MATIC might cross above its 50-day moving average, thanks to ETH whales

- MATIC makes it into the list of the top most purchased tokens by ETH whales.

- Its price action in the last 24 hours reveals that the token is still struggling to secure more upside.

Polygon’s native token MATIC kicked off this week with a bullish pivot on Monday (12 December) and has been gradually recovering since then. A recent WhaleStats analysis revealed incoming whale demand that may trigger more upside for MATIC.

According to the WhaleStats report, MATIC was among the top 10 tokens that found favor from the 100 biggest ETH whales in the last 24 hours. The observation means ETH whales have been buying MATIC, a move that may lend more strength to the bulls.

JUST IN: $MATIC @0xPolygon now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#MATIC #whalestats #babywhale #BBW pic.twitter.com/41C7tpFjhv

— WhaleStats (tracking crypto whales) (@WhaleStats) December 14, 2022

ETH whale participation in MATIC’s prevailing bullish demand may strengthen its rally. Enough bullish momentum may help it soar above the 50-day moving average.

The token has been struggling to push above this indicator since the start of December. MATIC traded at $0.921 at press time, which was still below the 50-day MA.

MATIC’s price action in the last 24 hours revealed that it was still struggling to secure more upside. But can this change as the weekend approaches? Perhaps some of Polygon’s metrics may provide useful insights into what to expect.

Is short-term profit-taking holding MATIC back?

MATIC dropped slightly in the last 24 hours despite observed ETH whale activity. One of the potential explanations for this outcome is that there was significant profit-taking by some market participants.

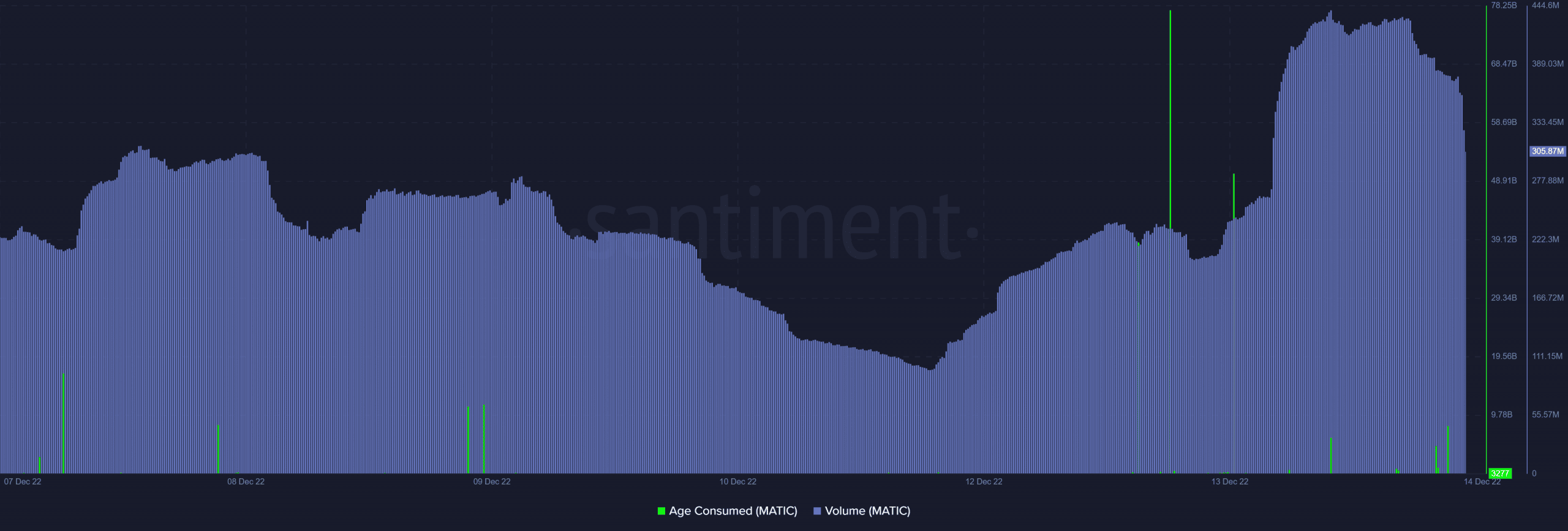

Such an outcome may have canceled out the buying pressure. Furthermore, MATIC’s age consumed metric registered increased activity in the last two days.

The age-consumed metric might indicate that some large whales are taking advantage of the resurgence of bullish demand to secure exit liquidity.

Also worth noting is that MATIC’s volume just achieved a new 7-day high in the last 24 hours. This confirms that trading activity has certainly increased over the last day.

