Solana beats Ethereum, Tron, other L1s on this front

- Fees and transactions on Solana were higher than other top L1s.

- SOL’s price might rise to $120, but before that, it could decline.

Out of all the top Layer-one (L1) blockchains, only Solana [SOL] registered an increase across all metrics. AMBCrypto confirmed this after a proper examination of a post put out by The Block Research.

According to the data provided, other L1s like Ethereum [ETH] and Tron [TRX] had major upticks in terms of stablecoin supply.

Solana was also not exempt, suggesting a surging interest in the crypto market.

Besides interest, the increase in stablecoin supply on different blockchains implied that market participants were armed with enough buying power to foster widespread price increases.

But when it comes to daily transactions, fees, and demand for their respective tokens, Solana outpaced both Ethereum and Tron.

3/ A decrease in inscription activity caused declines in daily transactions, user counts, and fees for most chains, except Solana, which maintained consistent demand across all key metrics. pic.twitter.com/ZkkIbqQyYd

— The Block Pro (@TheBlockPro__) February 14, 2024

Solana’s thriving season is not over

Outperforming these L1s was a sign that the market was interested in SOL and tokens in its ecosystem. The reason for this could be connected to the price performance.

At press time, SOL changed hands at $115.91. This was a 98.47% 30-day increase. Within the same period, ETH’s price climbed by 42.67%. TRX, on the other hand, jumped by 27.35%.

AMBCrypto provided further proof of Solana’s dominance on the 14th of February. In the said piece, we reported how the Proof-of-History blockchain surpassed Binance Coin’s [BNB] market cap.

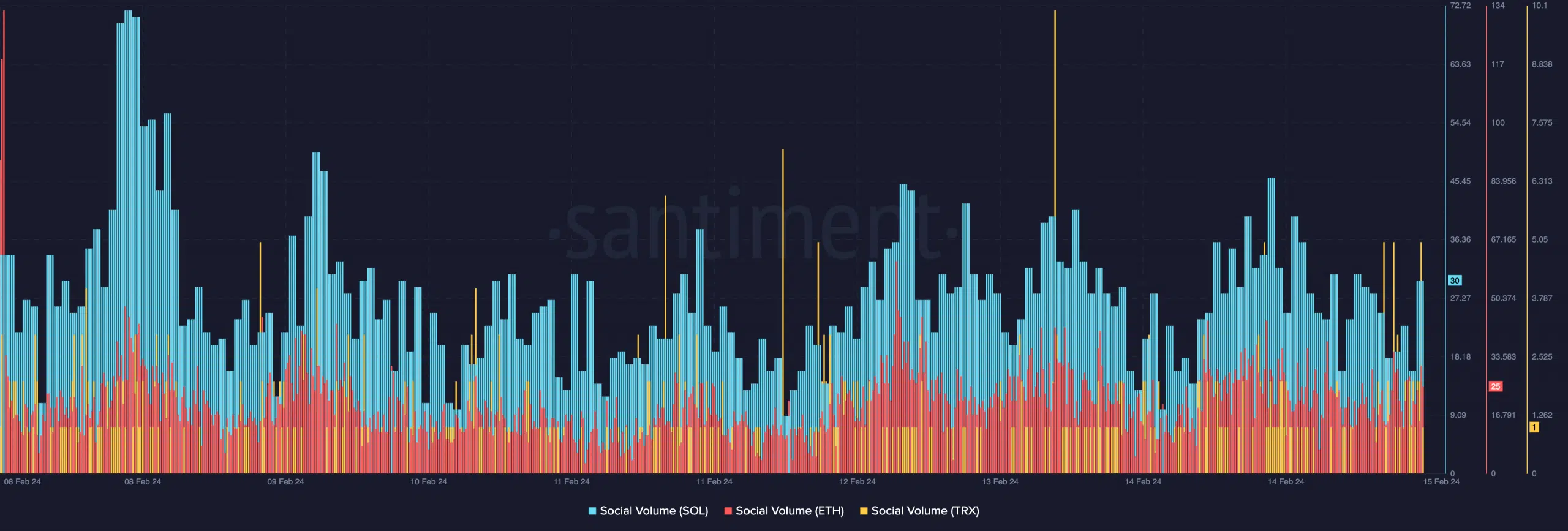

Concerning the social volume, on-chain data confirmed that Ethereum and Tron could not match up with Solana.

At press time, ETH’s social volume was 25. TRX’s volume was lower, while SOL outpaced both with a reading of 30. Social volume tracks the text documents or searches connected to a project.

Therefore, one can conclude that Solana was one of the most sought-after projects, while Ethereum lagged behind.

Before the rally comes the pullback

Social metrics can have a snowball effect on cryptocurrency valuation. In SOL’s case, an increase in the social volume might propel the price to $120 in the short term.

But if the metric gets too high, it could spell a local top, thus leading the price action to decline.

On the daily SOL/USD timeframe, the 9 EMA (blue) and 20 EMA (yellow) closed in on one another. Movements like this suggest that the short-term bullish outlook could be coming to an end.

If SOL’s price drops below the 9 or 20 EMA, the bullish thesis previously identified could be invalidated.

If the EMA crossover remains bullish, then SOL could head toward $140. In the meantime, the Relative Strength Index (RSI) was 68.35, suggesting a solid buying momentum.

Realistic or not, here’s SOL’s market cap in ETH’s terms

If the RSI reading reaches the 70 to 75 region, SOL might retrace, as it would have been overbought.

Being overbought means the price might slide, if possible, below $100. But in a highly bullish case, Solana’s validation could retest $150 for the first in more than two years.