Polkadot’s rally in the near-term is subject to these factors

Gavid Wood’s indication that the DOT treasury has 18.9 million tokens (amounting to $826.497 million at press time) ready to be spent on the development of the ecosystem, invited heightened anticipation for Polkadot. For close to three months now, Polkadot has had a sustained rally with occasional speed breakers but an all-in-all-good run.

As BTC regained momentum and at press time noted a 4.30% rise to $62,000, major altcoins followed suit. Polkadot, too, looked primed for a breakout this time as it oscillated at $43.59 and noted 2.15% daily gains.

What’s paving DOT’s way?

On 22 October, PolkaPet World, the Polkadot ecosystem NFT project in partnership with 21 of the biggest Polkadot projects, announced that the first-round funding for its highly anticipated PETS token closed at over $3.1 million.

With the announcement of the first Polkadot parachain auction, the altcoin’s path towards a rally was already paved. However, as November approaches, since the initial batch is scheduled for 11 November, the hype around DOT still persists.

High anticipation for the eighth-ranked alt was also visible in its high social volumes. Further, a negative weighted sentiment for DOT (noting -0.56) at the time of writing, gave additional room for the alt to rally.

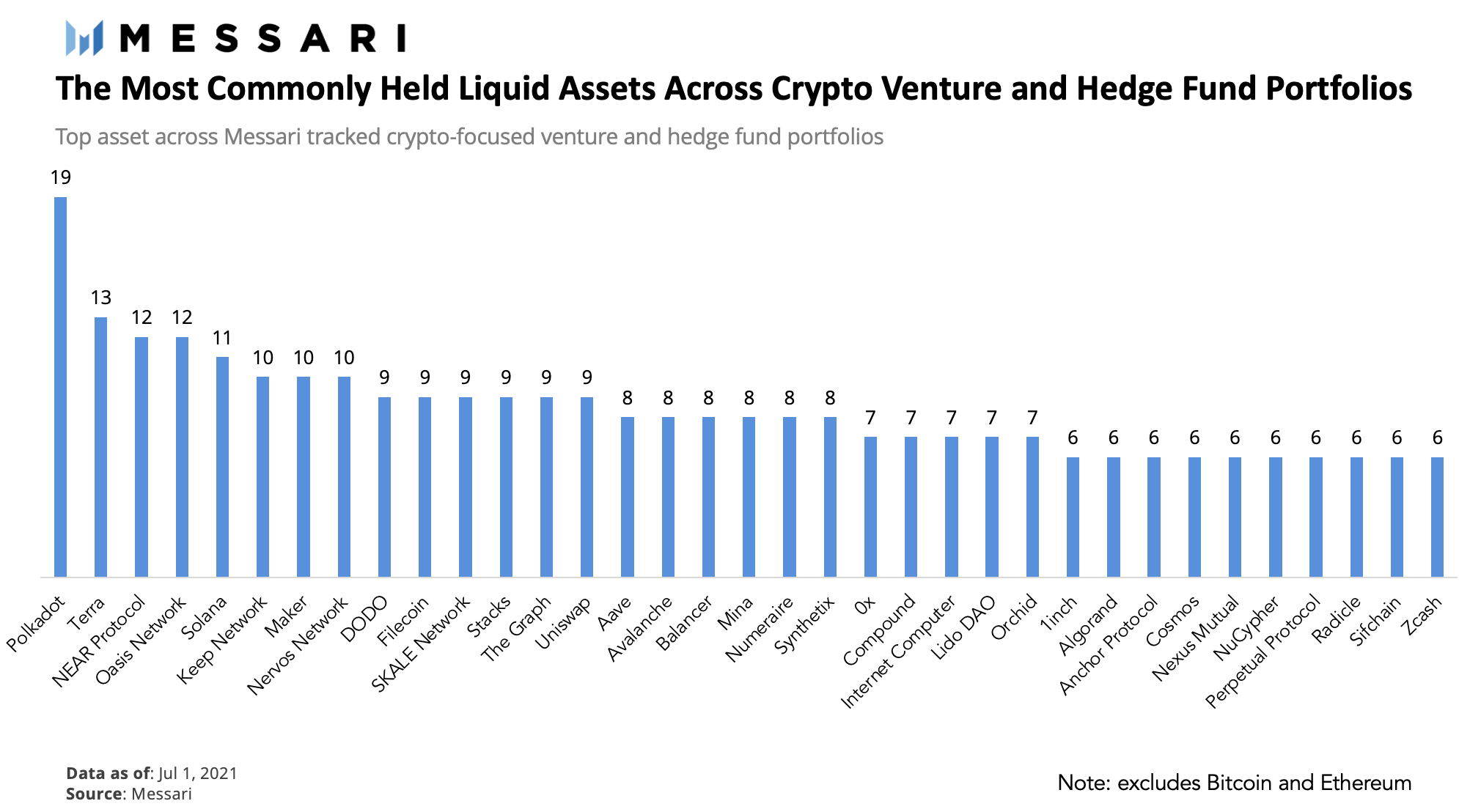

That being said, all through June, Polkadot was also the most held asset by VCs and hedge funds. This meant, that big money players had their hands deep in DOT. This was another reason why market analysts like Lark Davis were bullish on the alt.

