Lido Finance [LDO] may enjoy some bullish recourse, thanks to these observations

![Lido Finance [LDO] may enjoy some bullish recourse, thanks to these observations](https://ambcrypto.com/wp-content/uploads/2022/12/1663544317498-0187ab30-3ca1-4075-9f78-314e0022d8fd-e1671574058107.png)

- Lido Finance makes it to the top 500 whales’ most used contracts.

- The demand characteristics of Lido Finance’s native token LDO are starting to change.

Lido Finance, one of the famous crypto-staking platforms is back in the headlines. It reportedly earned its way into the list of most used smart contracts among the top 500 ETH whales, according to Whalestats.

Are your LDO holdings flashing green? Check the profit calculator

It is the second time that Lido Finance is making it to the list this month. Well, the last time, it barely had a significant impact on LDO’s price. But this time might be more significant, especially now that more factors are aligning for a potential pivot.

JUST IN: $LDO @lidofinance once again a MOST USED smart contract among top 500 #ETH whales in 24hrs ?

We've also got $BAL, #auraBAL, $BOBA, $ENJ & $SUSHI on the list ?

Whale leaderboard: https://t.co/tgYTpOm5ws#LDO #whalestats #babywhale #BBW pic.twitter.com/5cMzvi9VtP

— WhaleStats (tracking crypto whales) (@WhaleStats) December 20, 2022

This observation about Lido Finance means whales are taking advantage of its offerings.

Can LDO pull off a pivot at its current level?

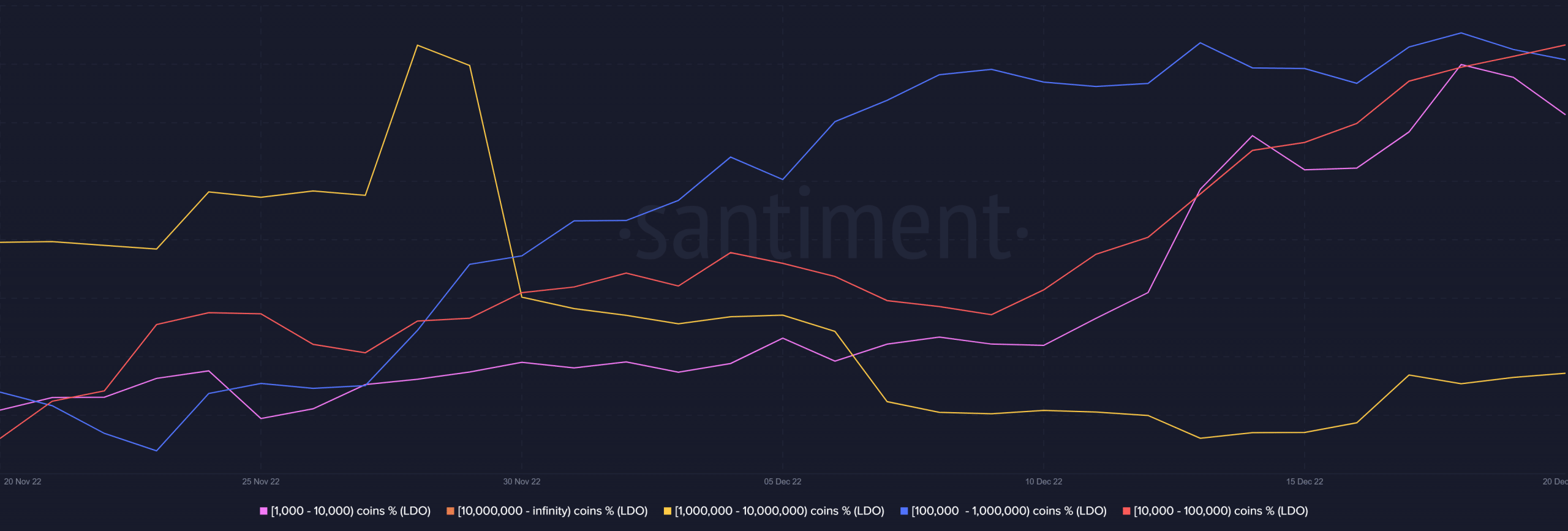

The demand characteristics of Lido Finance’s native token LDO are starting to change. For example, a look at LDO’s supply distribution reveals something interesting that may pave way for a bullish demand.

