NEAR Protocol makes competitors “SWEAT” with this new development

NEAR protocol managed to witness a massive surge in terms of its number of active users. One of the reasons for this surge could be the Sweat Economy, a move-to-earn application similar to STEPN.

____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for NEAR for 2022-2023

____________________________________________________________________________________

Breaking a sweat

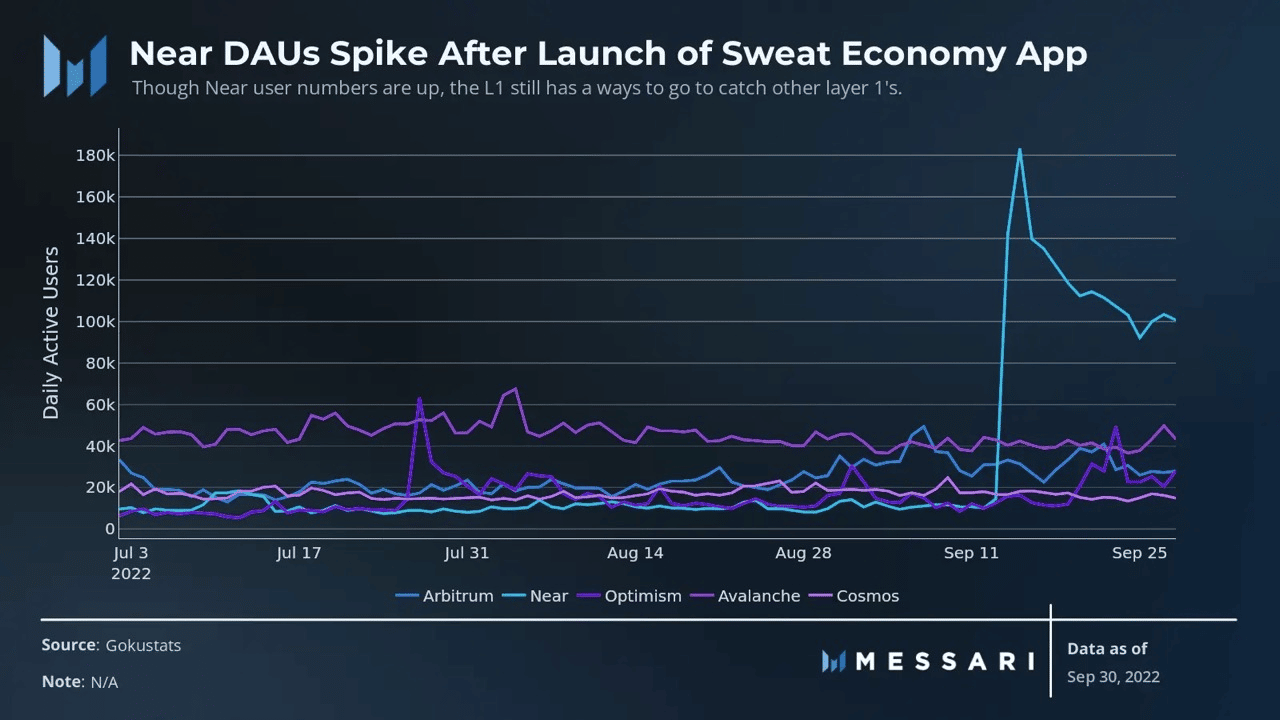

Messari, a leading crypto analytics firm, tweeted on 15 October that the number of daily active users on the NEAR platform observed a massive spike. Additionally, the NEAR protocol outperformed a lot of its competitors with the help of ‘Sweat Economy’.

