Solana unlock postponed, but is it enough to save SOL from declining

- Solana’s co-founder briefly comments on Solana’s involvement in FTX

- Unlocking of staked tokens postponed as price witness slight uptick

The SOL token started falling on 6 November, and while this might have been written off as a regular market movement at first, the decline has continued for more than two days.

As the decline continued, several theories were proposed, but the connection to FTX’s impending insolvency seemed to hold. Up to this point, the Solana team had not made any sort of public comment.

Read Solana (SOL) Price Prediction for 2022-2023

What Solana’s Co-Fonder had to say

Co-founder Anatoly Yakovenko responded briefly on Twitter, stating that Solana did not hold any FTX assets. He went on to say that the company was incorporated in the United States (maybe dropping a hint about compliance with rules) and that it had sufficient cash reserves to keep operating for another 30 months as it had a lean staff.

Huobi Research reported that FTX, via Alameda, made direct investments in several companies, one of which being Solana. Yakovenko’s brief statement may have been insufficient because it prompted more questions than it answered.

It is probable that the recent sell-off and downward trend of the SOL token were motivated by concerns over a possible dump of the SOL tokens claimed to be held by FTX.

However, on 9 November, there were numerous reports that staked SOL would soon be released. And, thus the downward trend continued.

SOL unlock postponed

The Solana unlock had been scheduled on 10 November, but the Solana Foundation said in a recent update that the date had been moved. This amounts to about 5.4% of the entire supply or 28.5 million SOL from 250 accounts that were scheduled to be unstaked at the conclusion of Epoch 370.

The SOL, however, had been restaked, and unlocking had been delayed.

Is SOL recovering?

Looking at the price movement of SOL revealed an over 60% decline in the price. On the Volume indicator, it could be seen that the buy and sell pressures were fluctuating in the 6-hour timeframe.

The downturn and excessive volatility were both highlighted by the Bollinger Band.

The asset appeared to have gained close to 1% over the trading period that was seen in the daily timeframe. At the time of this writing, SOL was trying to make a recovery.

Relative Strength Indicator data from the same time period indicated that the asset was still in the oversold area. Additionally, if purchasing pressure continues, there may be indications of an impending shift out of the area.

Solana’s TVL gives no joy

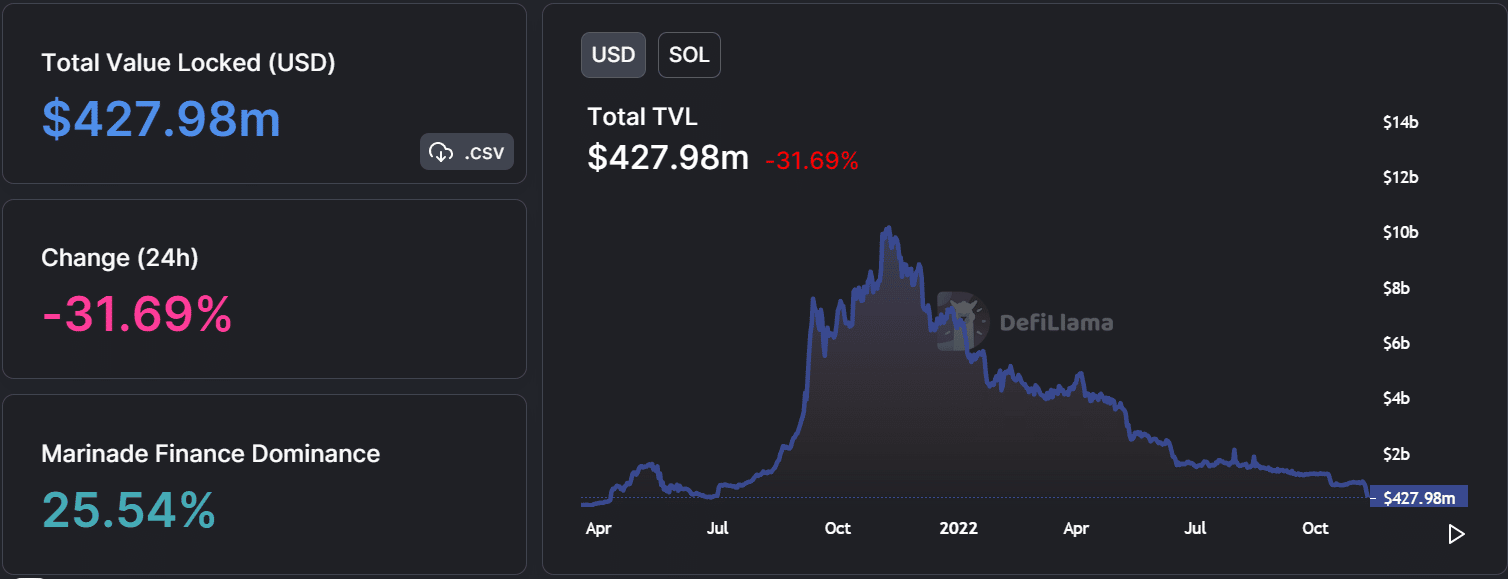

A declining trend was also evident when looking at Solana’s Total Value Locked, according to DefiLlama. The TVL decreased by more than 30% as of the time of this writing and was valued at $427 million.

The figure showed a clear reduction from the TVL’s early October value of over $1 billion, which was a drop of over 50%.