Polygon’s [MATIC] short-term prediction for noise traders, and market timers

![Polygon's [MATIC] short-term prediction for noise traders, and market timers](https://ambcrypto.com/wp-content/uploads/2022/12/benjamin-matic.jpg.webp)

- MATIC was in a bearish market structure.

- It could break below $0.7652.

- A break above $0.7781 would invalidate the above forecast.

Since 28 December, Polygon [MATIC] has experienced several price rejections at $0.7652. In addition, Bitcoin’s [BTC] recent sideways market structure has also prevented the altcoin market from moving higher.

MATIC has since fallen and broken through several support levels, as BTC’s trading range has undermined trading volume. At press time, MATIC was trading at $0.7675 and was on the verge of falling below $0.7652.

Read Polygon’s [MATIC] Price Prediction 2023-24

MATIC’s freefall: Will $0.7652 hold?

MATIC’s recent freefall has broken a few supports, including the immediate supports at $0.7827, $0.7755, and $0.7736. However, technical indicators suggested that it could plummet further.

In particular, the Relative Strength Index fell from the upper ranges into oversold territory. This suggested that buying pressure declined and selling pressure increased.

The on-balance volume (OBV) also declined steadily, suggesting that the decline in trading volume contributed to easing buying pressure. In addition, Chaikin Money Flow (CMF) was below zero, thus reinforcing that the bears had more influence on the market at the time of the press release.

Therefore, MATIC could break below $0.7652 and find new support at $0.7571 or $0.7524 if the selling pressure increased in the next few hours or days, starting from the time of writing. These levels can serve as targets for short-selling.

They can also serve as discounted buying opportunities, as MATIC was in an oversold area, one of many conditions that can influence a price reversal.

However, a break above $0.7781 would invalidate the above trend. But the bulls need to overcome the immediate hurdles at $0.7755 and $0.7736 to gain leverage.

Investors should therefore look for the CMF to cross above the zero line and the RSI rejection in the oversold zone for a price reversal. This would be a clear signal to close the short positions.

