Report: Hong Kong-based Coinsuper clients unable to withdraw funds, tokens

Hong Kong-based cryptocurrency exchange Coinsuper is reportedly hit by frozen funds. A report by Bloomberg noted that customers are unable to withdraw money or tokens from the exchange, pushing some of them to file police complaints.

When will withdrawals from your exchange start working? Have a conscience! Let everyone know about the problem.

— Zhdun (@B548T) December 1, 2021

While the matter has just come to light, the issue seemed to have persisted since November 2021. Many users took to Twitter to get answers on the exchange’s last tweet on 1 December.

I have been waiting for my withdrawal of usdt more than 24 hours please withdraw I need my money please

— Daniel Felipe Malaver Segura (@MalaverSegura) November 30, 2021

Terry Chan, one of the affected customers told the media outlet that he noticed that trading volume on the exchange had become less liquid. Meanwhile, five of the complainants told Bloomberg News that they are unable to retrieve $55,000 in cumulative tokens and cash. With that being said, many frustrated Twitter users have gone ahead to call Coinsuper an “exchange scam.”

The exchange was founded in 2017 and has investments by names like Sky9 Capital, Pantera Capital, and China Equity among other institutions while being run by former UBS China Inc. President Karen Chen. So far, none of the parties have come forward to comment on the situation.

The report also notes that admins have stopped responding to the affected users on Coinsuper’s Telegram channel. However, its trading app remains operative, as per the report.

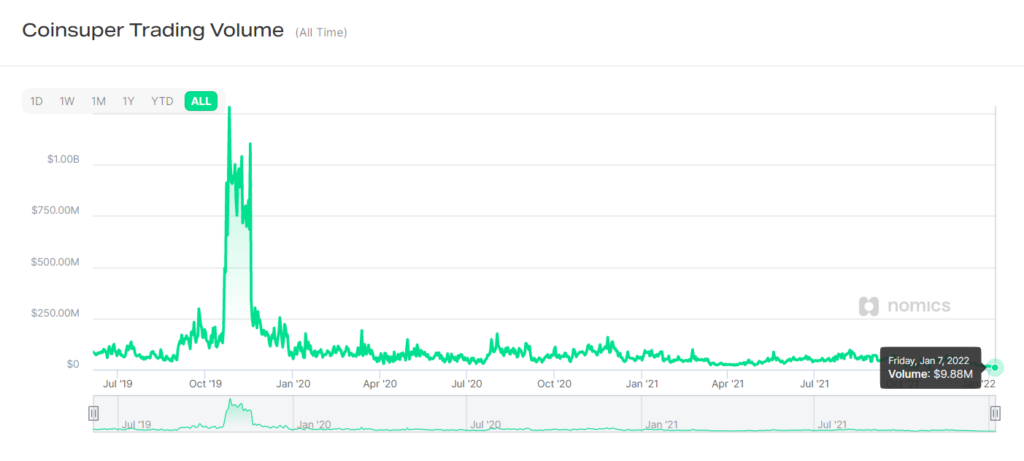

As one of the biggest exchanges in Hong Kong, Coinsuper reportedly handled a record 24-hour trading volume of $1.3 billion back in 2019. Which has fallen to $9.8 million as of 7 January on Nomics.

Source: Nomics

With that being said, Hong Kong was once a crypto hotbed with names like Tether, BitMEX, and Bitfinex coming out of the country. On the investor front, a Visa study had found Hong Kong was also among the most active markets with 18% of residents actively invested in the crypto class while 13% sitting on a passive exposure.

However, lately, the regulators have grown stringent in the sector. While the regulatory regime remains unclear, the Government of the Hong Kong Special Administrative Region recently announced arrests for alleged money laundering using cryptocurrency.

Meanwhile, it is worth noting that frauds by centralized exchanges are also not uncommon in crypto history. Chainalysis noted in its recent research that close to “90% of the total value lost to rug pulls in 2021 can be attributed to one fraudulent centralized exchange, Thodex, whose CEO disappeared soon after the exchange halted users’ ability to withdraw funds.”