Maker: Can a surge of interest from these holders have MKR aiming for the stars

MakerDAO has been on the radar of large investors and whales for quite some time now. One of the reasons for the renewed interest from whales could be MakerDAO’s foray into short term bond investments.

_____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for MakerDAO [MKR] for 2022-2023

_____________________________________________________________________________________

Swimming with the whales

WhaleStats, a crypto whales tracking platform, tweeted that MKR was on top 10 purchased tokens amongst the 5000 biggest Ethereum whales in the last 24 hours. Furthermore, at press time, the top 100 whales were holding $63 million worth of MKR.

JUST IN: $MKR @MakerDAO now on top 10 purchased tokens among 5000 biggest #ETH whales in the last 24hrs ?

Peep the top 100 whales here: https://t.co/kOhHps8XBB

(and hodl $BBW to see data for the top 5000!)#MKR #whalestats #babywhale #BBW pic.twitter.com/dcuCXkqvL0

— WhaleStats (tracking crypto whales) (@WhaleStats) October 29, 2022

Coinciding with this development was MakerDAO’s $50 million investment in the US government bond ETFs. Additionally, 60% of that investment would be going in 0-1 year bonds and 40% of it would be going towards 1-3 year bonds.

From this development, it appears that the team at MakerDAO was constantly taking decisions to improve and strengthen the position of MakerDAO. Furthermore, MakerDAO also managed to perform well in the DeFi space. MakerDAO’s TVL at the time of writing, was around $8.35 billion according to data provided by DeFiLama.

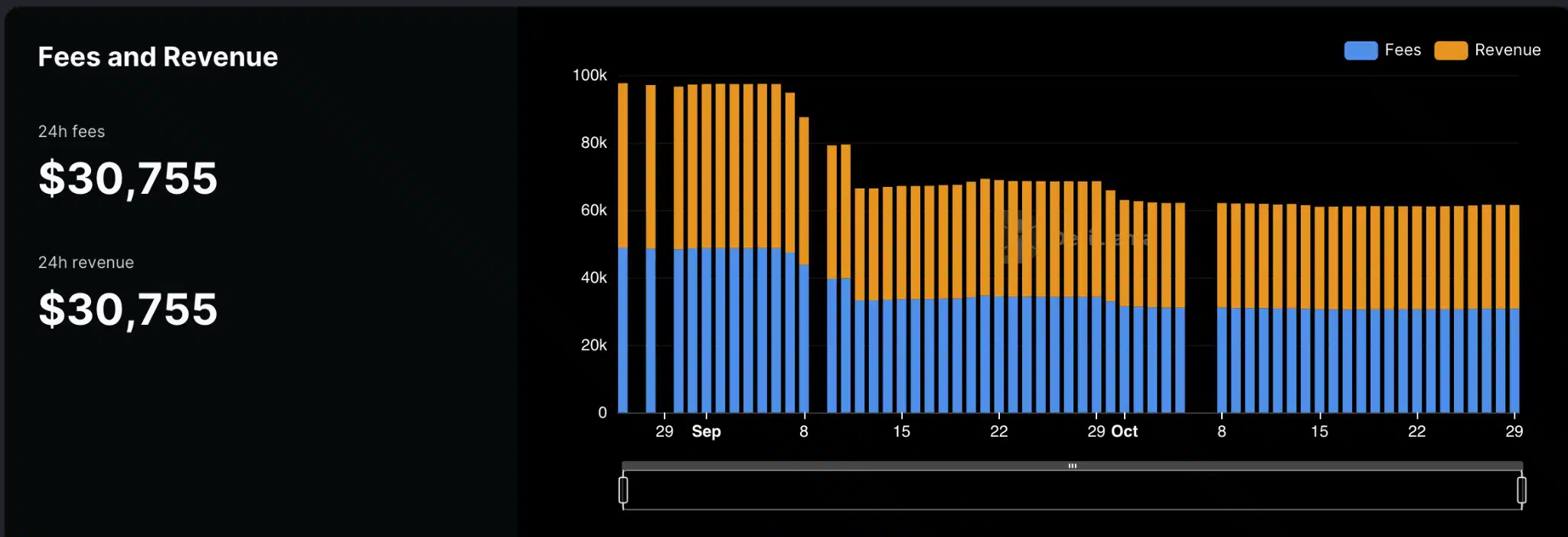

However, the overall fees and revenue collected by MakerDAO continued to decline as can be seen from the image below. Furthermore, the overall revenue collected by MakerDAO also witnessed a decline over the past month.