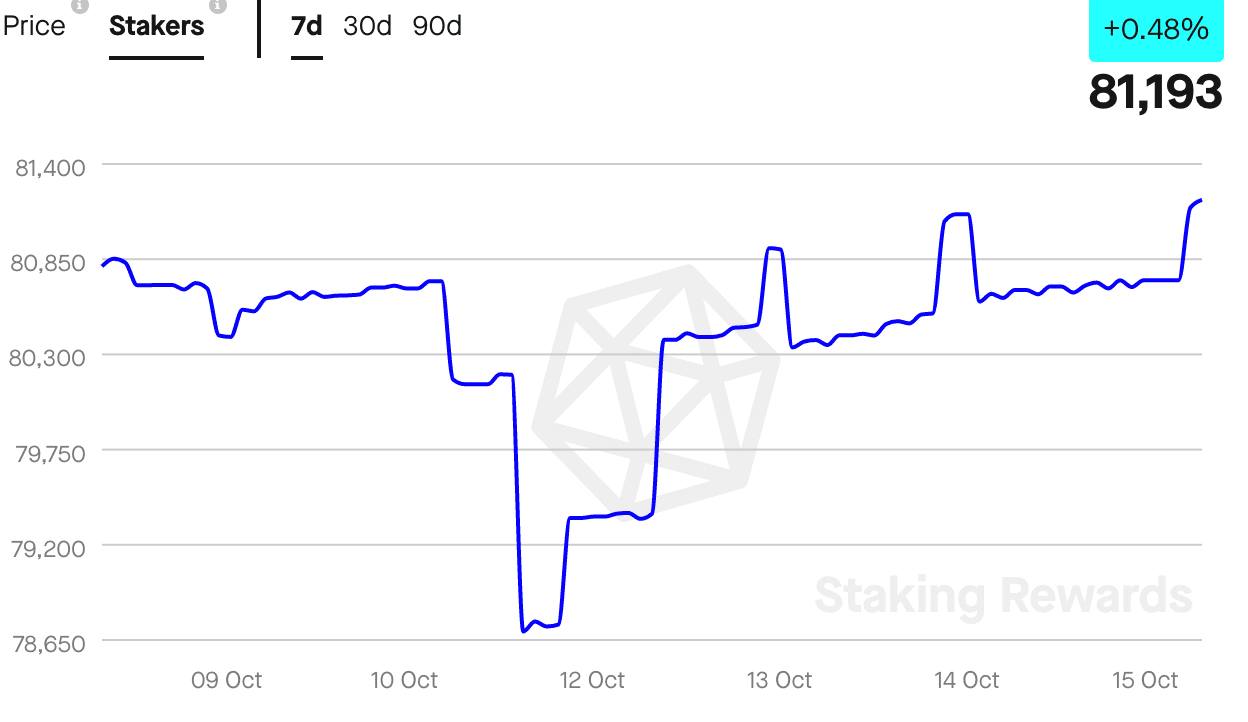

The number of stakers on the platform also grew immensely over the past few days. The number of stakers grew by 0.48% since the last week after witnessing a dip on 12 October as can be observed from the image below.

The staker revenue witnessed a consistent growth according to the data provided by Staking Rewards. Furthermore, the amount of revenue that could be earned by staking NEAR increased by 9.76% in 2022.

