Did Tether dominate the stablecoin market again? Here’s the stablecoin report for 2020

Despite a tumultuous 2020, stablecoins not only managed to stay ahead, but showed considerable growth and industry penetration. From a COVID-induced black swan event to an explosion in DeFi to Bitcoin’s stark price surge, 2020 has been a defining year. Stablecoins, in particular, saw major developments, both in terms of adoption and regulations.

Major Stablecoin Developments

Here are some important stablecoin developments in no particular order.

- Regulation

- The most recent regulation by China banning Yuan-backed stablecoins and proposals.

- Other regulations include China’s attempt to stop USD-backed stablecoins usage in China

- European ministers’ call to regulate stablecoins, etc.

- Announcement of Facebook’s stablecoin [Diem formerly Libra] launch next year

- A proposal to allow stablecoin issuers to apply for bank charters

- COVID has caused the larger traditional finance market to look to the crypto-ecosystem for alternative investments. When institutions come, they mean business, and hence, large capital. What better than stablecoins which allow easy transfer and parking from and to exchanges? Perhaps, it is due to this reason, stablecoins, in general, have seen an increase in their market share, despite regulatory concerns that could cause disruption.

- Additionally, the OCC issued guidelines that allow banks in the U.S to hold stablecoins and provide services to stablecoin issuers or stablecoins that are backed by the US dollar. In fact, Jeremy Allaire, CEO and Co-founder of Circle stated, “I can’t speak on behalf of other stablecoins but, we’ve seen really robust demand from significant banking institutions to get involved in reserve banking stablecoin clients.”

- Another important development is that Tether, the world’s largest stablecoin, has caught a break from critics alleging that it is what’s causing the inflation in Bitcoin’s price. In fact, a report emerged stating just the opposite – “Stablecoins are killing in.” It said,

“We trace the aggregate issuance of Tether from Tether Treasury to the secondary market. Using our measure of flows to the secondary market, we observe no statistically significant effect on crypto asset prices (BTC and ETH).”

While this list goes on, let’s take a microscopic look at how stablecoins performed over the year, both individually, and in comparison to each other. The results are based on 7 stablecoins – USDT, USDC, BUSD, DAI, HUSD, PAX, & GUSD. Data collected will range from January 2019 to 12 December 2020.

Stablecoins under the lens

Market Share

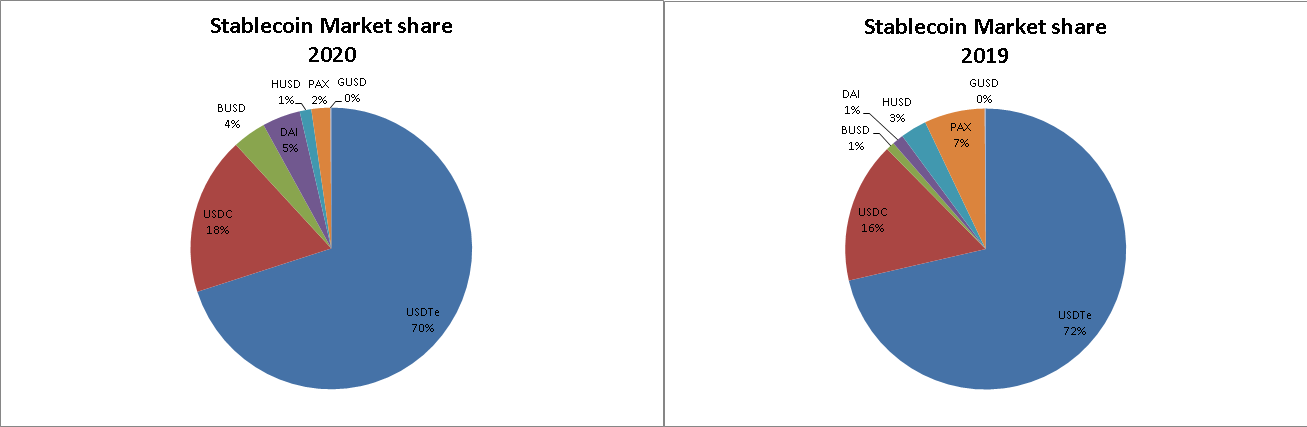

Source: Coinmetrics

- Surprisingly, Tether’s market share dropped year-on-year, however, it managed to be the world’s largest stablecoin with a market cap of $12.4 billion. Tether’s market share reduced from 72% in 2019 to 70% in 2020 and this, despite seeing a 444% increase in 2020.

