Polkadot [DOT]: Retest of $7 likely if BTC traverses this path

![Polkadot [DOT]: Retest of $7 likely if BTC traverses this path](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x900-9.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- DOT retested key support and bullish order block near $5.76.

- Exchange long/short ratio and liquidations offered bulls little hope.

Polkadot [DOT] showed signs of recovery despite prevailing macro headwinds. So far, the bulls have defended a key support and bullish order block near $5.76.

The support hasn’t cracked throughout the second half of March and April. A recent performance update captured DOT’s exemplary record in Q1, but Q2 has seen a bumpy start.

Is your portfolio green? Check DOT Profit Calculator

Meanwhile, Bitcoin [BTC] still exhibited choppiness. It retested $30k before dropping sharply back to $27k on 26 April. At press time, BTC reclaimed the $28k zone, setting DOT to edge higher. However, persistent BTC fluctuations can whipsaw DOT.

A likely upside or nuke for DOT?

In the past six weeks, the price action has retested the bullish order block and support level near $5.76 three times. The first retest faced price rejections near $6.5, while the second retest edged higher and hit $6.959 after a little stalling near $6.5.

The third retest, seen at press time, also witnessed a pullback retest confirming a likely uptrend continuation.

As such, DOT could rally and retest the resistance and bearish order block of $6.959. However, an FVG (fair gap value) within $6.552 – $6.799 (white) could also offer resistance to the likely recovery.

Conversely, bears could gain more influence if the support level (cyan) cracks. Such a breach could set DOT to aggressive selling and sink the asset to the March swing low of $5.245 or $5.0 support level.

At press time, the RSI retreated sharply to lower ranges but inched closer to the neutral level – a dip in buying pressure, but buyers remained steadfast. Notably, the OBV edged higher – reinforcing the buying pressure.

Bulls’ have slight leverage; sellers can’t be overruled

How much is 1,10,100 DOTs worth today?

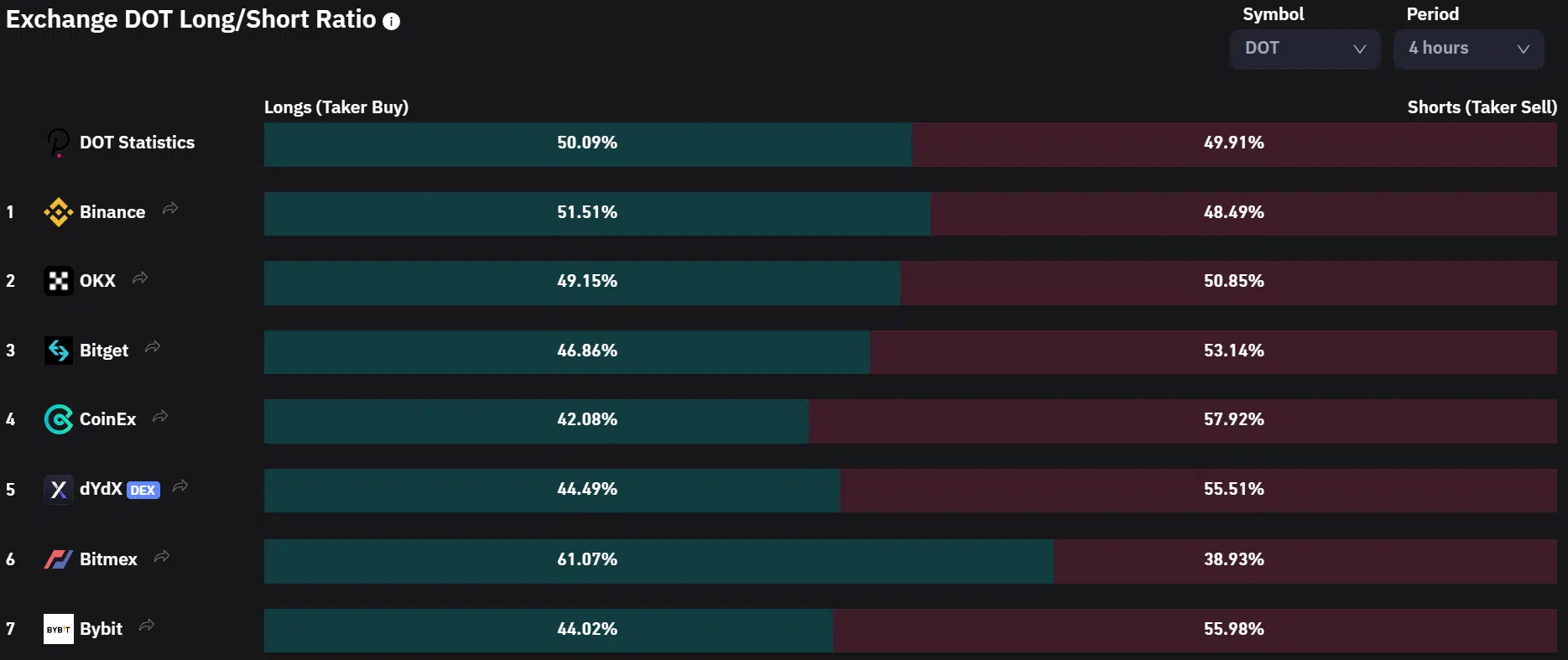

According to Coinglass, the exchange DOT long/short ratio showed long positions were dominant at 50.09% on the 4-hour timeframe at press time.

It shows mild bullish sentiment in the short-term, but bulls only have little leverage, and sellers couldn’t be overruled.

On the liquidations side, more long positions have been liquidated in the past few days than short positions – limiting a strong recovery.

At press time, twice as many long positions (over $30k) were wrecked in the past 4-hours compared to short positions ($15k). It shows short-term selling pressure looms despite the mild bullish sentiment; hence caution should be exercised.