Russia witnesses surge in stablecoin usage post sanctions- Details inside

Russia has witnessed a rise in the usage of stablecoins after the EU and the U.S. imposed sanctions on Russian financial institutions and individuals following the Russian invasion of Ukraine, stated a recent Chainalysis report.

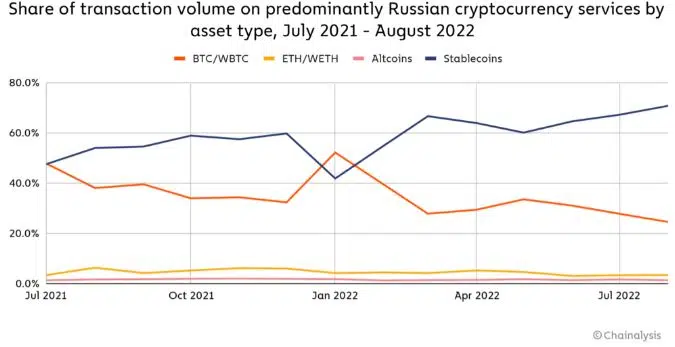

Stablecoins constituted 42% of the volume of transactions on Russian cryptocurrency services in January, followed by a 55% share in February and 67% in March.

Conversely, usage of Bitcoin, Ethereum, and other altcoins has been falling significantly. This is the same timeframe when Russia invaded Ukraine.

Increasing crypto adoption amidst Sanctions

Increasing crypto adoption amidst Sanctions

Chainalysis spoke to an expert on money laundering in Eastern Europe who opined that the possible reason for this phenomenon is businesses and individuals trading Ruble for stablecoins in order to protect their assets’ value.

Besides, a lot of businesses are now increasingly adopting cryptocurrency for their financial transactions.

The European Union last week put a blanket ban on all crypto-related payments to and from Russia as a part of its latest set of sanctions against the superpower.

The EU prohibited all crypto-asset wallets, accounts, or custody services, irrespective of the amount of the wallet.

In June, Russian banking institutions were removed from the SWIFT banking network following earlier EU sanctions. Due to this ban, Russia has been facing difficulties in international commerce, in particular, exporting commodities like oil.

This change could push many users towards suspicious exchanges to evade the sanctions.

Bitcoin.com has however reported that despite the EU’s ban, a list of crypto exchanges, including Binance, Kraken, FTX and Garantex, Huobi Global, Okx, Kucoin, Bybit, and Mexc Global have not introduced new restrictions on Russian users.

Last month, it was reported by a local news agency that Russia’s central bank had been rethinking the approach to regulating cryptocurrency and agreed with the finance ministry to legalize crypto for cross-border payments.

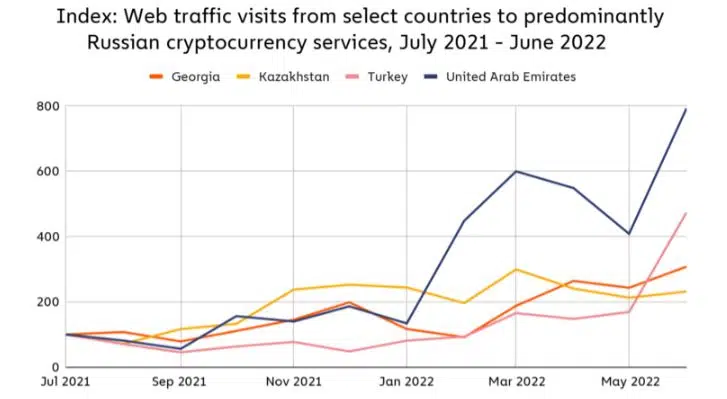

However, we also observe the anxiety of individuals from other countries who have invested in cryptocurrency on Russia-based crypto exchanges.

Many countries such as Georgia, Kazakhstan, Turkey, and the United Arab Emirates saw a surge in visits to Russian cryptocurrency services over the past few months.

Russia cybercriminals

In an earlier report published in February 2022, Chainalysis concluded that individuals and groups based out of Russia account for a disproportionate share of activity in several forms of cryptocurrency-based crime.

Roughly 74% of ransomware revenue in 2021, over $400 million worth of cryptocurrency, was related to Russia in some way.

It is not surprising therefore that we are witnessing such patterns in cryptocurrency usage in Russia.