Solana enthusiasts should consider this before buying back at the current level

- Analyzing the good and bad sides of the Solana network in 2022

- Why investors should consider a different strategy for SOL

Investors’ interest in Solana’s native cryptocurrency, SOL, has slowed down in the last few months. This is not just because of the bearish market conditions, but also due to the network downside incidents and FTX woes. While these factors have eroded interest in cryptocurrency, its current discount is quite attractive.

Read Solana’s (SOL) Price Prediction 2023-24

Although SOL’s discounted price is enticing, there is no getting around the eroded trust. As a result, the cryptocurrency has barely secured enough bullish momentum for a sizable rally since June. This underscores why SOL might not be the ideal cryptocurrency for investors looking for a big price pump during the next bullish wave.

One factor that fueled Solana’s initial hype in 2021 was the hope that it would be an “Ethereum killer.” Fast forward to the present, and the outcome has not matched expectations. However, it is not all doom and gloom.

There is still hope for SOL

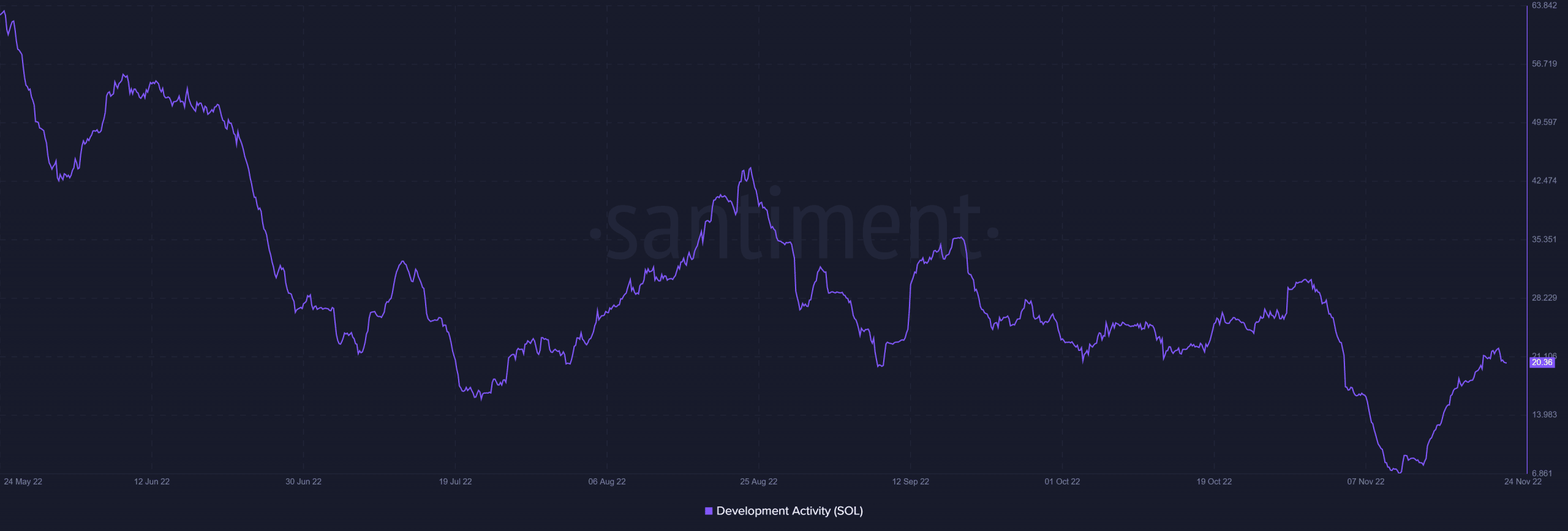

Solana has certainly not fared well this year, but there are some aspects that highlight why its community remains hopeful. It has maintained a healthy development activity and continues to focus on long-term development.

