Monero’s long-term may be sorted, but what about its short-term?

Monero [XMR], the market’s leading privacy coin, has seen its fair share of ups and downs this year. The altcoin massively rallied during the initial few months of the year, hit its local 3-year high in May, and commenced its downfall right after that.

At the time of writing, XMR’s state was quite congruent to the state of other altcoins struggling to shield themselves from broader market corrections. With Bitcoin prolonging its stay in the rangebound zone, looks like alts, especially XMR, would have to wait a little longer before the next uptrend sets in.

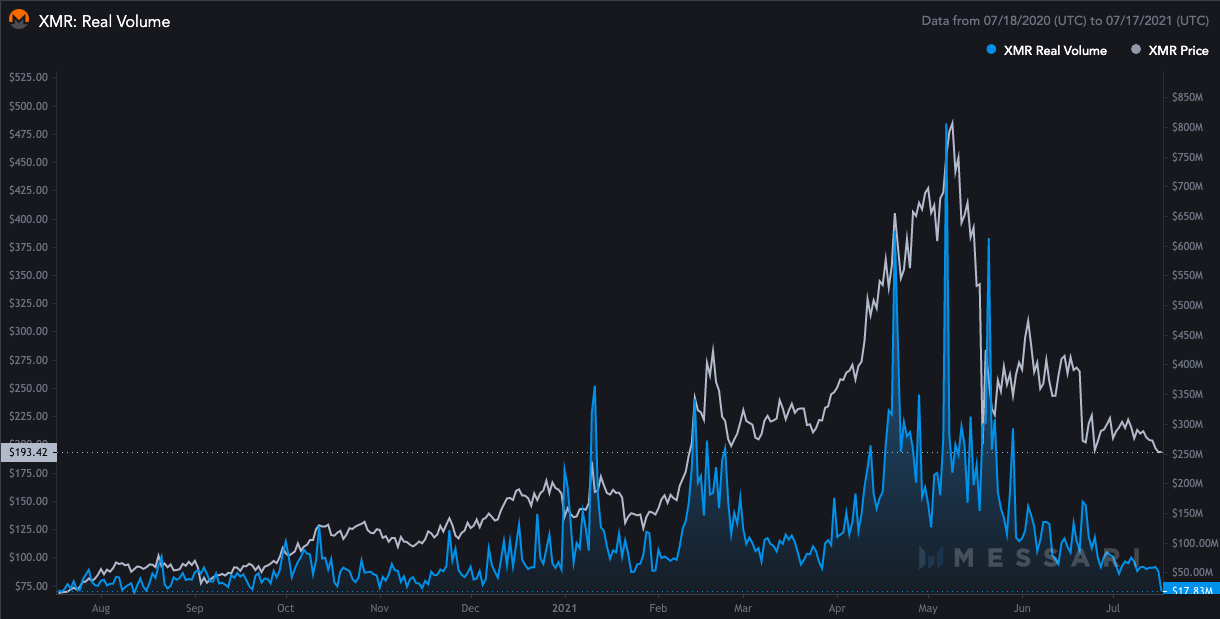

The 27th largest crypto’s price lost close to 11% of its value over the last seven days. Notably, the price drop was well-sustained by the drop in real volume too. On 7 May, for instance, XMR’s real volume crossed the $800 million mark. However, the same at press time reflected a value of just $17.83 million.

Such a stark drop is well evidenced by observing the chart attached below. Notably, such low levels were previously witnessed only in August last year.

Looking at the aforementioned dramatic drop, what actually triggered Monero’s downfall is a point to ponder over. Well, a host of factors, together, have resulted in XMR’s devastation.

Consider the Sharpe Ratio, for starters. To be specific, this metric outlines the potential risk-adjusted returns of an asset. The drop in this ratio became prominently noticeable in the month of June. Precisely, at press time, the same shared a value of -3.12.

Now, whenever this ratio is negative, it generally implies that the portfolio’s returns are expected to be negative (Because the risk-free rate is greater than the portfolio’s returns). Negative returns, arguably, do not provide investors any incentive to buy. Ergo, XMR’s price will get the required support only when this ratio climbs back above zero.

Additionally, XMR’s market cap dominance has also been losing its grip. On 25 April, for instance, the alt’s market dominance stood at 0.37%, while the same, at press time, was just 0.27%. The drop in this metric has added to XMR’s bearish burdens.

At this stage, it would be unfair to turn a blind eye to Monero’s ecosystem-centric developments. As far as the month of July is concerned, 9 commits (individual changes made to a file) have been made in one repository, and the month is not done yet either. Moreover, at the time of writing, community-led “Moneroexamples” had over 57 repositories on GitHub while the Monero Ecosystem had over 34 repositories.

Even though the community has been working on various developments simultaneously, Farcaster, a Bitcoin-Monero atomic swap project remains the most popular one. What’s more, COMIT Network has already launched Monero-Bitcoin atomic swaps on the mainnet. Additionally, Santiment’s data pointed out that the number of developers actively contributing to the XMR’s ecosystem has been rising too.

Keeping in mind the number of projects associated with the network, the growing adoption rate, and long-term predictions, looks like the current wobbly phase will end up negating itself in the long run. However, the altcoin doesn’t seem to have glossy prospects in the near-term future.