MEXC Global launches Spot Grid Trading on MEXC Quantitative

MEXC Quantitative is a platform where users are able to operate quantitative trading strategies by trading bots automatically and effortlessly. With no additional fees, it offers 24/7 all-round robot butler services for multiple trading strategies and purposes.

As the first live feature on MEXC Quantitative, Spot Grid Trading enables MEXC users to automate the buy and sell orders and adjust the investment amount, and users can profit from market volatility by automatically buying low and selling high within a given price range.

John Chen, CEO of MEXC Global, commented, “Quantitative trading has become a powerful tool for more and more traders in the cryptocurrency market. As always, we are on a lookout for products and tools to help our users keep winning on the bull run. With spot grid trading, I believe we are bringing our user experience into the next level.”

Introduction to Grid Trading

Grid trading is a trading strategy (quantitative trading strategy) that automatically executes “sell high and buy low”. Currently, MEXC supports the grid trading for cryptocurrency spots.

Grid trading can help arbitrageurs set the lowest and highest price, grid quantity, and investment amount within a specified base price, and help them automatically buy at low prices and sell at high prices to gain profits from market fluctuations.

Arbitrageurs need to first choose the benchmarked asset (such as BTC) to buy a certain position as core holdings. Then, set a price range (the lowest price ~ the highest price), and divide the price range into N equal parts (the set interval). Place buy orders at intervals below the specified base price, and sell orders at intervals above the specified base price to profit from “buy low, sell high”.

Grid trading can be seen as a fisherman casting a net to catch fish. You “cast a net” in volatile markets and perform operations such as increasing the position (when the price of the benchmarked asset falls), reducing the position (when the price of the benchmarked asset rises), and “closing the net” (close the position) to catch fishes (the intervals) in the “sea” that match the grid size (the conditions for your trading strategy).

The advantages of grid trading are:

- It is an automatically-executed trading strategy. Users do not need to keep track of the orders and can avoid repeated works.

- It restrains the weaknesses of human nature such as greed, fear and fluke, and helps users grasp the best opportunity to gain profits.

- It is very effective in volatile markets. The more turbulence the market is, the more profits it generates.

Grid trading is usually used not only by professional quantitative institutions that profit from small price intervals, but also by individual traders. It is a very suitable trading strategy for the current bear and volatile market.

A Guide to the Operation of Grid Trading

The main principles on how to select the benchmarked asset for grid trading:

- Choose the cryptocurrencies supported by the cryptocurrency exchange: Different exchanges support different cryptocurrencies. MEXC currently supports the grid trading for 60 cryptocurrencies including BTC, ETH, XRP, DOT and more.

- Choose a rising market that fluctuates repeatedly. In a unilateral downtrend, any long-only strategy cannot be profitable; in a unilateral uptrend with small fluctuations, it is easy to go short and fail to outperform the broader market trend.

- Choose a currency with greater volatility: The ROR of the grid trading depends on the volatility of the asset. The stronger the volatility, the greater the possibility of executing the buy and sell orders. The more you sell, the greater the profit. Therefore, aside from BTC and ETH, you can also choose DOT, SOL, AVAX, MATIC, CRO, ATOM, DOGE, FIL and other cryptocurrencies with relatively small market capitalization. Currently, MEXC supports the trading for more than 2,400 cryptocurrencies, and more cryptocurrencies will be added into the grid trading later.

Create your core holdings

You need to create your core holdings for grid trading. The size of your core holdings is determined by the project valuation. If the current valuation of the project is low, the core holdings can be slightly increased, and if the valuation is high, you can liquidate some of the core holdings.

Take ETH as an example. Its current price is around 1148USDT. If you think the current valuation is low, you can choose to increase your core holdings. If you think the current price is too high and hasn’t reached the bottom, you can choose to reduce your positions.

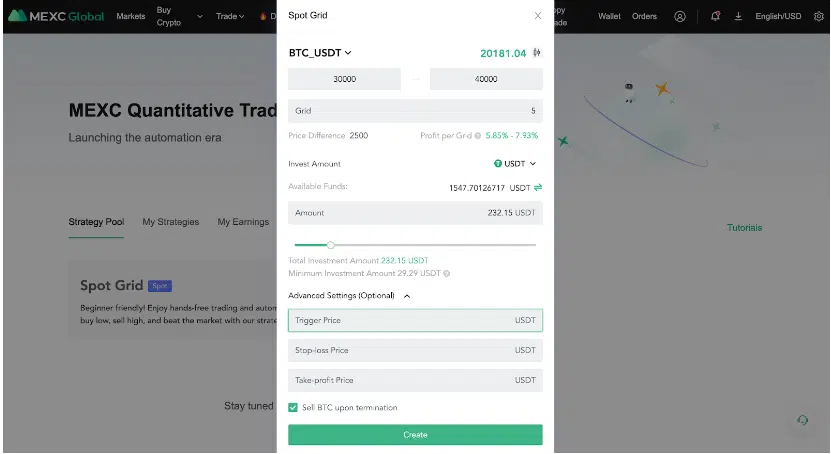

Set the grid size

Take the grid trading for BTC spot as an example. Assume the current BTC price is 30000USDT, you can set the lowest price as 20000USDT, the highest price as 40000USDT, and the number of grids as 5.

Hence the price interval is (40000-20000)/5=4000. The orders that can be set according to the intervals are 40000, 36000, 32000, 28000, 24000, 20000. Here is how you can place the orders:

Place a buy order at 20000U, a sell order at 24000USDT, a buy order at 24000USDT, and a sell order at 28000USDT; and so on until a buy order at 36000USDT, and a sell order at 40000 USDT.

The premise of this grid trading is: (Assume) that in the recent trend, the possibility for BTC to fall is relatively small, and it may rise due to the base price. If the assumption is wrong, it is easy to buy at a “high price”. (The purpose of grid trading is to make small high-frequency profits, which is essentially different from the BTC standard position holders. Hence, assume the traders that use the grid trading buy BTC at 35000USDT. When BTC falls to 34500USDT, it will be a huge financial loss for them.)

Grid trading – a perfect way to maximize profits

To sum up, you can use grid trading to maximize your profits in the bear market, especially the volatile bear market. Even if the price direction is misjudged, its cost is relatively low. On the contrary, you are more likely to stand on the “mountain peak” of the candlestick chart in the bull market.

About MEXC Global

Established in April 2018, MEXC Global is a digital asset trading platform with over 7 million users, which offers users one-stop services, including spot, margin, leveraged ETFs, derivatives trading and staking services. The core members of the team come from international enterprises and financial companies and have experience in blockchain and financial industries.

Disclaimer: This is a paid post and should not be treated as news/advice.