Litecoin: A rise in sell pressure could still reap these LTC holders some profits

- Litecoin’s short-term sellers could benefit from LTC’s ongoing price action

- Litecoin ranked #1 as the biggest cryptocurrency by median hold

Crypto investors that bought Litecoin [LTC] after the FTX crash were reaping the benefits following its bullish performance. LTC turned out to be the best cryptocurrency to hold in the medium term. However, Litecoin’s current outlook suggested that it might be about to give up some of its recent gains.

Read Litecoin’s [LTC] price prediction 2023-2024

In its latest upgrade, the Litecoin Foundation noted that LTC took the number 1 spot as the biggest cryptocurrency by median hold. This meant that Litecoin holders had lower losses than other coins in the medium term and this was largely because of its upside.

Ranking the biggest cryptocurrencies by median hold period: #Litecoin is in the #1 spot ?

As of this time last year it was 93 days. Now it's 101 days. $LTC is the most HODL'd digital currency. pic.twitter.com/73WrMunfxF

— Litecoin Foundation ⚡️ (@LTCFoundation) November 28, 2022

Litecoin delivered an overall positive performance after finding favor with investors. It rallied by as much as 72% from its monthly low to its current monthly high. A look at its latest price action revealed an interesting observation that might indicate a potentially sizable bearish retracement ahead.

A comparison between Litcoin’s price and Relative Strength Index (RSI) revealed a price-RSI divergence. LTC’s price managed to achieve a new monthly high last week compared to the previous high in the first week of November. Interestingly, Litecoin’s RSI achieved a lower high last week as compared to the previous high.

This pattern can be considered bearish because it underscores lower relative strength for the underlying asset. In this case, Litecoin’s price action might be about to experience a surge in sell pressure. Especially if the overall market conditions fail to improve in favor of the bulls.

Is Litecoin sell pressure building up?

