Ripple gets new allies- Decoding what this update means for XRP

As fresh information about the case comes in, the Ripple v. SEC case just continues to grow more intriguing. After much opposition, it was disclosed last week that the SEC had finally conceded to the Amicus Brief motion, although with their own conditions.

On 31 October, several of the parties to the brief were made public, and one of them surprised everyone and might perhaps be viewed as an unanticipated ally in the lawsuit against the SEC.

Here’s AMBCrypto’s Price Prediction for XRP (XRP) for 2022-2023

A surprise ally?

Coinbase had asked a federal court for permission to submit an “amicus” brief in the case between the SEC and Ripple Labs. The SEC filed a lawsuit against Ripple at the end of 2020 on allegations that it sold XRP as an unregistered security.

Coinbase has since joined the Blockchain Association, SpendTheBits, and lawyer John Deaton in an effort to bolster Ripple’s case against the SEC.

This back-and-forth focused on whether or not the SEC gave “fair notice” before commencing its enforcement action, poking fun at the widespread concern that the regulator has not provided adequate direction to firms. Coinbase made a similar argument, saying that the SEC’s erratic attitude to regulation in this area is bad for business.

Even if it does not currently list XRP, the latter factor played a role in the decision made by the cryptocurrency exchange to file its own Amicus brief. Prospective investors would continue to regard the space with skepticism if Ripple and the SEC were engaged in a protracted court battle.

SEC files for Redaction

On 31 October, another document related to the court battle was made public, albeit it did not directly address the Amicus brief. According to this filing, the SEC requested that some portions of the Hinman documents recently provided to Ripple be redacted.

This meant that the material in those sections of the documents would be kept secret from everyone save the plaintiff and the defense. The motion was granted to the SEC.

NFTs on XRPL

Well, 31 October also saw the introduction of a significant update to the XRP community that has the potential to drastically alter the ecosystem’s future.

It was announced that XLS-20 support had been added to the XRP Ledger. This meant that NFTs were finally supported on the ledger itself.

With the release of XLS-20, the XRP Ledger network has established a uniform protocol for NFTs, marking a major step forward for NFT projects and apps built with the XRPL.

With this version, the XRPL network may be used for not just the creation of NFTs but also for their transfer and storage.

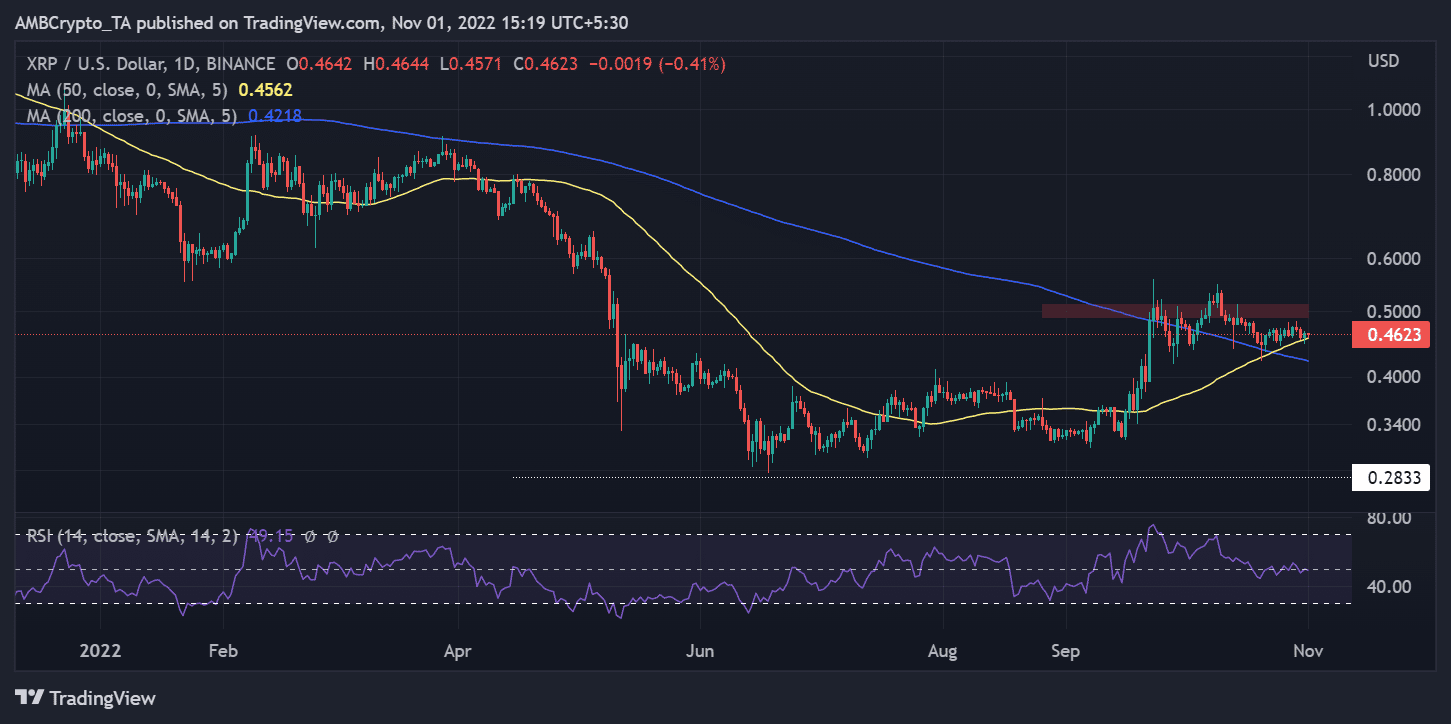

The $0.48 to $0.5 area was where XRP was seeing resistance as of the time of this writing, according to a check at the XRP chart on the daily time frame.

It was spotted trading at approximately $0.46, with the yellow and blue lines representing the short and long Moving Averages acting as support.

The lawsuit between Ripple and the Securities and Exchange Commission has been widely seen as having far-reaching implications for the cryptocurrency industry.

Coinbase’s entry into the fray demonstrates that there are worries that a lack of clarity around what XRP could have a “Ripple Effect” on other tokens and coins already in circulation.

Since this would have repercussions in the market, their input is essential. The adoption of XLS-20, among other recent developments, has given XRP holders renewed optimism and may have a beneficial effect on the value of XRP.