The highest address category (addresses holding over one million LDO) is no longer contributing to selling pressure. And it has instead been buying for the last few days.

The same top addresses category has been contributing to selling pressure since the end of November. Meanwhile, the second largest category, (addresses holding between 100,000 and one million coins have been buying since the last week of November.

However, the same category had slight outflows in the last two days. Also, addresses holding between 10,000 and 100,000 LDO coins are contributing to buying pressure.

A 178.72x hike on the cards if LDO hits ETH’s market cap?

The above observations confirmed that selling pressure from top addresses had subsided. This reflected the price action which registered a slight upside in the last 24 hours, at press time.

It further confirmed that sell pressure, at the time of writing, was tapering out. In other words, this gave way to some upside. LDO traded at $0.98 at press time after rallying by slightly over 3%.

LDO’s RSI indicator appears to be pivoting in favor of the upside. This move will likely be accompanied by more price increases. There are other observations that support this expectation.

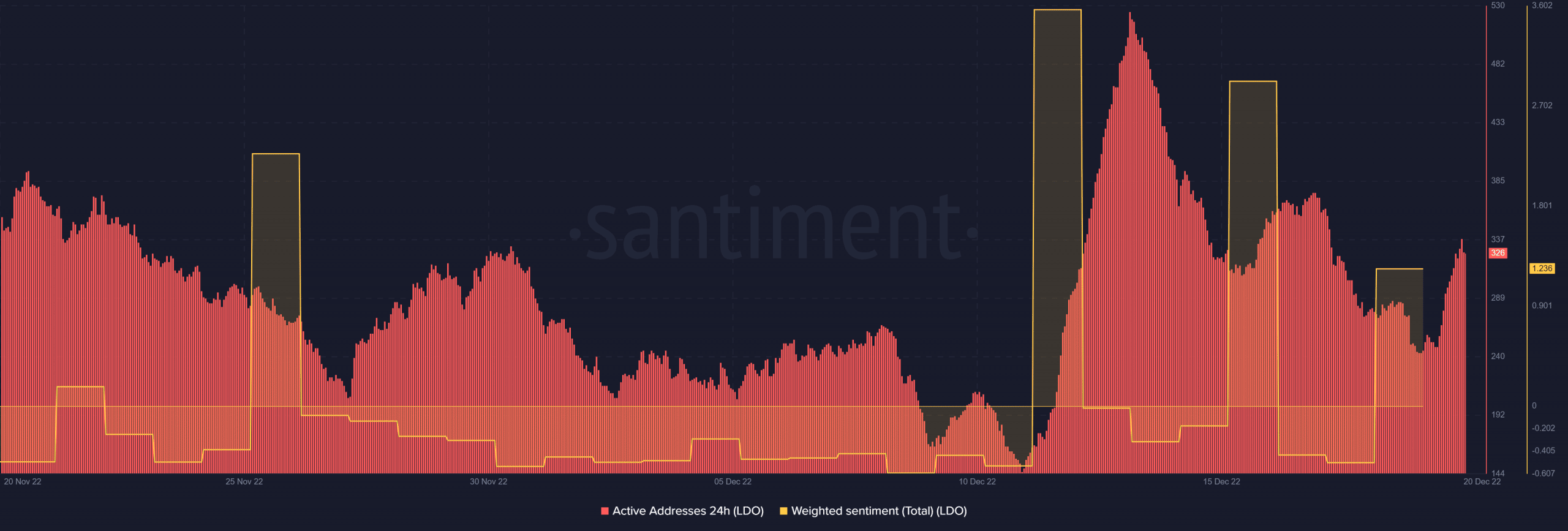

For example, LDO’s weighted sentiment bounced back in the last two days. This suggested that investors were gaining more optimism about its bullish prospects.

That said, LDO’s 24-hour active addresses also registered a sizable uptick in the last 24 hours, at the time of writing. This might be a sign that bullish demand is taking over.