- Circle’s USDC increased its market share from 16% to 18%, while growing by a whopping 520% in market cap.

- Paxos & HUSD saw a diminishing market share. PAX’s market share dropped from 7% to 2%, HUSD’s from 3% to 1%.

- BUSD saw a stark growth not just in its market cap [which increased by 2112%] but also in its market share, which increased from 1% to 4%.

- Overall, the stablecoin market [including the top 7 stablecoins] grew from 3.2 billion in December 2019 to 17.7 billion in December 2020, a 455% increase.

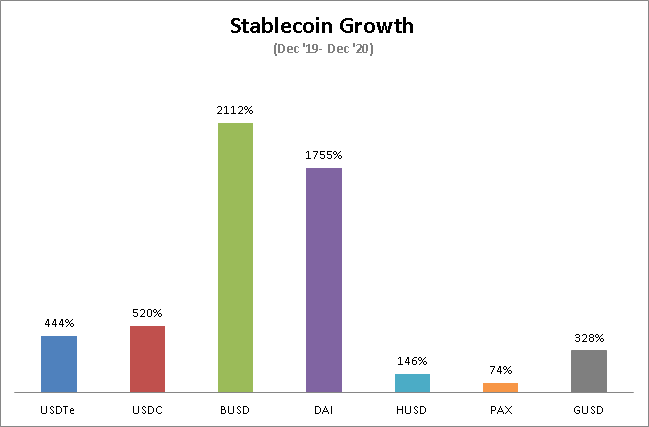

Source: Coinmetrics

One thing to consider here is that while Tether’s growth isn’t as much as BUSD’s, USDT had a market cap of $2.2 billion at the start of 2020 and it still grew to ~$12.4 billion. Usually, a stablecoin’s market share drops after it gets big, but Tether hasn’t slowed down.

