Terra: Amid news of UST’s depegging, here’s how the future looks for LUNA

Imagine trying to escape the volatility madness that plagues the cryptocurrency market by holding a stablecoin. You know that stablecoins usually peg their market value to some external reference such as currencies like the U.S dollar or commodities like gold.

Now you have woken up to the news that a stablecoin backed by the U.S dollar and in which you hold a most of your assets is gradually losing its value. Yes, that frenzied state you are in now was how investors holding UST felt this past weekend with the UST, a stablecoin backed by the U.S dollar trading at $0.9956. This state is commonly referred to as “depegging”.

Terra’s UST, following a massive selling off on Binance and Curve Finance depegged from the one dollar position and slipped to a position below it. This led many to trade LUNA for the discounted UST thereby generating a profit and pushing the price of LUNA to take on a downward trend.

Not Having a Really Good Time

Trading at $61.97 at the time of press, the native token declined by 19% in the last two days when investors first observed the depegging. Several miles away from an ATH of $119.18 recorded just about a month ago, the ongoing bearishness of the crypto market did not help matters.

A look at the price charts showed significant bearish bias following the news of the depegging. Increased distribution was spotted with the RSI maintaining a position below the 50 neutral region at 30.84 and inching closer to the oversold position at the time of writing.

Similarly, the Money Flow Index (MFI) for the token stood at 24 at the time of this press indicative of investors heavily distributing to take profit.

Run, Run, Run…

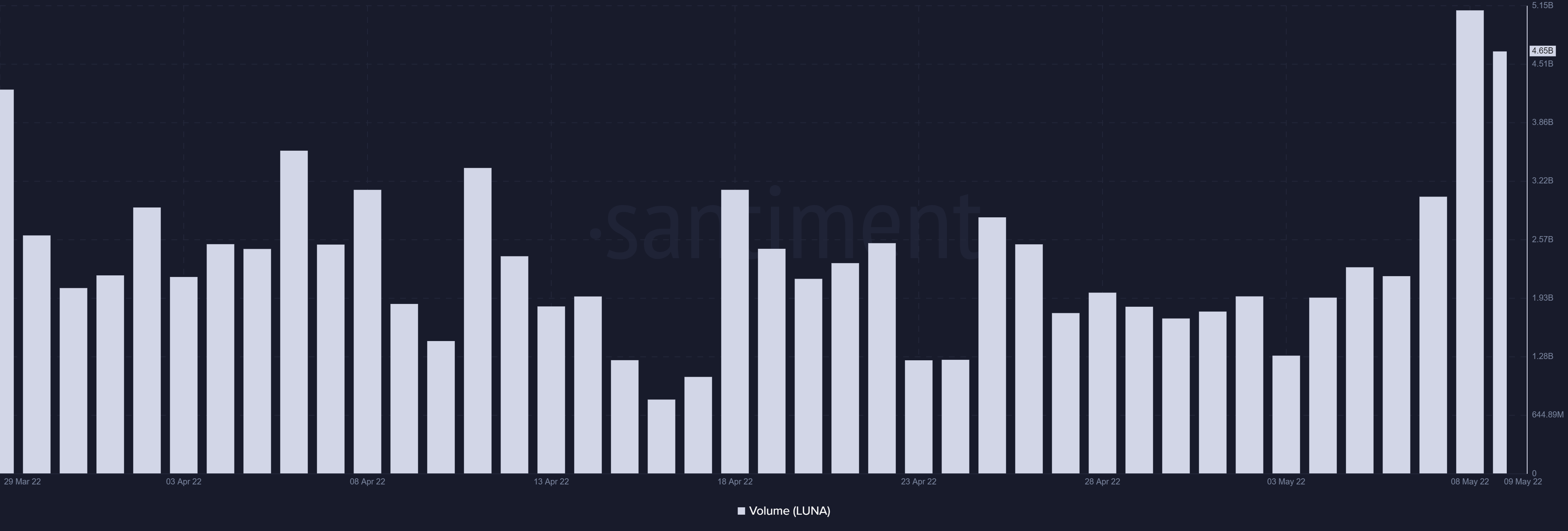

On chain analysis showed an increment in the trading volume of the native token yesterday. A 64% spike in trading volume was recorded within 24 hours following the news of the depegging. Without a corresponding spike in price, this only points to one thing; investors are exiting their positions.

The news of the depegging created a significant buzz across social media platforms as Social Dominance for the LUNA token went as high as 1.532% 24 hours after the depegging. At the time of writing, this stood at 0.835% suggestive of decreasing conversations.

Similarly, the Social Volume recorded a 69% spike 24 hours after the depegging. At the time of writing this stood at 156. This may be attributed to the CEO and founder of Terraform Labs, Do Kwon attempting to diffuse the tension.

Oh well…

People hold stablecoins to edge against the volatility that comes with other forms of crytocurrencies. The fact that stablecoins can be depegged does not provide much hope or inspire confidence in those who already have a low appetite for risks.