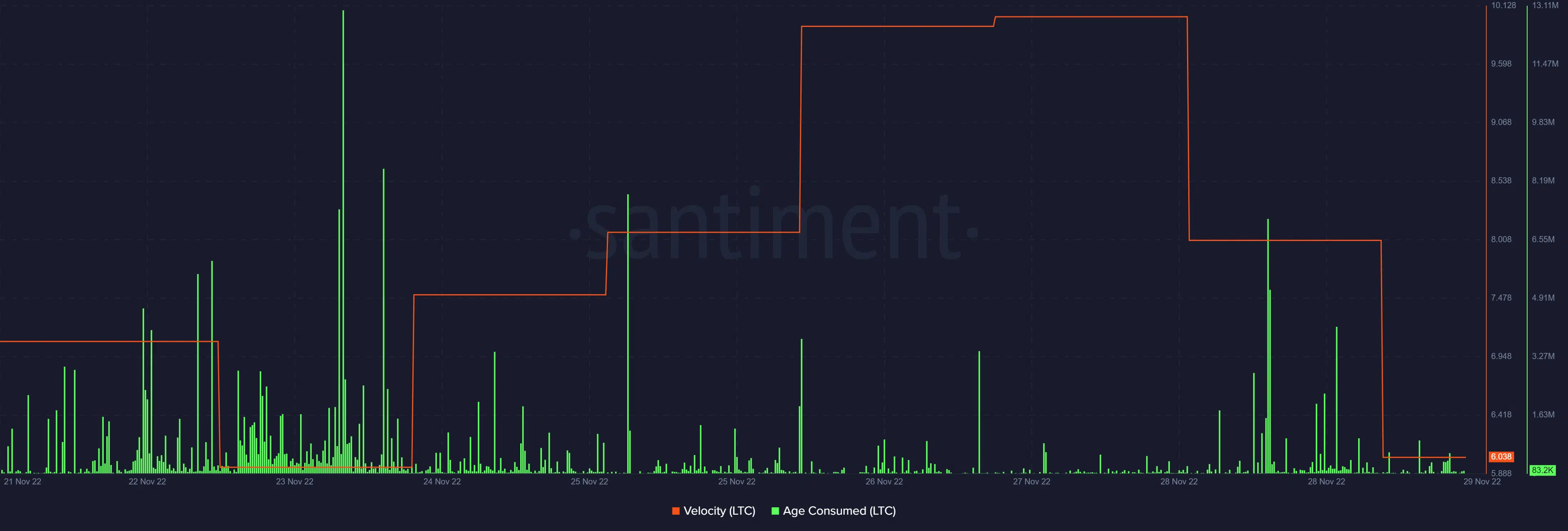

A look at some Litecoin metrics already indicated that some notable changes were occurring. For example, its velocity slowed down between 27 and 29 November. At the same time, the Age Consumed metric registered more activity, indicating that coins that have been held for some time were exchanging hands.