Moreover, MakerDAO observed a massive spike in terms of social mentions and social engagements. According to social media analytics website LunarCrush, the number of social engagements of MakerDAO grew by 88% over the last week. The number of social mentions, on the other hand, increased by 46.59% as well.

However, its weighted sentiment continued to decline, as evidenced by the chart below. The weighted sentiment remained negative throughout the last month for MakerDAO. This indicated that the crypto community had more negative than positive things to say about MakerDAO over the past 30 days.

Some more declines to follow

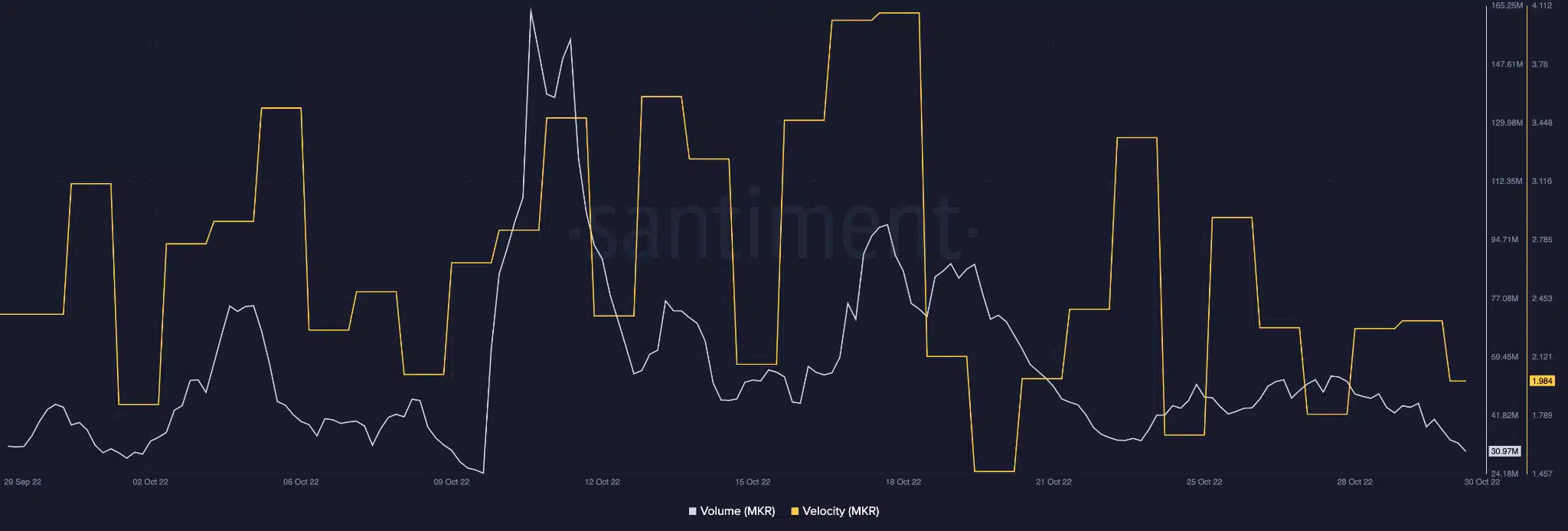

Along with the declining sentiment, MakerDAO’s volume depreciated as well. The volume went from 50 million to 36 million in the last two weeks. Coupled with that, MKR’s velocity declined as well. This implied that the frequency at which the number of addresses were exchanging MKR had reduced.

At the time of writing, MKR was trading at $918 and had depreciated by 6.87% in the last seven days. Its volume had also depreciated by 31% in the last 24 hours. Despite its declining prices, MKR had managed to capture 0.1% of the total crypto market.