Metrics lining up

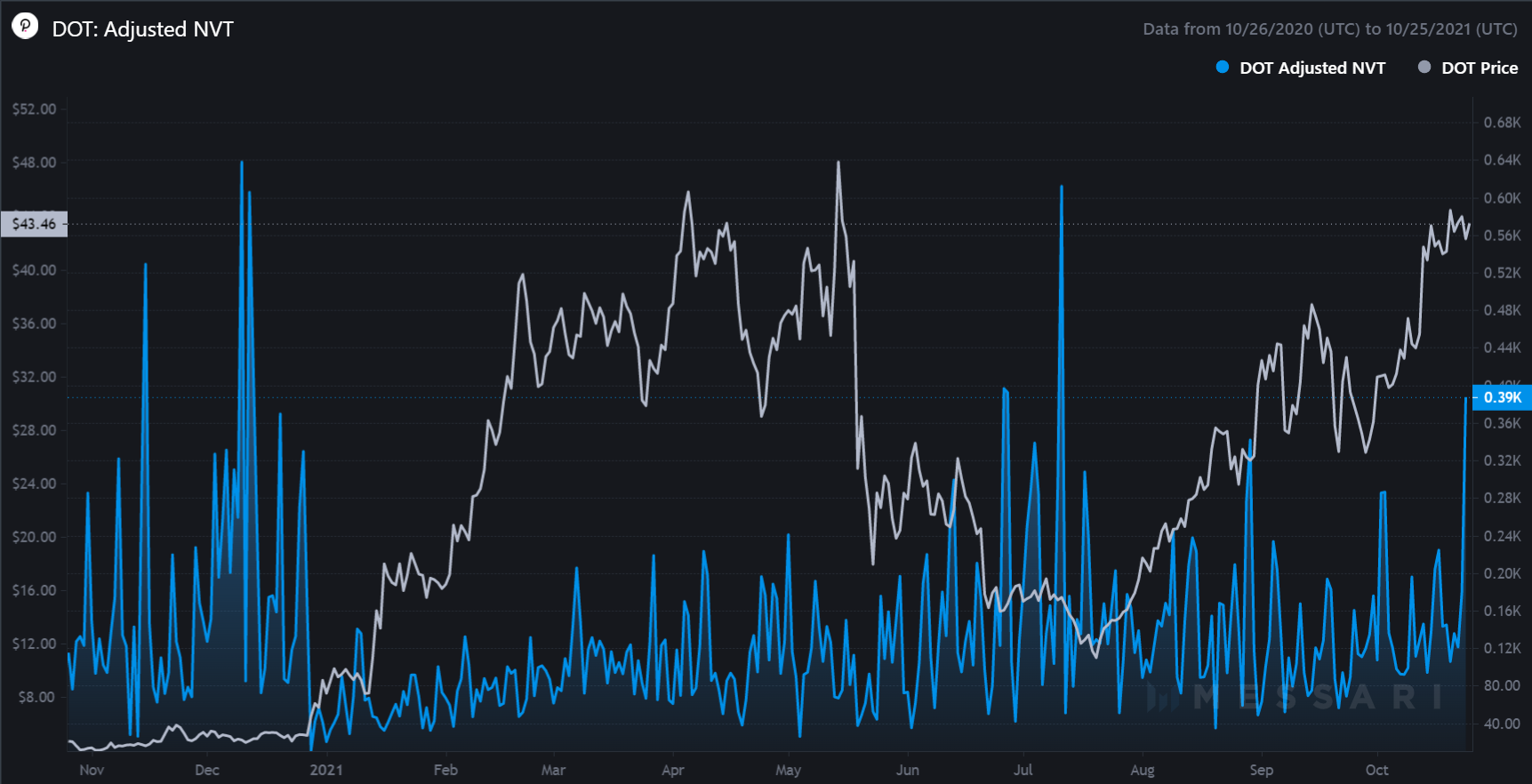

Notably, DOT’s adjusted NVT saw a considerable spike over the last day which indicated high network valuation. In DOT’s case, a higher NVT value most likely depicted legitimate growth stages.

Even though Polkadot’s price seemed to be consolidating, as its candlesticks on a one-day chart were visibly shorter, the alt’s circulating market cap and market cap dominance were peaking. Additionally, Polkadot’s Sharpe ratio held well despite the recent week-long consolidation. This represented that DOT’s performance, compared to a “risk-free” asset, was pretty decent.

At press time, the percent of Stablecoin Total Supply held by whales with more than 5 million USD stood at 53.02, at an all-time high. Looked like whales were stacking up looking more solid than ever ahead of the parachain launch.

Moreover, BTC’s correlation to DOT was important for its rally too. Over the last month, DOT has been sensitive to BTC’s upward momentum. Yet again depending on BTC’s rally, DOT’s path can be clearly anticipated.