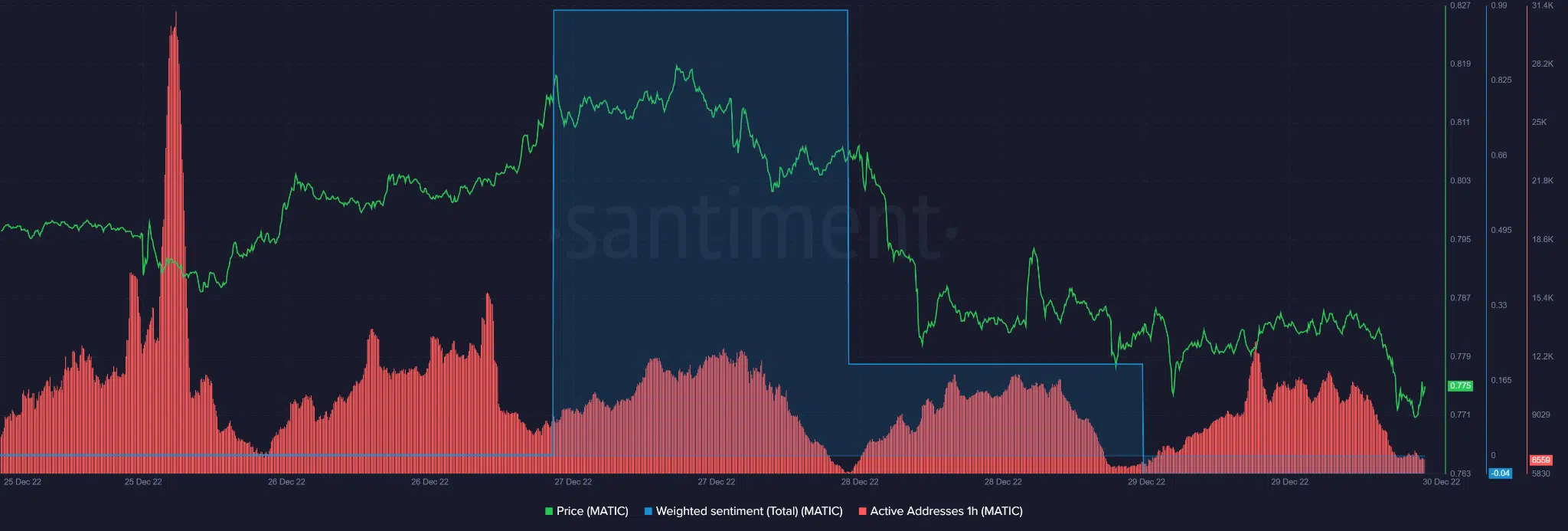

MATIC recorded a bearish sentiment as the number of active addresses remained low

According to Santiment, MATIC’s number of active addresses remained almost constant in the last hour at press time. In addition, weighted sentiment fell slightly into negative territory, indicating a bearish sentiment.

Therefore, a stagnant number of active addresses would undermine buying pressure, and bearish sentiment would further increase selling pressure.

How many MATICs can you get for $1?

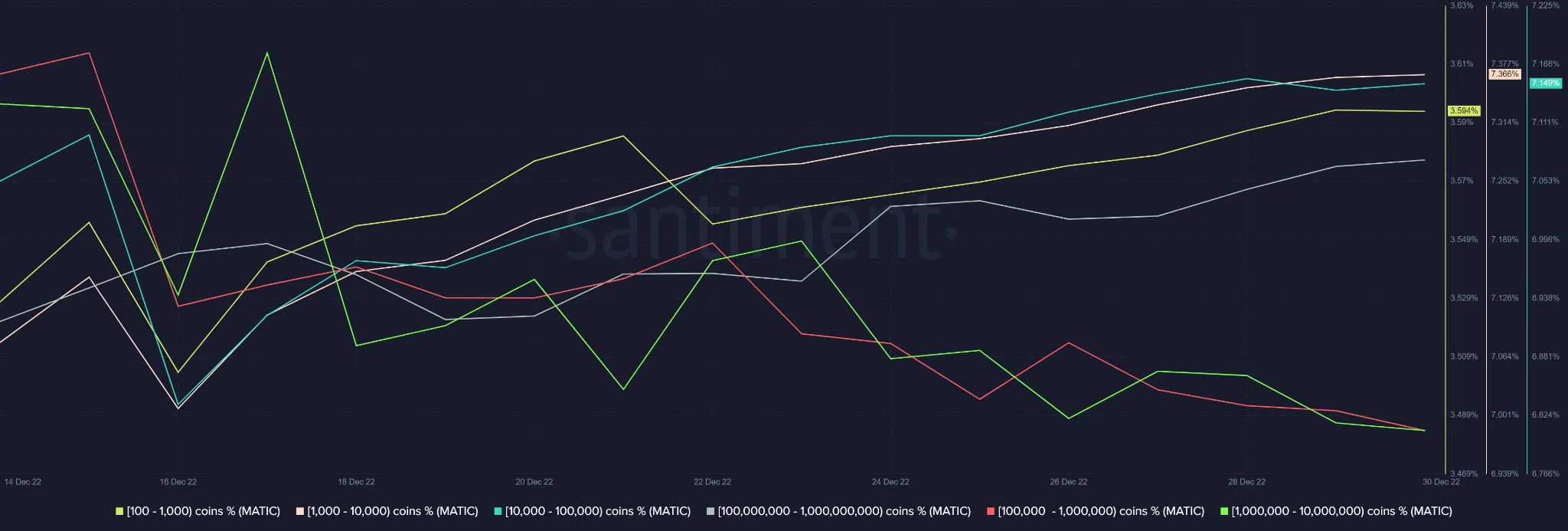

The supply distribution also showed that all supplier categories increased their holdings except for the two groups (100K-1M) and (1M-10M) coin holders. Therefore, the two whale categories were responsible for the selling pressure at press time.

However, the whale category (100 million to one billion coins), with a supply control of over 50%, also increased its holdings. Was this an indication of a possible trend reversal?