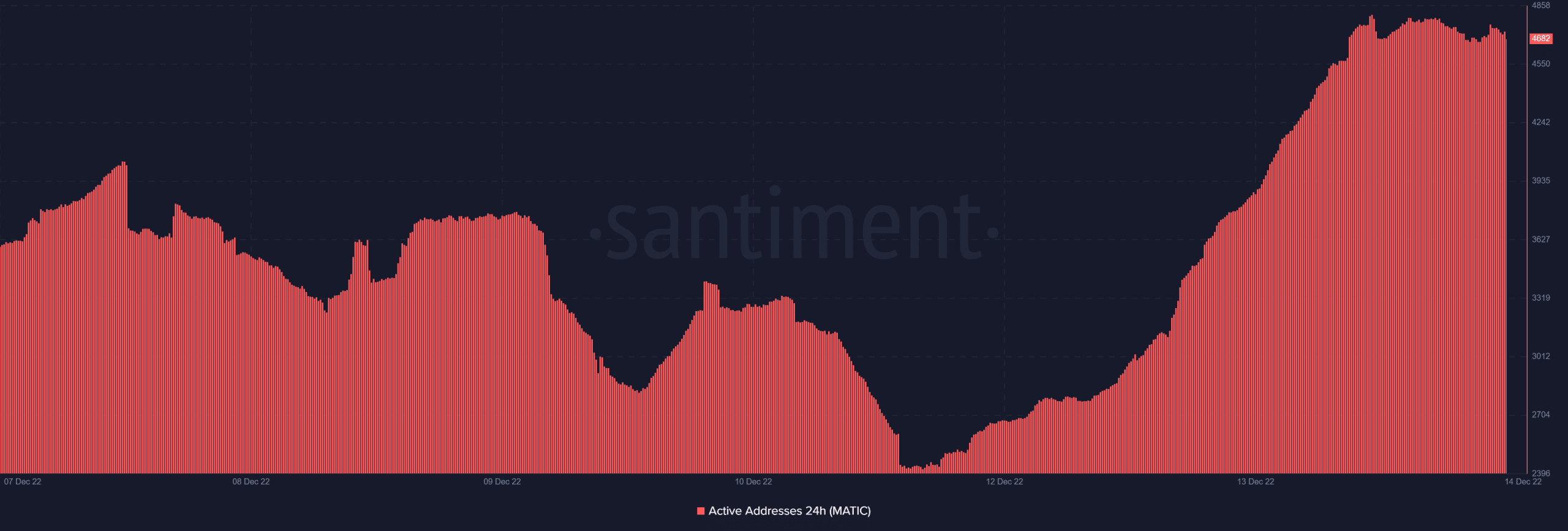

As expected, daily active addresses have also increased especially in the last four days, which suggested that there was significant retail activity.

This surge in daily active addresses is still favorable to MATIC from a network activity point of view. The token will likely have more price volatility now that there is more buying and selling going on.

But this does not offer much clarity in terms of direction. Perhaps supply distribution can provide more clarity.

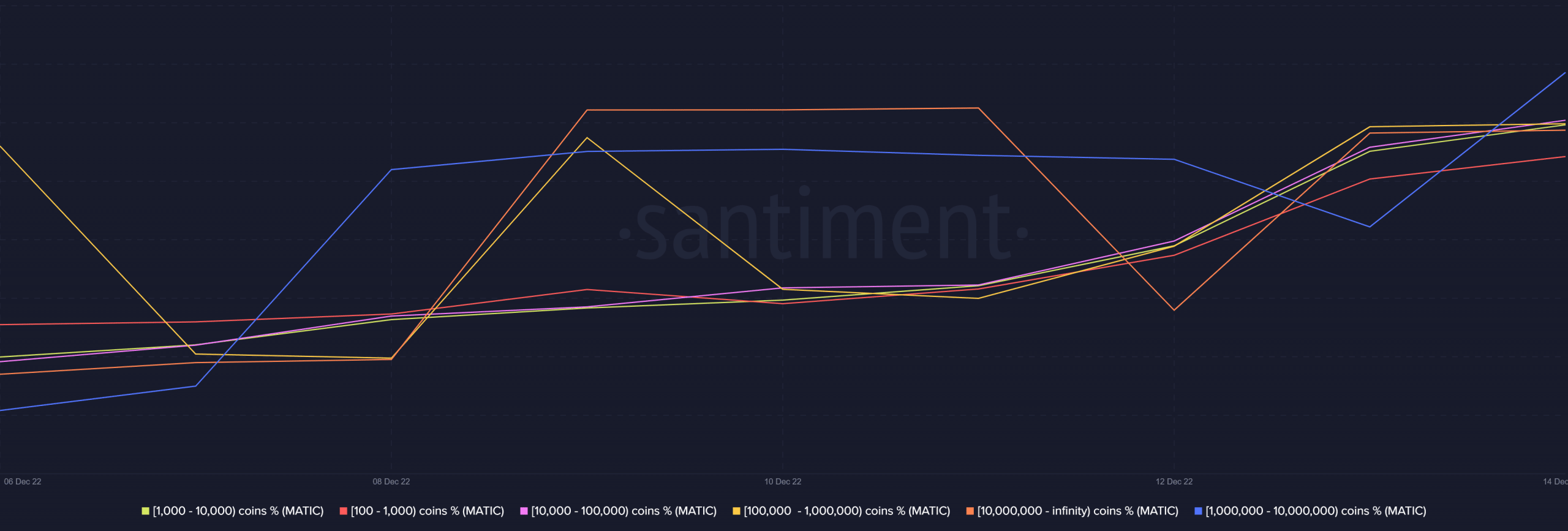

According to recent observations, the top addresses are currently increasing their balances. This means there is a higher probability that MATIC will deliver a significant upside.