MakerDAO community proposes Spark Protocol, details inside

- Spark lend to enable the lending and borrowing of DAI.

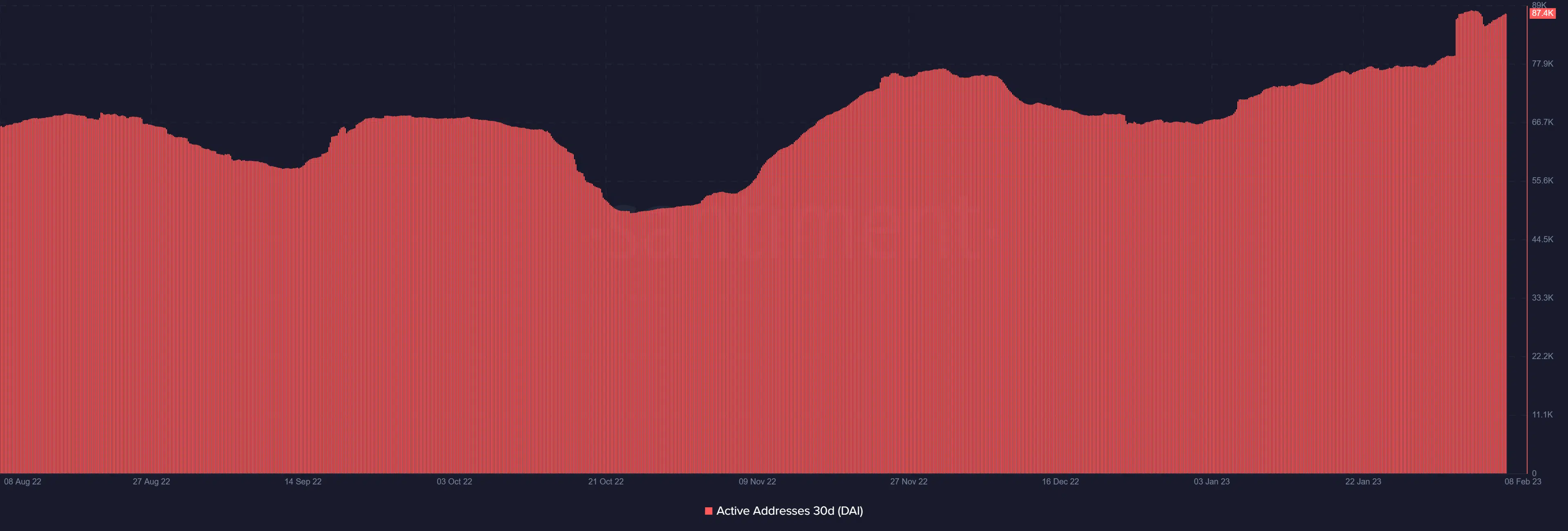

- DAI has seen an increased active address in recent weeks.

Dai [DAI] is among the front-runners in the stable cryptocurrency market. By market capitalization, CoinMarketCap places it as the fourth-largest stablecoin and the seventeenth-largest cryptocurrency overall.

Some MakerDAO members have proposed that the stablecoin take on new responsibilities in the Decentralized Financial System (DeFi). What could this mean for the stablecoin?

A spark for DAI?

Some members of the MakerDAO community submitted a proposal to the Maker governance forum on 8 February. Content analysis revealed that they are suggesting the introduction of a new protocol that the DAO will administer.

In their proposal, they suggested a new protocol called Spark that would facilitate the lending and borrowing of Dai (DAI) through a liquidity market.

It is proposed that Spark implement Aave v3’s smart contract framework, with 10% of the protocol’s proceeds from the market over the following two years being donated to the Aave DAO.

The plan states that Spark Lend will be the first product offered and will enable consumers to borrow DAI at the existing Savings Rate of 1%.

As collateral, Spark Lend will accept highly liquid decentralized assets like DAI, Bitcoin, and Ethereum, as well as the wrapped versions of Bitcoin and Ethereum.

In addition, maker’s Spark will serve as the company’s first official protocol interface for lending and borrowing on the Maker platform.

How active is DAI?

Additionally, the 30-day active address measure from Santiment revealed that DAI had over 87,000 active addresses. The number of active addresses was at its highest point in more than six months.

This shows that the stablecoin’s usage is rising and its utility in recent times.

Furthermore, a glance at Crypto Quant’s Netflow statistic revealed that it has been experiencing a significant amount of Outflow.

On 8 February, the stablecoin experienced an outflow of over 8 million, as shown on the chart. This demonstrated the dominance of the migration of the stablecoin off exchanges.

This entire action from the MakerDAO community may be related to the endgame strategy. However, whether this will have a long-term positive impact on DAI is still to be seen.