Shark investor Cuban reveals his ‘non-Shark’ crypto, NFT investments

Shark investor and billionaire Mark Cuban confirmed in a recent podcast that 80% of his ‘non-Shark’ money goes to virtual assets. The statement doesn’t come as a surprise as Cuban has been quite vocal about his love for cryptos since the beginning.

“80% of the investments that I make that are not on Shark Tank, are in or around cryptocurrencies.”

He also noted,

“The investments I’m making now are not in traditional businesses.”

It is noteworthy that last year, the television personality’s NBA team, Dallas Mavericks, had announced a partnership with crypto platform Voyager. And, as part of his many other crypto partnerships, his brand also accepts Dogecoin for payments. In this context, he also stated,

“Put aside all the speculation you read about with Bitcoin and Dogecoin, all that. Set that aside, that’s just the gamesmanship that’s played with stocks and everything.”

However, in the latest podcast, he revealed that he has now been looking at decentralized autonomous organizations (DAOs).

“Every token holder in that application has a chance to set the direction of the network, not always equally, but typically equally. That is really where I look to invest.”

In the past, Cuban had also predicted that DAOs could be lead to some “disruptive” business opportunities.

The future of corporations could be very different as DAOs take on legacy businesses. It’s the ultimate combination of capitalism and progressivism. Entrepreneurs that enable DAOs can make $. If the community excels at governance, everyone shares in the upside. Trustless can pay

— Mark Cuban (@mcuban) May 31, 2021

Along with that, Cuban is also bullish on smart contracts- The lifeblood of DAOs, DeFi, and NFTs. Meanwhile, his NFT wallet seems to be holding collectibles built on Ethereum, Polygon, and Solana.

Interestingly, he does believe cryptocurrencies might not be everybody’s cup of tea right now.

“[Cryptocurrency] is hard to understand and it’s a hassle. But 10 years from now, there’s going to be those that succeed. That will create its own economy.”

Here, it’s worth noting that recently, the serial investor had joined the funding round of Seattle-based fintech Seashell. An investment company that looks to offer high yields by providing crypto-backed loans. Apart from that, in the past, Cuban had reiterated that his BTC, ETH, and alt portfolio is in the ratio is 60%, 30%, and 10% respectively.

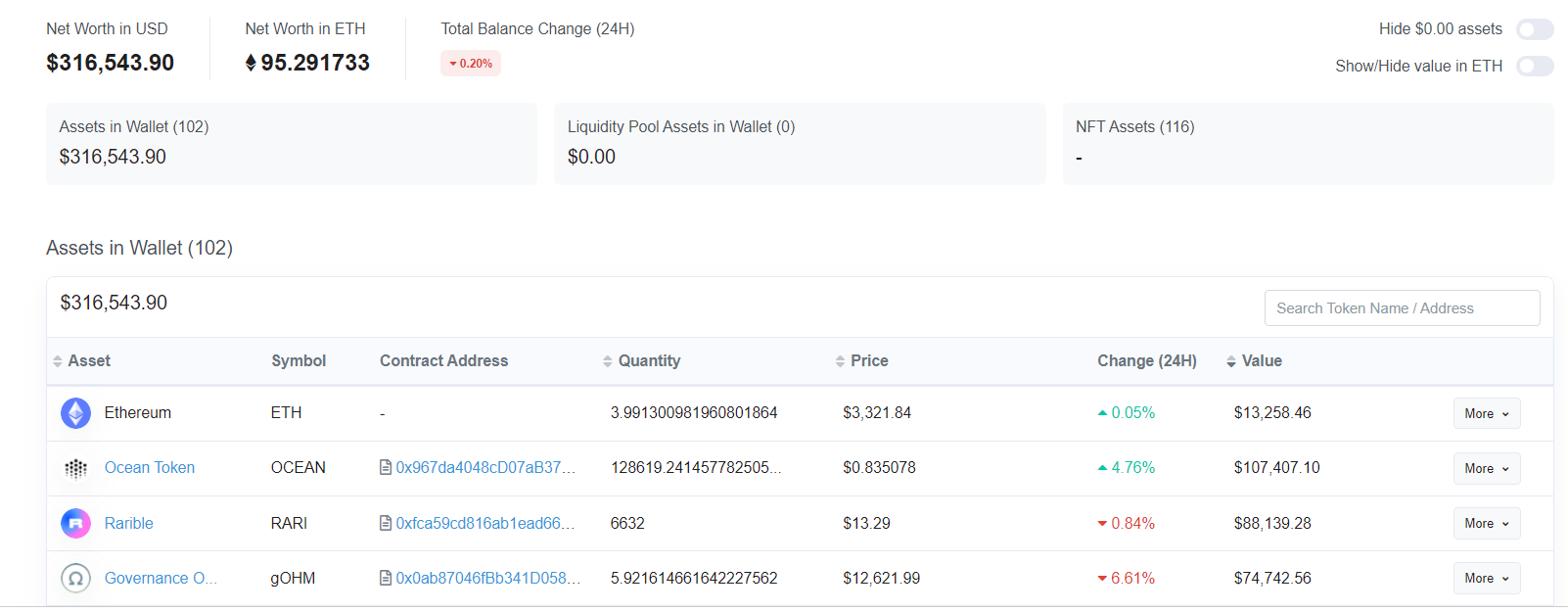

To understand where he invests among alts, it’s interesting to look at Cuban’s supposed EtherScan address. The unmarked account seems to hold Ocean Protocol (OCEAN), and Rarible (RARI), along with Olympus DAO’s Governance OHM (gOHM) token, and Audius (AUDIO) among other alts.