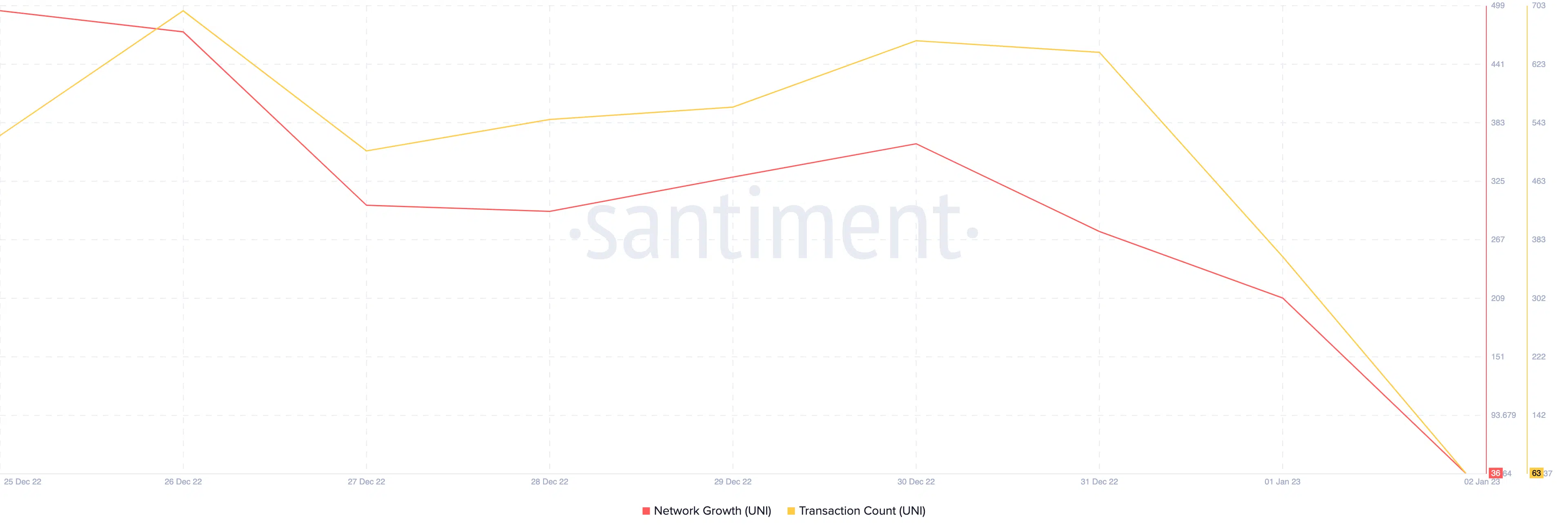

Coupled with the declining number of unique users, Uniswap wasn’t able to garner interest from new users as well. This was showcased by Uniswap’s decreasing network growth.

A declining network growth suggested that the number of transactions being made by new users for the first time decreased.

Despite all these negative factors affecting Uniswap, it continued to maintain dominance in the DEX space. At press time, Uniswap managed to capture 53.6% of the overall DEX market share according to Dune Analytics.