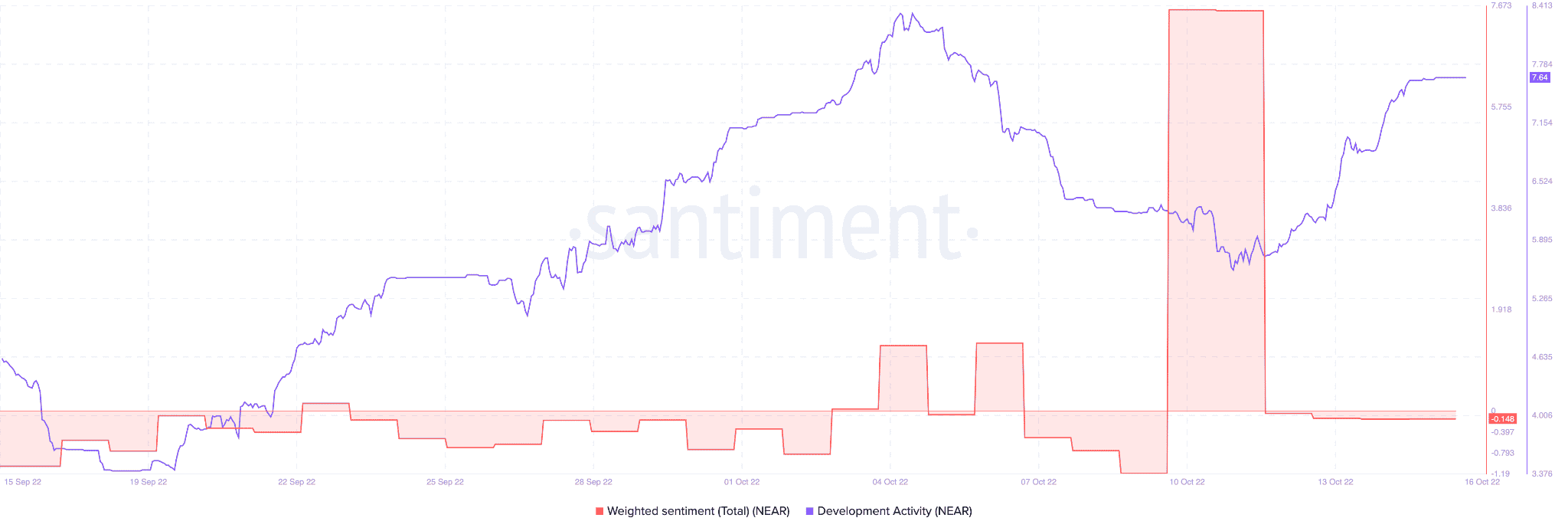

The interest from stakers could be attributed to the increasing staker revenue. However, the growth in development activity may have also peaked trader and investor interest. Over the last month, NEAR’s development activity grew significantly indicating that the NEAR protocol’s team might be working on new updates and upgrades.

This spike in dev activity may also compel traders to go long on NEAR. However, they should keep NEAR’s weighted sentiment in mind before making this decision. The weighted sentiment for the NEAR protocol declined over the past few days. This indicated that the public sentiment for NEAR was slightly negative.

A long journey to the end…

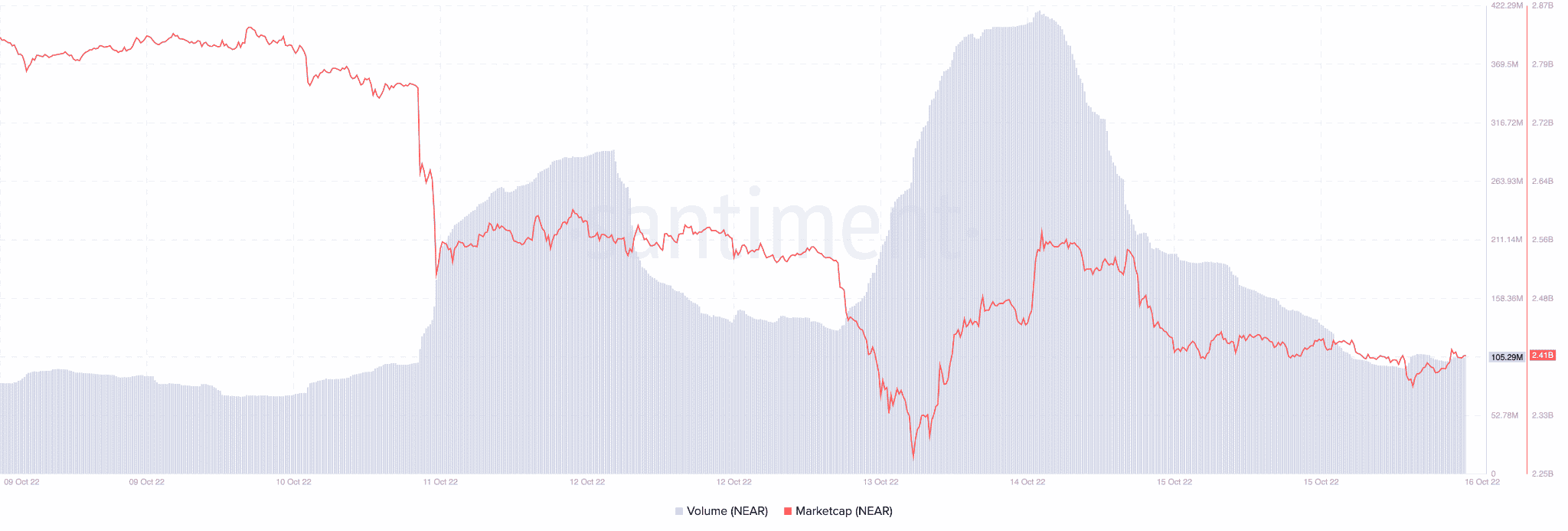

Along with the sentiment, NEAR’s volume decreased as well. In the last two days, NEAR’s volume decreased from 416 million to 105.6 million at press time. This could imply a bearish outlook for NEAR in the coming future. Additionally, NEAR witnessed a decline in its market cap and stood at 2.4 billion at the time of writing.

NEAR was trading at $2.97 at press time and its price had depreciated by 0.87% in the last 24 hours. Along with NEAR’s declining prices, its volatility also witnessed a depreciation and fell by 18.73% in the past week.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)