The BAYC-FTX connection: Why the Apes may not climb any price trees soon

- BAYC’s royalties and treasury were stored on the FTX US exchange

- Floor price and volume dropped significantly over the week

The NFT market felt the impact of falling prices as crypto rates plunged over the last few days. In fact, even Ethereum [ETH] blue-chip collections like Bored Ape Yacht Club [BAYC] could not bank on their popularity to counter the adverse effect of the FTX collapse that left the market in turbulence.

Interestingly, there was a new twist to the effect FTX had on the NFT collection. This was due to the revelation by NFTGo that BAYC’s floor price decreased about 10% in the last seven days. A quick overview of the collection’s floor price showed that it was 60.79 ETH, a 2% decrease from the previous day.

What is the connection between the two, you ask?

As reported by Wu Blockchian, Yuga Labs, the team behind the collection development, stored 18 ETH in royalties on FTX.

According to NFTGO, in the past 7 days, the floor price of BAYC has dropped by nearly 10%, and the total market value of CryptoPunks has surpassed BAYC. The main reason is that the BAYC treasury and royalties of more than 18k ETH are stored in Blockfolio acquired by FTX.

— Wu Blockchain (@WuBlockchain) November 13, 2022

Leaving BAYC in shambles

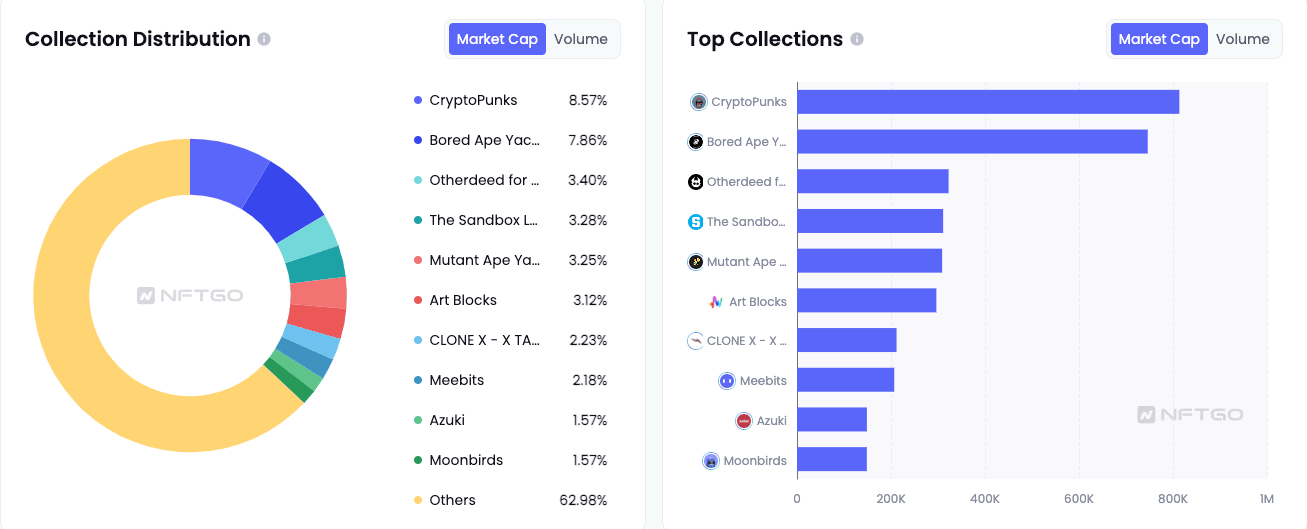

Due to this, BAYC lost its top position in the NFT market. According to NFTGo, Crypto Punks surpassed the collection in terms of market capitalization. As of this writing, the NFT data tracker revealed that Crypto Punks shared 8.57% of the total market value, and BAYC came second with 7.86%.

Hence, the FTX-Blockfolio link depreciated the asset value. Similarly, traders might have also shifted focus to owning the Punks rather than the Apes.

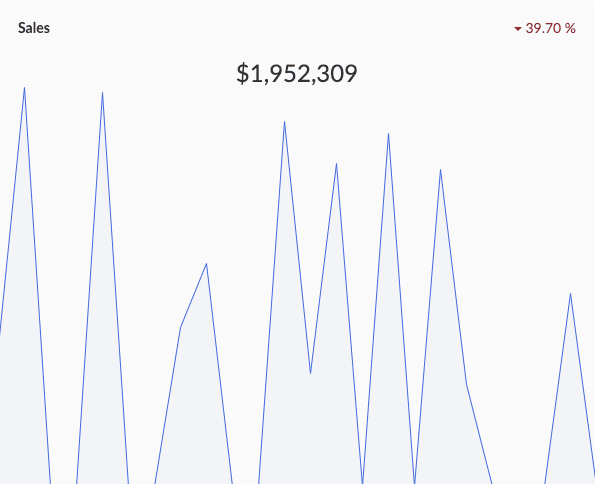

On the other hand, BAYC seemed to have held the line per sales volume. At press time, data from CryptoSlam showed that the collection was at the crest of sales in the last 24 hours. Nonetheless, its stay at the pinnacle did not reflect an increase in transaction or trading volume.

According to the NFT collections aggregator, BAYC’s volume within the aforementioned period was $1.95 million. This volume represented a 39.70% drop. It was also noteworthy to mention that the transaction happened between 23 buyers and 20 sellers.

This involvement of traders also signified a significant decline. Thus, it implied that not only did the FTX collapse affect traders, but they were less interested in grabbing collections in such market conditions.

All thanks to this saving grace

On the wider NFT market, CryptoSlam disclosed that ETH NFT sales were down 34.39%. This drop led to the overall sales volume remaining at $7.97 million. Thus, it was not only blue-chip that had lost the numbers, but the broader market sentiment was mostly negative as well.

However, fears about BAYC being unable to reclaim its treasury and royalty had been resolved. This was because Yuga Labs noted that it was able to salvage the situation by transferring the assets to Coinbase.

Yuga Labs said the ETH asset was held in FTX US, and earlier this week moved the entire asset to Coinbase Custody. Despite FTX being a seed investor, Yuga has never used FTX and was not affected by the FTX/Alamade crash.

— Wu Blockchain (@WuBlockchain) November 13, 2022

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)