Stablecoin usage: Retail v. Institution

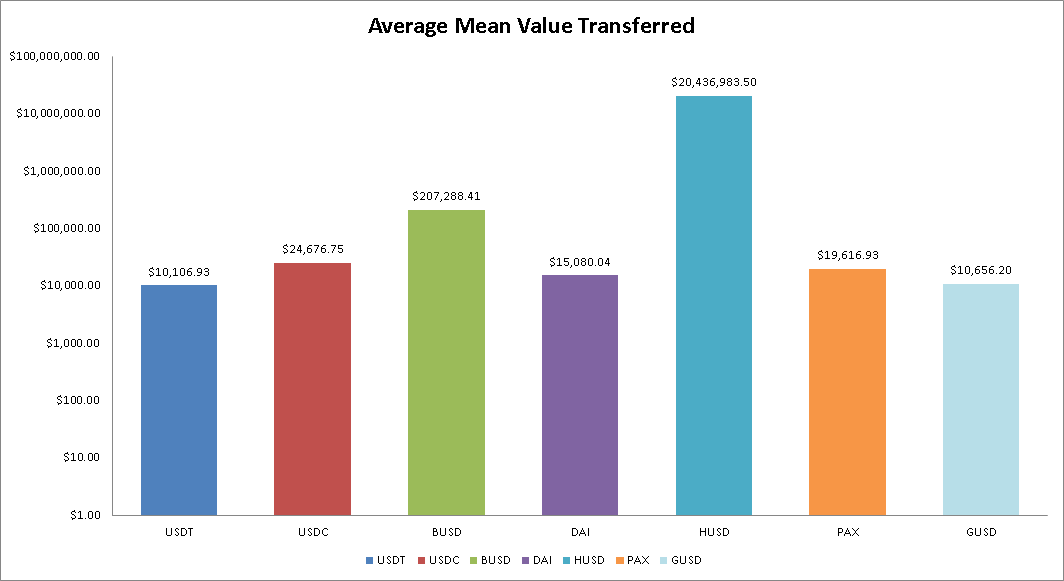

Source: Coinmetrics

Knowing the average and the median transfer value can help identify which stablecoins are used by whom. A lower mean and median value transfer indicate that the stablecoin is mainly used by retail. However, if this value is high, then it is used by institutions or high net worth individuals.

Among the 7 stablecoins, HUSD had the highest median and mean value transfer. The average median value transferred via HUSD was $174,000, while following it was BUSD at $17,151. The rest of the stablecoins had an average median value of under $1,000.

Source: Coinmetrics

Following a similar trend, the mean value transferred was the highest for HUSD followed by BUSD, USDC, PAX, DAI, GUSD, & USDT. Perhaps, the exchanges getting into the mining & the OTC industry may be the reason why exchange-based stablecoins saw high median value transfer. From the looks of it, except HUSD and BUSD, other stablecoins were the most retail-popular coins.

Disclaimer: Institutions or high net worth individuals can break down their transactions into smaller units, hence, this result isn’t comprehensive and isn’t a conclusive test to determine if a stablecoin is retail-focused or institutional-focused.

Stablecoin Issuance & its impact

This section is really important and gives an insight into how the market [crypto as a whole and stablecoin] has matured. Stablecoins and manipulation have been topics of contention for quite some time now. While this is mostly focused on Tether, the world’s largest stablecoin, this topic does deserve the center stage since stablecoins are the most popular way to onboard users into crypto. Hence, the logic behind the question of price manipulation by stablecoins does make sense.

But, is it true though?

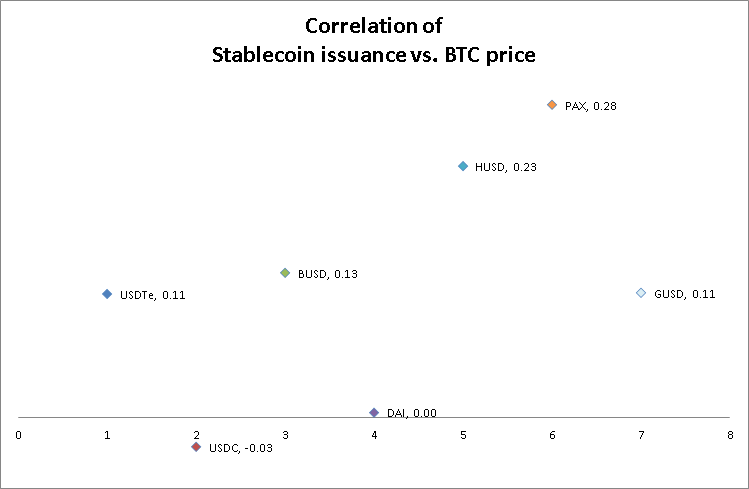

Well, studies conducted earlier showed conflicting results. So, another way to confirm if this is true is to compare the percentage change market cap with the price surge of Bitcoin and find if there is a positive correlation. [Note: This method doesn’t specify if it is supply-driven or demand-driven, hence, not to be taken at face-value or investment advice]

This method can be split into two ways,

- The first method compares Bitcoin returns against returns of individual stablecoins [ie., change in market cap, which ultimately refers to growth and hence issuance]

- The second method compares Bitcoin returns to the whole growth of the stablecoin ecosystem as a whole [in this case, the combined market cap of all 7 stablecoins]

Individual stablecoins had a varying correlation with Bitcoin, with Paxos having the highest correlation among the bunch. Pax had a 0.28 correlation and USDC had the least correlation [-0.03].

Source: Coinmetrics

The second method yielded a 0.009065 correlation and proves that there is no correlation between stablecoin issuance and the price of Bitcoin.