Should you consider ApeCoin in your portfolio for the recovery rally

Investors looking to ape back into the market for the relief rally may have a hard time choosing which coins to add to their portfolio. ApeCoin (APE) might be an interesting option to consider for numerous reasons.

Read Apecoin (APE) price prediction for 2023-2024

The alt is trying to attract more development activity through the recently rolled out ApeCoin DAO.

The latter aims to encourage and fund the development of projects that will foster more growth within the ApeCoin ecosystem. The overall aim is to facilitate more utility for the network and if it works, then it might lead to healthy growth further down the road.

The DAO is here to fund your ambition & the sky’s the limit ?

Love the passion & brilliance being shared daily on Discourse – keep it up fam! If you have ideas to help our community or drive Web3 forwards, let's make it happen together ?

Key resources to get started below ?— ApeCoin (@apecoin) August 8, 2022

ApeCoin DAO represents plans that may have an impact on APE’s demand in the long-term. Fortunately, for investors, short-term demand is currently favorable. The latest analysis by WhaleStats has confirmed that APE is now one of the top 10 most purchased tokens by ETH whales.

JUST IN: $APE @apecoin now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

Check the top 100 whales here: https://t.co/N5qqsCShZR

(and hodl $BBW to see data for the top 5000!)#APE #whalestats #babywhale #BBW pic.twitter.com/ukDhG03tEq

— WhaleStats (tracking crypto whales) (@WhaleStats) November 10, 2022

Should you go with the APE whale flow?

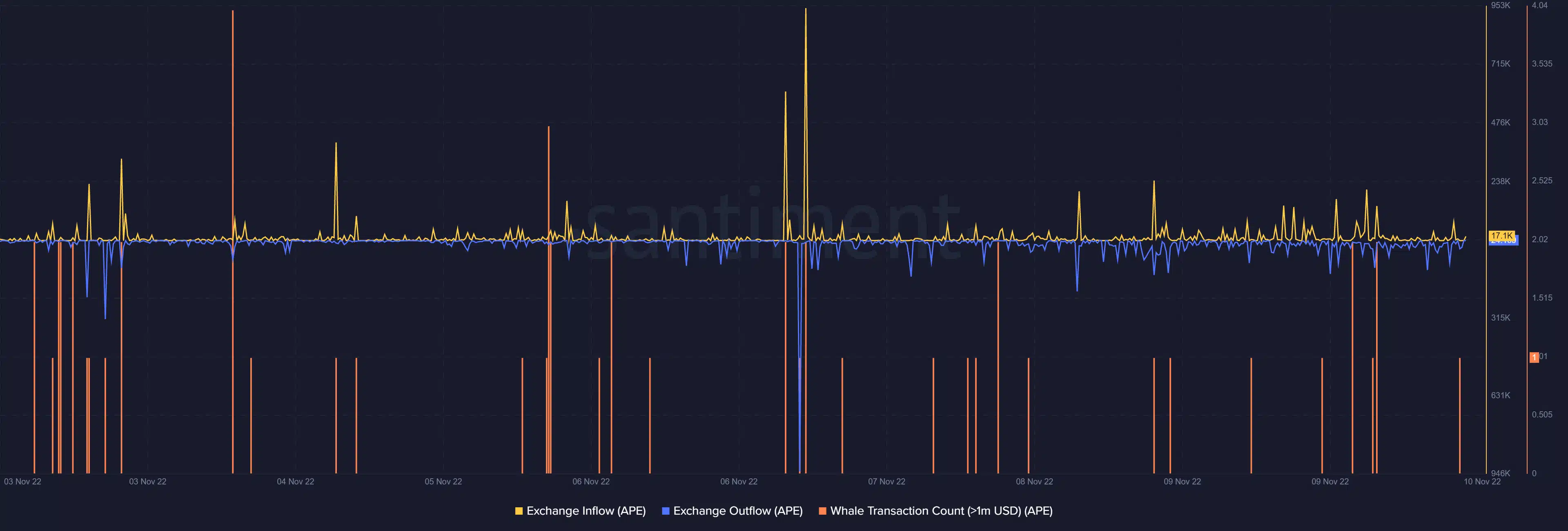

The return of whale activity is often a healthy sign for a token or cryptocurrency but is that the case for APE? The whale transaction count metric for transactions worth over $1 million registered some whale activity in the last 24 hours.

