Monero, Algorand, Hedera Hashgraph, Enjin Coin Price Analysis: 07 April

Monero showed bullish behavior as it approached the crucial resistance level of $282.9. Algorand awaited more signals to break away from its range, while Hedera Hashgraph was tipped to lose out on its $0.308-support. Finally, Enjin Coin projected a subdued market if the price falls below its long-term moving average line.

Monero [XMR]

Source: XMR/USD, TradingView

Monero’s market bulls ignored bearish divergences mentioned in a previous analysis and continued to push north on the 4-hour timeframe. Having overturned $262.67 to a region of support, the bulls now eyed the upper ceiling at $282.9. Clearing this level would have certain implications on its long-term trajectory. Not only would a breakout complete XMR’s recovery since the late February pullback, but would also allow the cryptocurrency to maintain its upward trajectory over the long run.

The MACD was close to a bearish crossover, but the same was still above the half-line and the bulls should not be threatened of losing the market. Meanwhile, capital inflows were strong, according to the Chaikin Money Flow.

Algorand [ALGO]

Source: ALGO/USD, TradingView

On the 4-hour chart, it appeared as if Algorand broke out from its range of $1.44-$1.23, but a bearish candlestick denied a breakout possibility at least over the short term. However, trading volumes have been on the rise and it was possible that the bulls were gathering strength before the next big swing.

The MACD should be observed carefully over the coming sessions to understand ALGO’s trajectory. If the MACD moves below equilibrium after a bearish crossover, then ALGO would break down from its channel and head towards the $1-mark. The ADX remained flattened at 18 and showed a lack of trend. For a northbound breakout, both the MACD and volumes must trend higher.

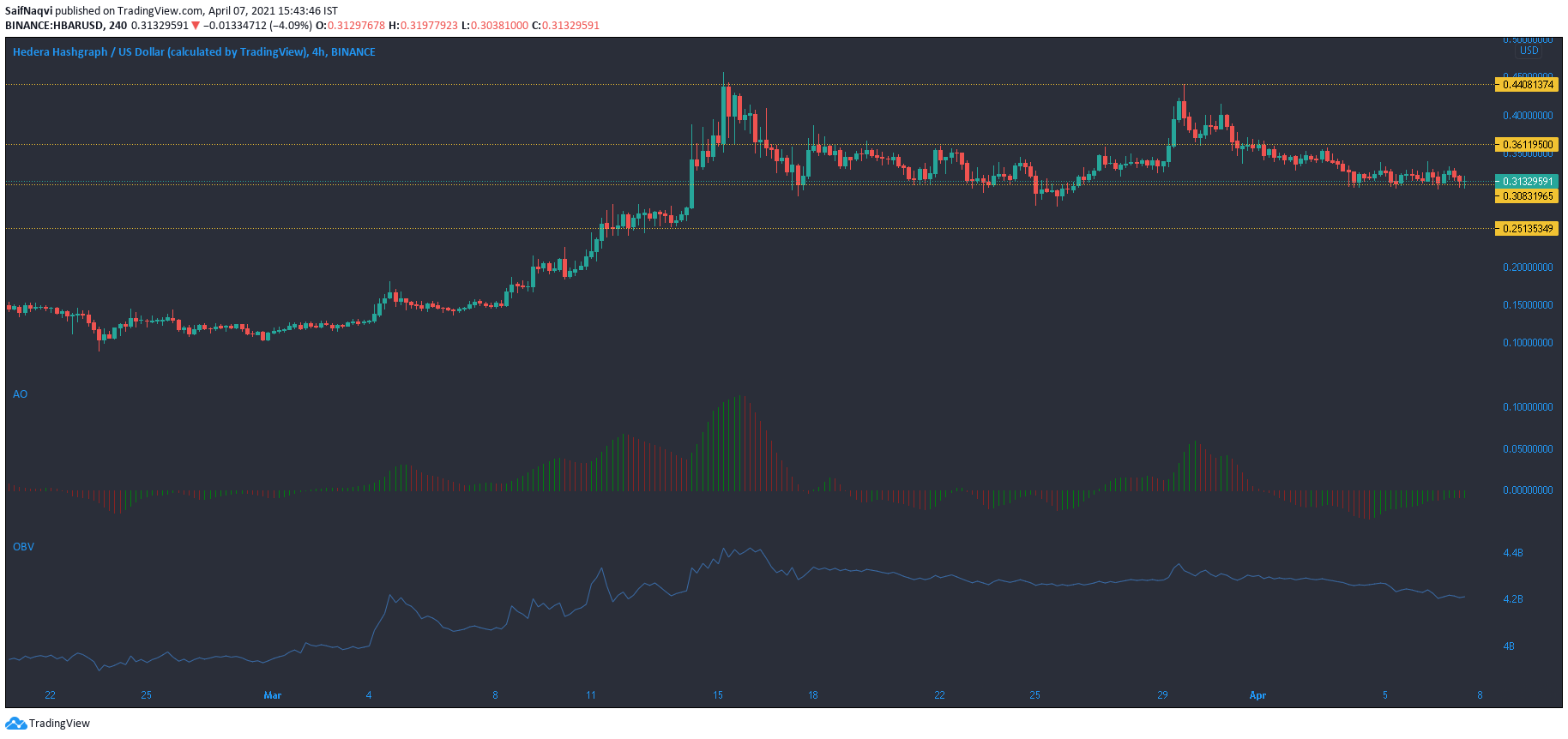

Hedera Hashgraph [HBAR]

Source: HBAR/USD, TradingView

It seemed like only a matter of time till Hedera Hashgraph lost out to the $0.308-support on the 4-hour chart. So far, the aforementioned level has defended a sell-off on multiple occasions over the last 25 days, but ominous signs were present in the market. Trading volumes were on the decline over the last few days, while the OBV drifted lower after a constant uptrend seen during March.

Momentum was also on the bearish side, according to the Awesome Oscillator, and the same remained below the equilibrium level over the past seven days. In case of a breakdown, HBAR could find support at $0.251.

Enjin Coin [ENJ]

Source: ENJ/USD, TradingView

Enjin Coin flipped the $2.33 region to a line of resistance once again after bearish movement over the last 24 hours. Moreover, the price was in danger of dropping below its 200-SMA (green) and this would lead to a subdued market over the coming weeks.

The Parabolic SAR’s dotted markers moved below the candlesticks and highlighted the said downtrend. The RSI was close to the oversold territory.

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)