MakerDAO increases its DAI Savings Rate, thanks to competitive DeFi landscape

- An executive proposal has been implemented to increase DAI Savings Rate to 1%.

- MakerDAO was momentarily displaced as the DeFi protocol with the largest TVL.

Following an executive proposal decided upon on 11 December and executed on-chain on 12 December, MakerDAO [MKR] implemented an increment of its DAI Savings Rate from 0.01% to 1%.

DAI is a decentralized stablecoin whose value is pegged to the dollar and backed by centralized stablecoins such as USD Coin (USDC) and Pax Dollar (USDP) and other cryptocurrency assets such as Ethereum (ETH) and Wrapped Bitcoin (WBTC).

Read MakerDAO’s [MKR] Price Prediction 2023-24

The DAI Savings Rate was launched in 2018 to incentivize DAI holders to lock their stablecoins into the DAI Savings Rate contract to generate interest.

However, the interest rate paid to holders who locked their DAI into the smart contract had been pegged at just 0.1%. With the new executive proposal, DAI depositors can now earn up to 1% interest on their DAI holdings.

In addition to a bump in interest rate, other changes implemented by the executive proposal included the distribution of 103,230 DAI to 20 Recognized Delegates, offboarding renBTC-A, the transfer of 257.31 MKR to MakerDAO’s TechOps Core Unit, and several parameter changes from the latest proposal of the MakerDAO Open Market Committee.

Maker dethroned momentarily

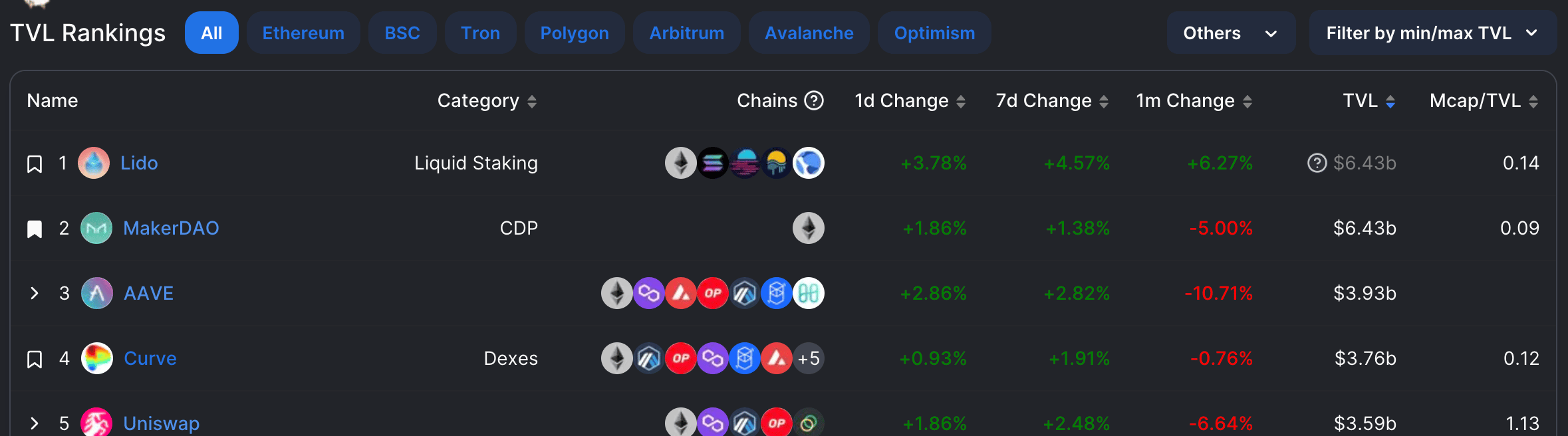

During the intraday trading session on 12 December, the leading liquid ETH staking platform, Lido Finance, saw its total value locked (TVL) climb to $6.45 billion to rank ahead of MakerDAO as the largest DeFi protocol by TVL.

Lido is now the largest DeFi protocol by TVL, with $6.45b deposited pic.twitter.com/E8kkOPiStu

— DefiLlama.com (@DefiLlama) December 13, 2022

The growth in Lido’s TVL was attributable to a jump in its staking annual percentage rate (APR) to an all-time high of 10.21% a few weeks ago. While this has retraced to the 4% level, staking deposits on the platform continue to rally.

The recent bump in MakerDAO’s DAI Savings Rate could represent attempts by the DeFi protocol to incentivize current depositors further and drive in new depositors as the DeFi landscape becomes increasingly competitive.

At press time, Lido Finance and MakerDAO each had a TVL of $6.43 billion.

MKR refuses to be rebound

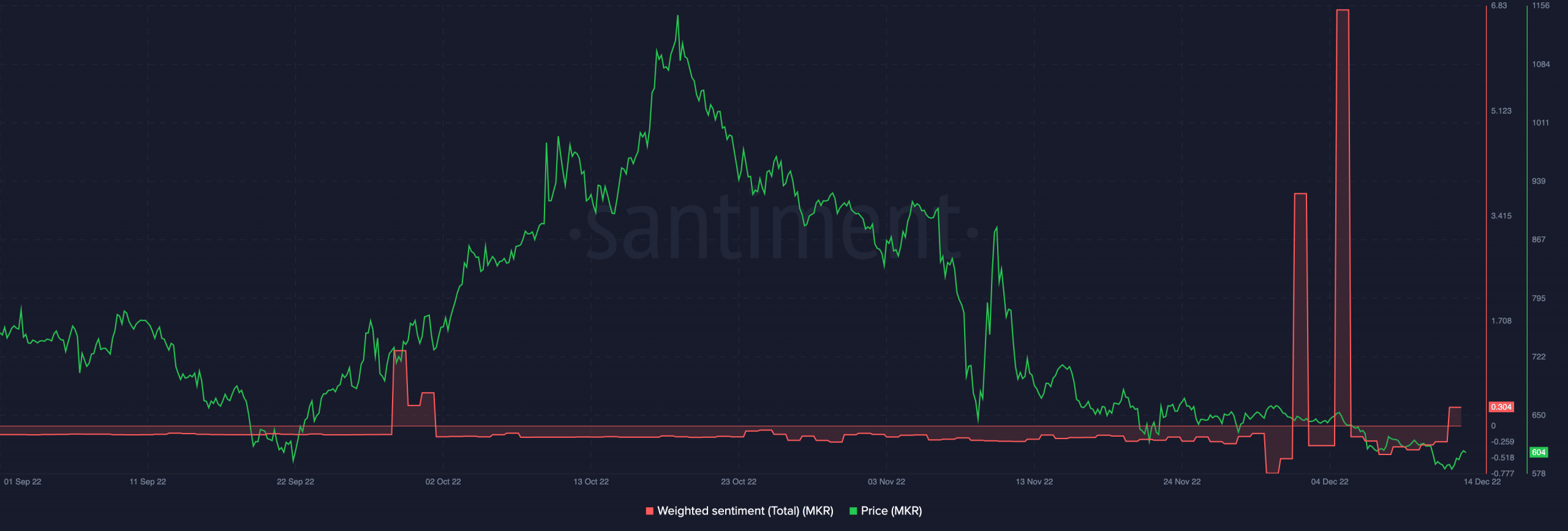

Exchanging hands at $604.43 at press time, MakerDAO’s native token MKR has seen a significant decline in value in the last month. Per data from CoinMarketCap, MKR’s price has declined by 11% in the past 30 days.

Apart from the general market decline, the consistent decline in MKR’s price is also attributable to the negative sentiment that has trailed the asset since FTX’s demise.