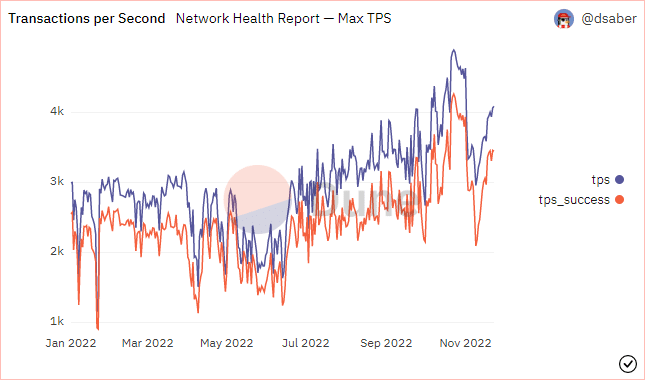

The development activity metric confirms that the network developers have been busy building. According to recent updates, some aspects of the network have achieved positive growth since the start of the year. For example, the maximum transaction per second figures has grown on a year-to-date basis.

The daily transaction count is another area where Solana achieved growth this year. There was healthy growth in the number of successful vote transactions. This confirms that the Solana community has been more actively involved in governance-related matters.

It also upheld noteworthy levels of vote-related transactions throughout the year, which is a confirmation of healthy network utility.

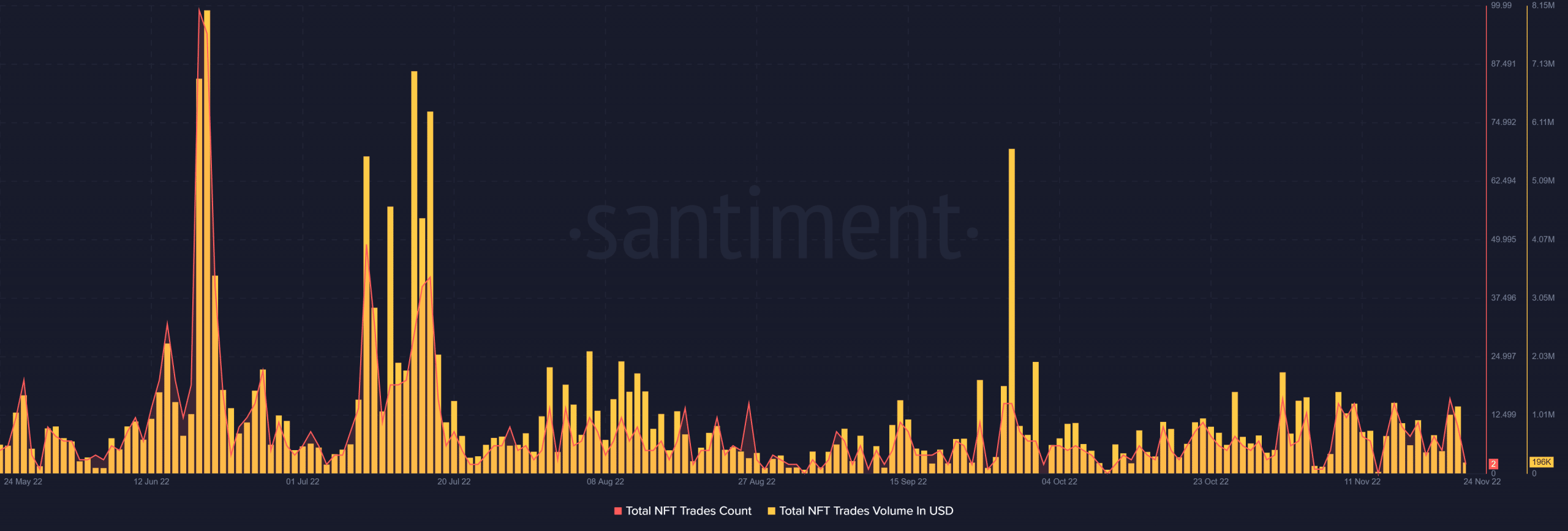

Solana’s NFT segment notably took a hit during the year, as seen by the total NFT trades count and total NFT trades volume. Despite that, Solana has maintained a significant amount of NFT trading activity.

A change of tactic

The fact that Solana has achieved growth in some aspects of its network is comforting to investors. However, investors still have to consider the negatives and what it means for the network, as well as for SOL’s price action.

Solana’s woes have already dampened the mood, but it is currently trading at a discount. Further, its latest price action has confirmed that there is a return of bullish demand.

While bullish demand is a positive sign for investors, a different strategy might be necessary. Adding it to a diversified portfolio would certainly not hurt, as opposed to aping all in on SOL.