However, it was notably not much different from the level of activity that whales demonstrated previously.

ApeCoin’s exchange flows reveal a significant amount of exchange outflows. This confirmed a healthy demand within the latest bottom range, but nothing out of the ordinary. In any case, there was still a sizable amount of exchange inflows observed in the last 24 hours.

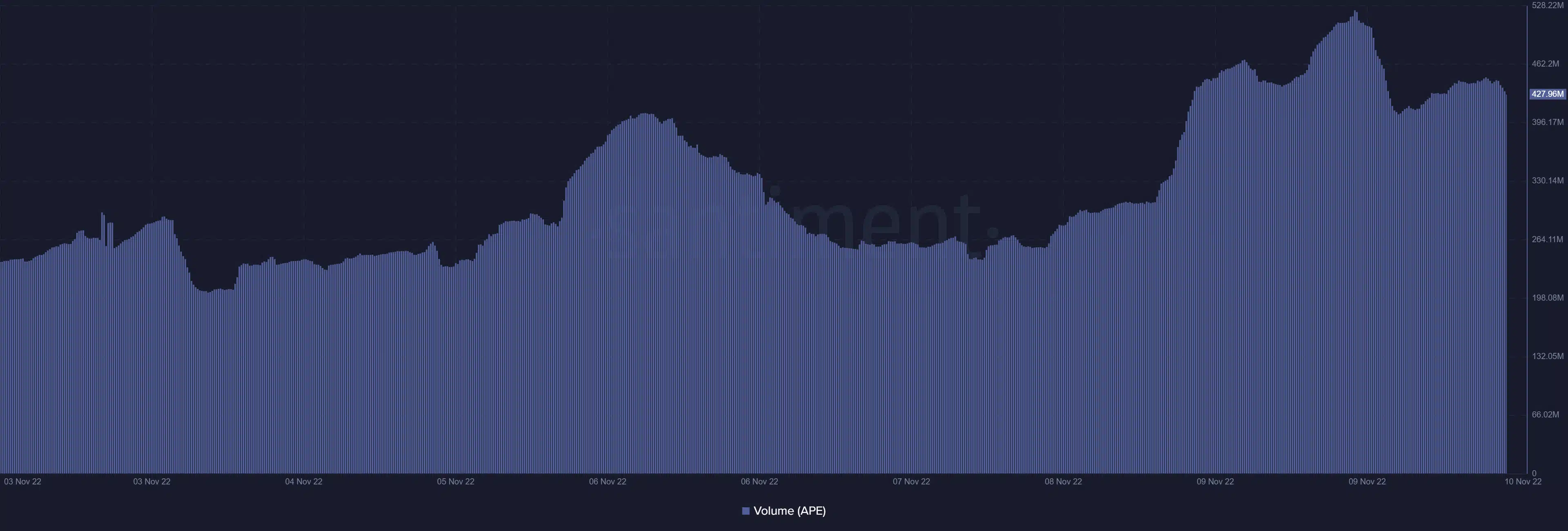

As far as APE volumes are concerned, we observed a strong increase in volume this week as prices dropped. This suggests that it was bearish pressure which quickly dropped off on 9 November. Nevertheless, the volume did register a slight upside in the last 24 hours despite it not being so enthusiastic.

The slight increase in volume might be associated with the return of bullish momentum especially considering the short recovery. But the limited nature of this volume increase may suggest that the buying pressure is quite limited. It also hints at the lack of strong retail demand.

APE’s price action

Furthermore, a look at APE’s price action reveals that the price crashed by roughly 45% so far this week. It managed to pull off a 13% recovery in the last 24 hours, to its $3.28 press time price.

The bounce back was courtesy of accumulation during its brief dip into oversold territory. APE is definitely one to watch especially now that it is receiving attention from ETH whales.