USDT’s new milestone means Tether’s market position is…

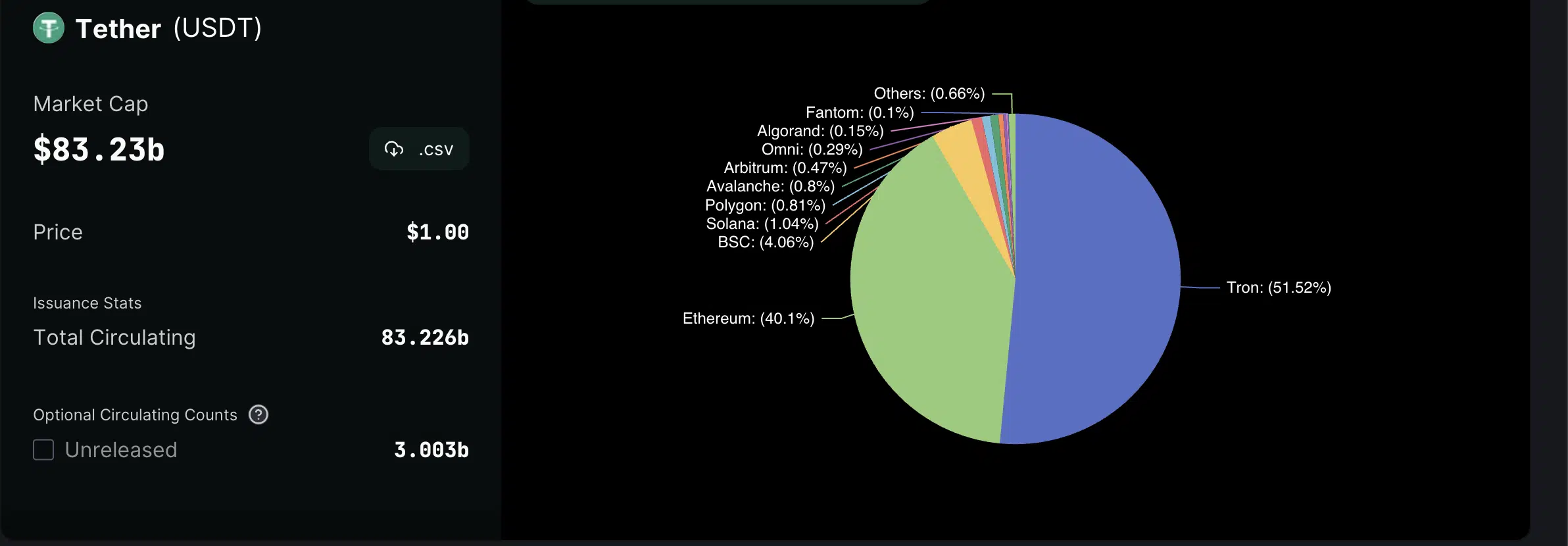

- The market capitalization of Tether’s USDT had surpassed the previous all-time high of $83.2 billion

- Tether also stated plans to partner with a licensed mining company to promote sustainable BTC mining

Tether in an official statement announced that the market capitalization of Tether’s USDT surpassed its previous all-time high of $83.2 billion. At a time when other stablecoins were struggling to maintain their market dominance, USDT was seen reaching new market cap heights.

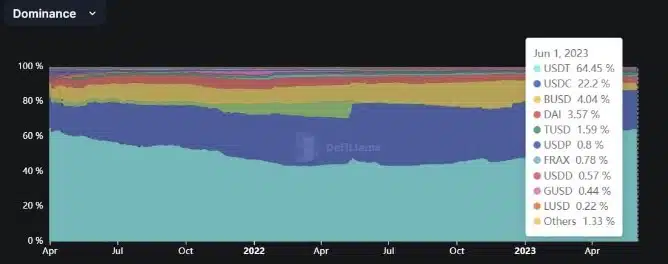

Tether’s dominance in the stablecoin market

According to data from DeFillama, USDT witnessed remarkable growth in 2023 as it gained approximately $17 billion in its market cap. Furthermore, considering the same period, it also managed to achieve a two-year market dominance of 64.45%.

Data from the intelligence platform DeFillama also revealed that about half of USDT’s circulating supply (42.86 billion) was on Tron, while 33.37 billion of its supply is on Ethereum. Tether also had a notable supply on other blockchain networks, such as Binance Smart Chain, Polygon, Solana, Avalanche, and others.

Tether’s success could be considered more pronounced considering the regulatory upheaval that had battled its major rivals like Binance USD [BUSD] and USD Coin [USDC].

Commenting on USDT’s latest achievement, Paolo Ardoino, CTO of Tether in a statement said,

“Tether ‘s tokens offered a safe harbor for the unbanked and allowed people in emerging markets to keep their buying power, even when their national currency is being devalued.”

It was to be reckoned that Binance extended support for deposits and withdrawals of USDT on Polkadot. In response to its most recent highs, Binance CEO CZ stated that,

BUSD, a fully regulated stablecoin, was "capped" (no new minting) by NYDFS at $23b. Now at $5b market cap.

Since then, USDT has seen tremendous growth. https://t.co/KqBkDK71WS

— CZ ? Binance (@cz_binance) June 1, 2023

Concerns over USDT

Amidst Tether’s dominance, a number of media reports surfaced that highlighted issues with its opaque reserves. The Wall Street Journal Article claimed that crypto companies behind Tether used falsified documents and shell companies to get bank accounts. Tether refuted these claims in a statement.

Furthermore, John Reed Stark, the SEC’s former official, urged regulators to ban USDT. He also referred to the firm as a “mammoth house of cards.” According to Stark, the stablecoin issuer operated in a regulatory vacuum, adding that its quarterly attestation cannot replace an audit. As of 9 May, the drama around USDT still continued.

IMHO, Tether is a Mammoth House of Cards.

Having studied markets and financial statements for 35 years, including during my 18 years as an attorney in the SEC Enforcement Division, IMHO, Tether, could be the next domino to fall. https://t.co/38SFD2fsRk

Tether, the first… pic.twitter.com/fOy3pzImbS

— John Reed Stark (@JohnReedStark) May 9, 2023

However, Tether again reiterated that it had no exposure to collapsed crypto firms.

— Paolo Ardoino ? (@paoloardoino) May 10, 2023

Still going strong…

Despite the ongoing drama, Tether announced plans to mine Bitcoin in Uruguay using renewable energy. The company stated its plans to partner with a licensed mining company in Uruguay to mine Bitcoin. Tether would do so using renewable energy sources such as wind and hydropower.

At Tether, we understand the importance of energy in driving progress & enabling thriving communities. That's why we're dedicated to harnessing the power of renewable energy to mine #Bitcoin, the world's most open & secure monetary network.

Learn More ? https://t.co/LmBQptyobi pic.twitter.com/VrG20OnE1Z

— Tether (@Tether_to) May 30, 2023