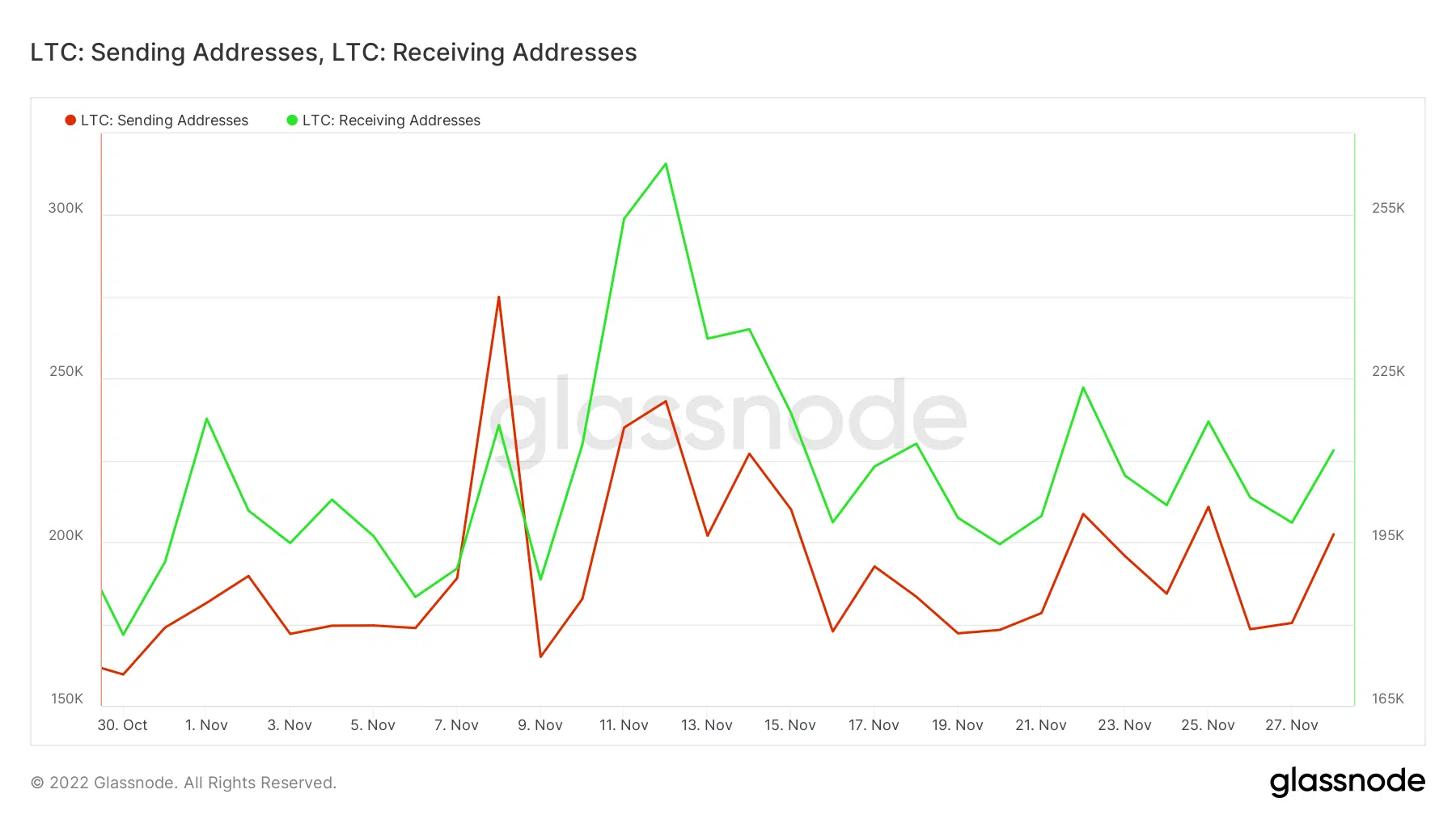

The above metrics confirmed that there was a noteworthy increase in sell pressure observed between 27 and 29 November. A look at address flows revealed an increase in both the sending and receiving addresses during the last 48 hours. This was confirmation of increased activity but the number of receiving addresses were slightly higher than sending addresses.

The higher receiving addresses confirmed that there was still some demand at LTC’s current level. However, this may not provide a comprehensive view of where demand is headed. A look at Litecoin’s supply distribution might be better suited to gauge directional momentum.

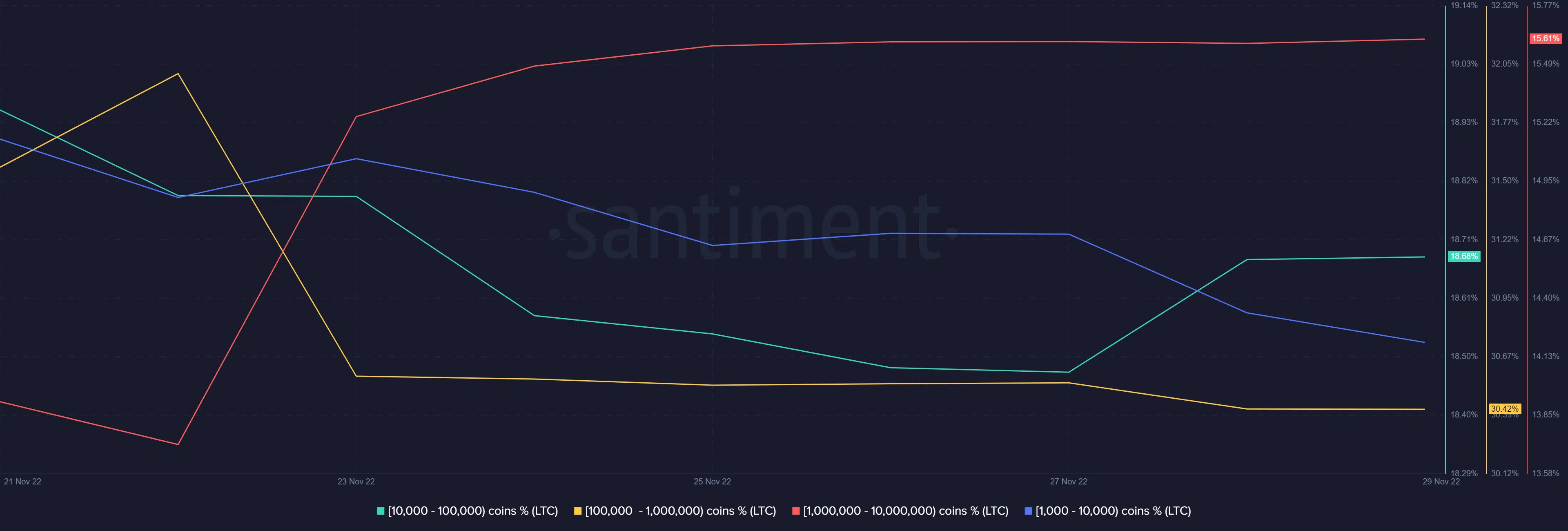

The supply distribution metric revealed that most of the large addresses categories leveled out. In other words, they weren’t contributing to sell or buy pressure. That being said, addresses holding between 1,000 and 10,000 LTC have continued trimming their balances in the last two days.

This supply distribution metrics observation suggested a higher likelihood of sell pressure dominating Litecoin in the next few days. If these observations turn out accurate, then short sellers might have an opportunity ahead.